IQ

Insight

Quarterly

Q4 | 2025

The used market: supply and values remain under pressure

The used car market has long been the stabilising counterweight to the volatility of the new market. Used transactions increased by 2.4% year on year up to the end of Q3 2025, which indicates that the sector is likely to remain stable throughout 2026, as it continues to enjoy steady demand and improving transactional confidence.

Supply is gradually increasing, although not at the same pace as the new car market. Meanwhile, price sensitivity remains high as values are increasingly driven by market fundamentals rather than the scarcity-driven conditions seen in recent years. Overall, the market is still shaking off the leftover impacts of the pandemic, but it remains highly competitive.

Underlying drivers

While typical seasonal trends are present, such as pricing, stock turn and fluctuations related to quarter-end activity and consumer confidence, the dominant forces shaping the used car market are structural and likely to continue influencing performance well beyond the current trading cycle.

The impact of COVID-19 continues to be the biggest driver of competition in the used market, as the production shortfall from 2020 continues to work its way through the vehicle parc. This is being seen beyond the youngest age cohorts, extending to older models. Five to seven-year-old vehicles are expected to be hit hardest in 2026, with volumes not forecast to return to 2024 levels for another decade.

The supply mix is also evolving. More brands, fuel types and ages available in the market are all adding further complexity to an already complex market. For example, this is illustrated by the 72.7% decline in diesel volumes over the past few years, compared with supply in 2018-2021. This is alongside a 21.2% fall in petrol units throughout the same period. Meanwhile, used electric vehicles (EVs) are transitioning from niche to mainstream and are expected to account for around one in five cars under five years old by 2026. They are selling faster than other fuel types of similar ages, as pricing trends settle and more buyers enter the segment. This mix of stock sources is a permanent shift and will be central to market strategy moving forward.

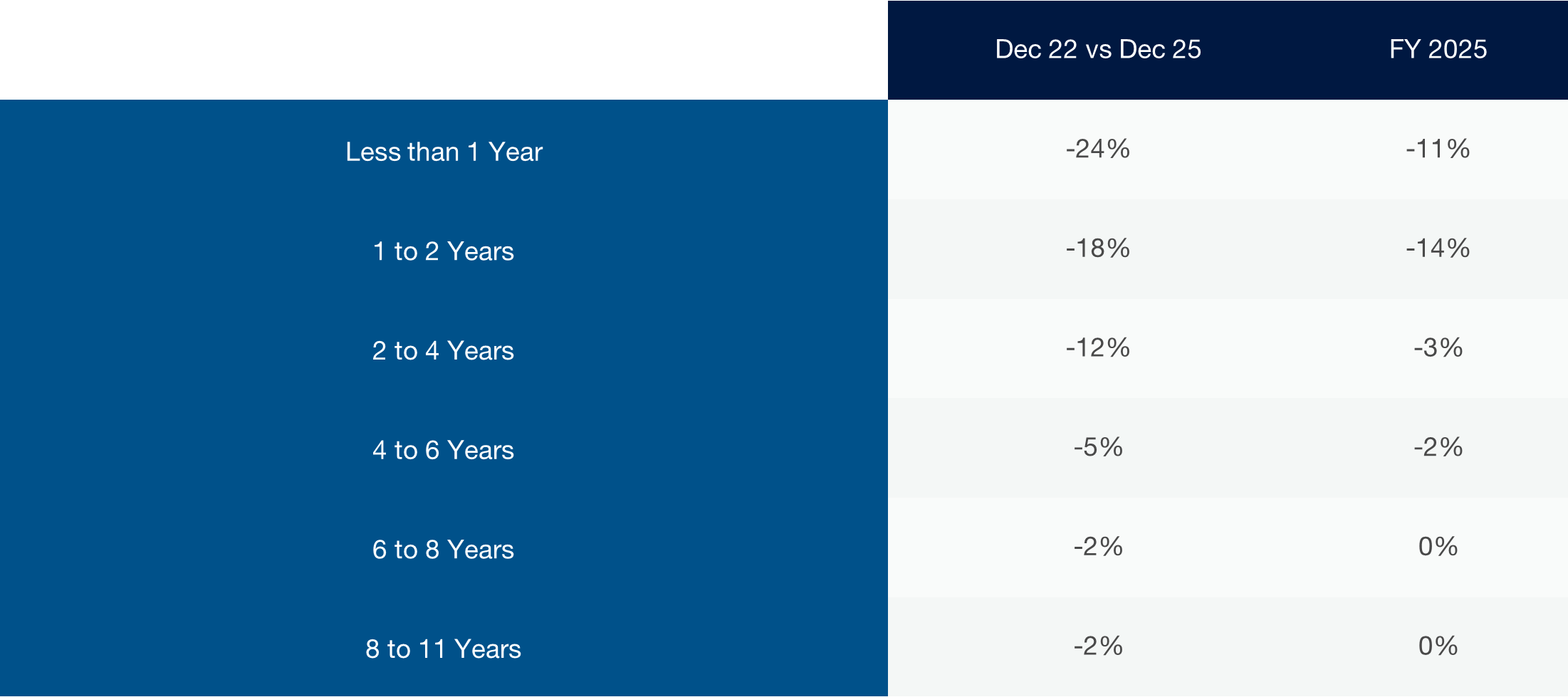

Residual values

The performance of residual values remains varied across ages and fuel types. After a period of extreme volatility, EVs have shown improving value stability across age brackets. Values for one to two-year-old EVs declined by 7% in 2025. However, when compared to values in 2022, they declined by 30%. Petrol vehicles of the same age saw their values decline by 11% and hybrid vehicles by 9% throughout 2025 but did not experience the same sharp decline over the previous three years.

All fuel excluding BEV %OCN

Source: Cox Automotive

To see the data behind the above forecast, please click here to view it in the Appendix.

Stabilising EV values are largely driven by faster sales and growing market acceptance. Towards the end of the year, values will come under renewed pressure as manufacturers pursue ZEV mandate compliance and move towards tactical activity to do so. This means EV values will likely remain more volatile than the wider market, improving where pricing, range and charging capability align with buyer expectations, but remaining exposed where supply growth outpaces underlying demand.

This year, it is not just EV values that will come under pressure. Vehicles of other fuel types are also likely to experience a level of depreciation as the impact of tactical activity in the new market impacts all vehicles - this is especially true where discounting and incentives affect nearly-new pricing. Also, as used supply continues to normalise, particularly with higher volumes of ex-fleet and rental vehicles returning to the market, values will be impacted. Ongoing shortages of some combustion engine vehicles may partially offset this.

Future considerations

The current market dynamics are giving buyers greater choice and transparency. However, the used market still needs to navigate a web of complications to ensure success in 2026. As competition for supply is likely to continue throughout the year, those responsible for stock sourcing will need to take a more proactive and diverse approach, while sellers should focus on stock turn, cost control and pricing discipline.

In the longer term, structural supply gaps and a more diverse stock mix are dynamics here to stay. Plans and stocking strategies for at least several years will need to factor these in, especially the constraints on five to seven-year-old vehicles.

Emerging dynamics

Could 2026 be the year the market gets a real measure of consumer demand for used vehicles from new market entrants? Reviewing 2025 registrations from six major new market entrants, it’s conceivable that we could see up to 67,000 young models entering the used parc this year. This means the market could gain its first insight into how the used proposition of these brands could play out, alongside how their residual values perform. Retailers interested in these brands, but not yet invested, will be watching this performance closely.

What should the industry be keeping a close eye on this year?

“The 10-year gap between the UK ZEV mandate deadline and those implemented in Europe will start to shape manufacturers’ decisions on where to allocate their used vehicles and how to prioritise compliance versus market share. Combine this with increasing competition from new entrants, particularly as their vehicles begin to enter the used parc, and the used car market may face new complexities by the end of the year. Success in this environment will depend on disciplined stock strategy, pricing accuracy and the speed of sales.”

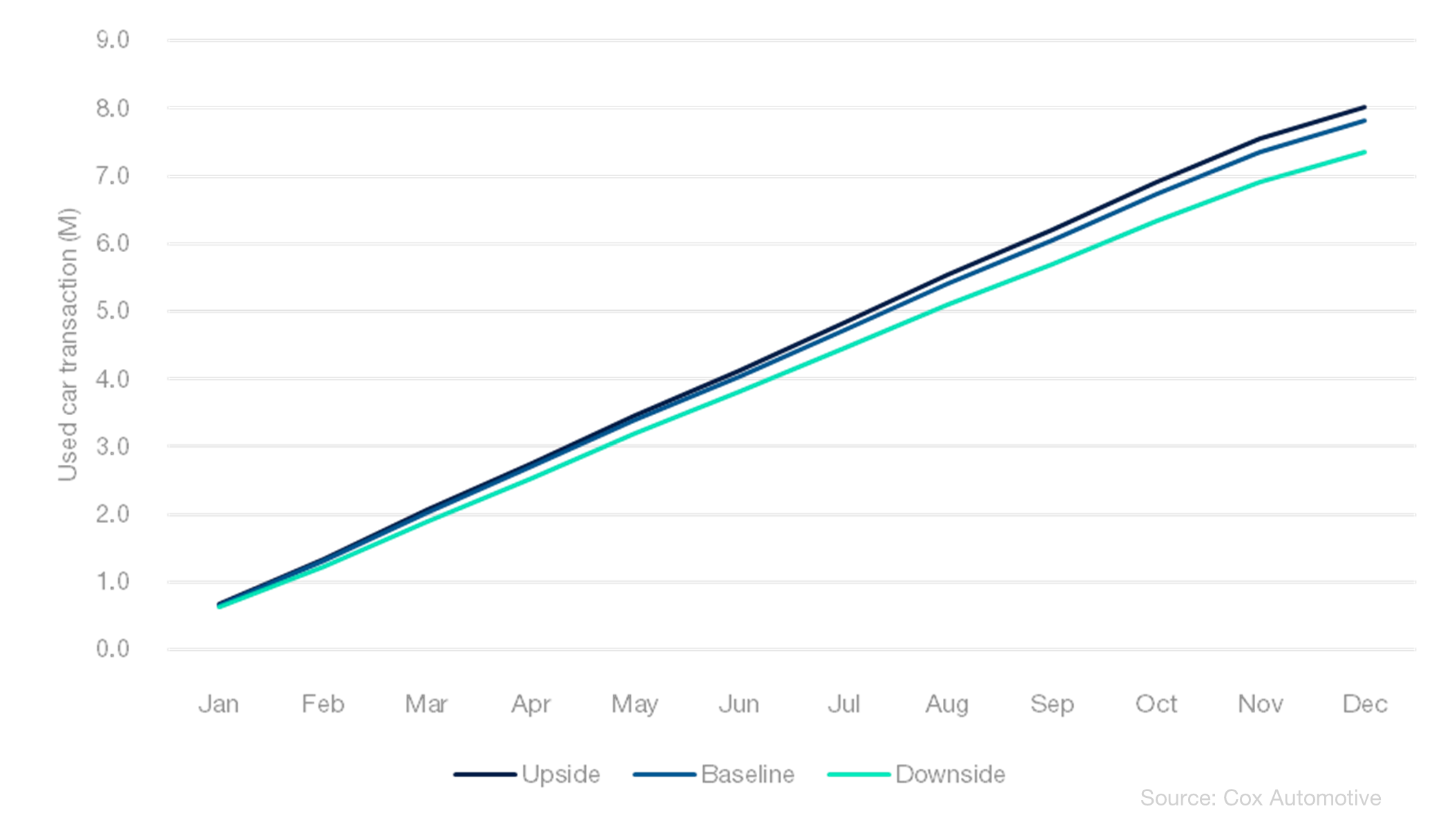

The used market: forecasts

Each quarter, we integrate our proprietary market insight with the latest used-vehicle transaction data to produce three 12-month outlooks: upside, baseline and downside. These scenarios reflect differing macroeconomic, policy and industry assumptions, providing a structured framework to support stakeholder planning for potential developments in the used-car market over the year ahead.

Our baseline scenario for 2026 anticipates a gradual return to a more typical market rhythm, with used-car transactions reaching 7,827,658. This represents a modest 1.0% year-on-year increase and places activity 6.1% above the 2001–2019 average, reflecting improving supply dynamics and more stable consumer demand.

Under a more optimistic (upside) scenario, transactions could rise to 8,026,607 units, equating to a 3.5% increase on 2025 forecasts and 8.8% above the 2001–2019 average. This outcome would be supported by stronger consumer confidence, improved affordability and continued normalisation of used-vehicle supply.

Conversely, the downside scenario projects transactions declining to 7,357,097 units, representing a 5.2% year-on-year contraction and leaving volumes 0.3% below the 2001–2019 average. This scenario reflects weaker economic conditions, constrained household budgets and a more cautious consumer environment, which would temper demand across the used-car market.

Upside scenario

In this more favourable outcome, economic conditions in 2026 evolve more positively than expected, creating a supportive environment for the UK used-vehicle market. Easing inflation, lower interest rates and improving household confidence translate into stronger transaction activity across both retail and fleet channels, with sustained momentum through the year.

- Improved economic stability underpins consumer spending, allowing several quarters of transaction volumes to exceed two million units.

- Normalising new-vehicle supply releases higher levels of part-exchange and ex-fleet stock, improving availability and supporting healthier retail turnover.

- Consumer attitudes towards EVs continue to improve, supported by more competitive pricing, broader model choice and added momentum from the Electric Car Grant, alongside the continued availability of the ECOS scheme.

- Retailers refine stock mix, pricing and remarketing strategies to better align with shifting demand, improving conversion rates across wholesale and retail channels.

- Reduced supply-chain disruption helps stabilise depreciation across core segments, strengthening residual values and limiting pricing volatility.

Baseline scenario

The baseline outlook points to a stable but constrained used-car market in 2026. While demand remains broadly resilient, affordability pressures and ongoing regulatory complexity limit the scope for stronger growth, leaving the sector focused on margin protection rather than volume expansion.

- Used-vehicle transactions edge modestly higher as consumer confidence improves incrementally and retailers maintain disciplined pricing strategies.

- Stock availability continues to recover as new-car registrations improve, though affordability constraints cap demand growth in volume segments.

- Retailers place increasing emphasis on operational efficiency, digital optimisation and tighter inventory management to protect profitability.

- The deferral of the ECOS scheme to 2030 provides greater policy certainty, supporting fleet and retailer planning, but does not materially alter near-term demand dynamics.

Downside scenario

In the downside scenario, the used-vehicle market faces a more difficult 2026 as economic pressures persist and confidence remains fragile. Rising costs and subdued consumer sentiment weigh on both retail and fleet activity, resulting in weaker transaction volumes and sustained margin pressure.

- High living costs, stubborn inflation and limited real wage growth continue to erode household purchasing power, suppressing discretionary spending on used vehicles.

- Stock availability remains uneven: while new-vehicle supply improves in some markets, weaker part-exchange volumes and affordability pressures limit availability in key segments.

- Retailer margins deteriorate as operating costs rise, stock holding periods lengthen, and competitive discounting intensifies.

- Although deferring ECOS to 2030 avoids a sudden policy shock, it is insufficient to offset broader economic headwinds, leaving the market exposed to prolonged weakness in demand and profitability.

Used Car Registration Forecast 2026

To see the data behind the above forecast, please click here to view it in the Appendix.