Parts supply issues ‘tip of iceberg’ for production constraints post-Brexit

The impact of the Brexit trade agreement is being felt across the new car market with early indications showing there will be a hit to new car supply in the early months of 2021, forcing UK retailers to focus on stockpiled vehicles to help maintain registration activity. Meanwhile the supply of parts into the UK threatens to impact production of vehicles within the UK, with a shortage of microchips being the ‘tip of the iceberg’ of production constraints according to several manufacturers.

In what is a crucial period of the year that on average accounts for 30% of annual new car registration volumes, supply constraints and the ongoing national lockdown will be a huge concern for those in the new car sector throughout Q1. The re-opening of showrooms before March’s plate change will be critical to retailers’ success.

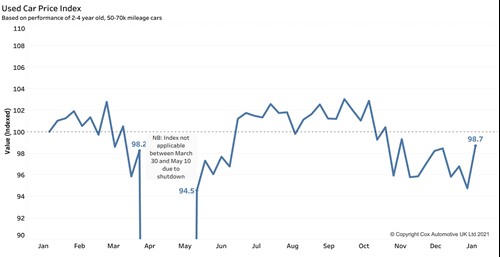

Short supply in third lockdown continues to drive used prices

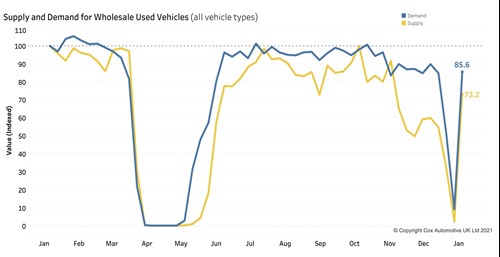

Consumer demand for used vehicles continues to outpace supply into the market, helping to maintain prices, albeit lower than the heights of last summer. With a third national lockdown announced at the start of the year, supply issues were expected, but retailers operating under click and collect measures have helped keep prices relatively stable.

As January has progressed, both supply and demand have also increased, but we anticipate supply pressure to continue in the short-medium term. Values should remain steady or ease slightly to reduce the risk of price realignment.

Demand for retail-ready wholesale vehicles is critical

Retail-ready and accurately graded vehicles continue to be in high demand in the wholesale market, helping to keep average sold prices stable year-on year at £5,993. Supply of these vehicles hasn’t been enough to match demand, leading many retailers to broaden their stock profiles and in turn resulting in an increase in average mileage (66,352, +4.29%) and age (90.9 months, +5.7%).

As we approach the end of forbearance and with the sector having around nine-months of backlog, we could begin to see increased volumes entering the market in the months ahead.