Cox Automotive urges a more cautious, data-driven approach to forecasting as the sector gears up for a challenging second half of the year driven by continuing uncertainty around new car supply and expected tougher economic conditions.

SMMT revealed an 18.8% YOY decline in sales volumes in Q2 2022, with 1,759,684 transactions completed during this period. These results validate official downside Q2 predictions of 1,769,066 from Cox Automotive earlier this year, which were accurate to within 0.5% (a margin of 9,300 units) of the final recorded figure. In addition, its overall H1 total forecast provided even greater accuracy, with a margin of only 0.1% between actual figures (3,534,035) and its baseline prediction (3,529,860), highlighting the strength of its forecasting capability.

As the used vehicle market braces itself for further headwinds throughout the remainder of the year, Phillip Nothard, Insight & Strategy Director at Cox Automotive, recommends that dealers should base future strategic decisions-on credible third-party data and insights to help their businesses navigate these challenges in an increasingly volatile market.

Nothard commented: "The accuracy of our forecasts reflects the sheer amount of work that goes into analysing market trends to provide our customers with a reliable picture of the market. Our track record means customers can take confidence in our insights, which are driven by our access to essential macroeconomic, financial and market data."

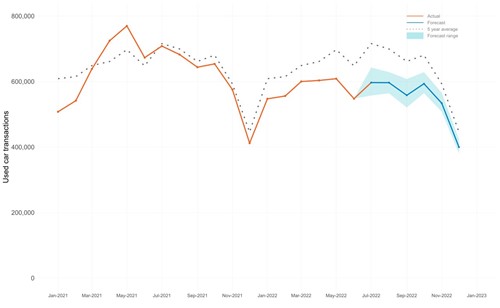

Cox Automotive released its full-year forecast in July 2022 within its AutoFocus publication. However, it has since downgraded its forecast based on continual headwinds influencing the industry, including the publication of H1 market data, the Bank of England's interest rate hike, and declining consumer confidence figures. In the best-case scenario, it predicts 2022 will end on 6.96 million transactions, falling 7.6% year-on-year representing a -3.5% downgrade. While the baseline scenario of 6.74 million will result in a 10.5% decrease year-on-year and a -4.4% downgrade. Finally, the downside scenario of 6.66 million used car transactions, -12.9% down year-on-year and a -5.0% downgrade.

Nothard added: "The fact that our forecasts from last month reflects the current pace of change within the market and the ongoing volatility. Monitoring data in real-time and adjusting our forecasts accordingly allows us to provide greater accuracy to the sector, enabling customers to make better decisions based on the latest insights. Predicting the future is never easy; however, we’re committed to providing accurate figures as much as possible, and our data-led approach should inspire confidence when the market is facing increased uncertainty."