IQ

Insight

Quarterly

Q4 | 2025

The new market: a new reality, beyond seasonal norms

At first glance, the new car market appears to have stabilised. We started the year with the positive news that new car registrations had topped two million units, for the first time this decade. However, this data glosses over greater underlying challenges, a consistent theme we’ve seen over the past few quarters.

Many of the conditions that previously underpinned a healthy market haven’t recovered since the pandemic. Meanwhile, shifts in consumer behaviour, funding dynamics, legislative pressure and fleet-led demand are reshaping activity beneath the surface. Private registrations still only account for just 38.6% of the market in 2025, down from their peak in 2022 of 51%. Fleet registrations continue to contribute disproportionate volumes to the market as private registrations struggle to recover amidst low consumer confidence. The unfortunate reality is that the scales have tipped in favour of supply, as it now outpaces demand.

This has driven manufacturers to adopt more short-cycle techniques to deliver volumes that will help them retain their position in the market. This means a greater emphasis is being placed on pricing discipline, channel mix and short-term volume gains, as opposed to focusing on organic demand growth.

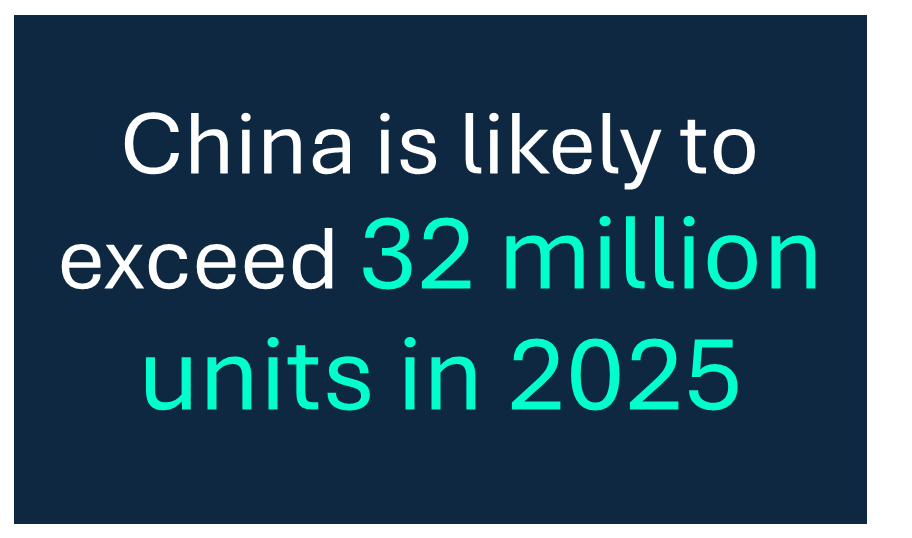

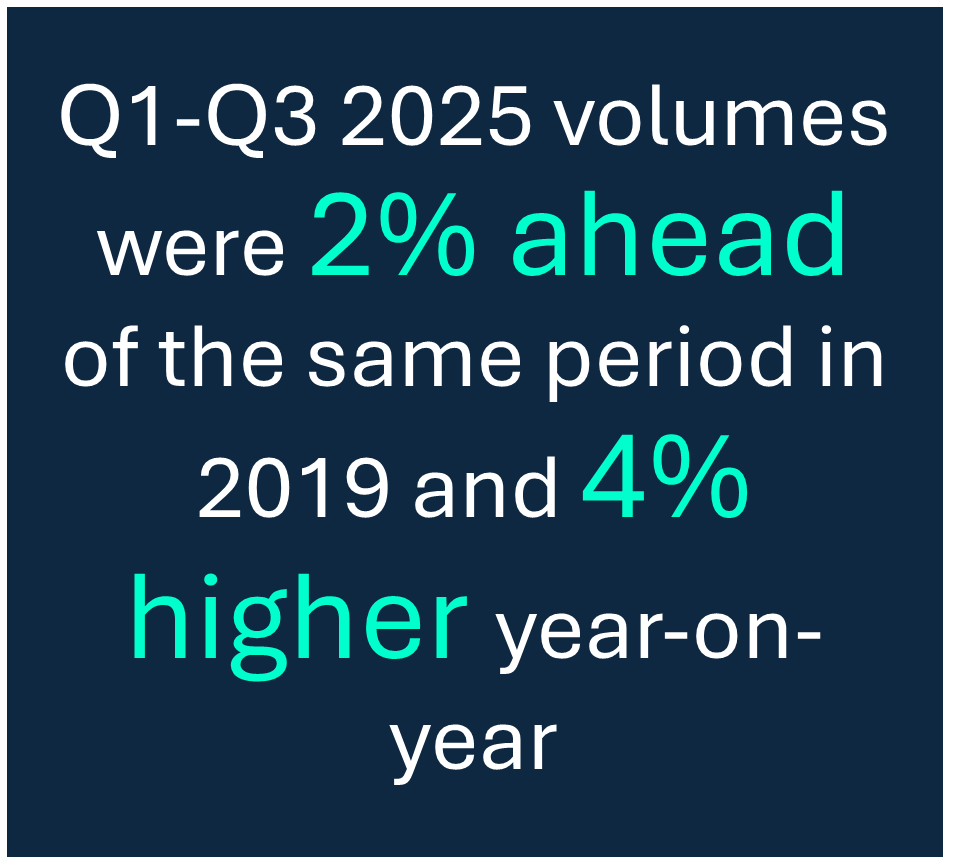

Looking at global vehicle production, the industry is exceeding pre-pandemic levels. Current available data shows Q1-Q3 2025 volumes were 2% ahead of the same period in 2019 and 4% higher year-on-year. Unsurprisingly, China’s continued meteoric rise has contributed to this growth. The region is likely to exceed 32 million units in 2025 once reporting is complete, as Europe and the UK were primary targets for scaling business.

This rapid rate of expansion has outpaced recovery in demand, as economic concerns remain for many consumers. With a surge of new cars entering the market, the UK is more competitive than ever, with more marques competing for dealer representation, consumer attention, and fleet business.

Much of this is new territory for the industry. While some behaviour follows seasonal patterns, we are well acquainted with, such as fluctuating demand and end-of-quarter and financial year targets, the majority of these trends represent much larger-scale market shifts and long-term behavioural change. The evolving competitive landscape is likely to shape the future of new car sales for years to come; meanwhile, regulatory pressures, especially around emissions and ZEV mandate targets, are influencing volume and incentives throughout the year, as opposed to traditional seasonal peaks.

Short-term considerations

As the industry can no longer entirely rely on learnings from years past to inform their strategies, staying informed is more important than ever. Retailers will need to monitor changes in fuel mix, manufacturer representation and technology adoption more closely to inform their strategies.

These will be vital considerations as they continue to impact demand patterns and buyer attitudes. Any shifts in consumer preferences and purchasing behaviour, especially around affordability, powertrain preference and usage models, will require greater agility in sales strategies and channel mix management. This will likely mean that stocking plans will become more complex, especially as new entrants prioritise aggressive market growth while legacy brands battle to maintain share.

Long-term implications

Looking at longer-term forecasts, electric and hybrid will capture significant market share from petrol and diesel. Diesel, especially, will see a sharp drop. Having already dropped from its 24% market share between 2018-2021 to just 7% between 2022-2025, by 2029, it is expected to account for just 2% of the market. Meanwhile, forecasts predict that EVs will account for 50% of registrations by 2029.

Although private registrations are still tracking below historic norms, they are set to gradually rebound. By 2029, forecasts show they could return to 44% of transactions, gaining ground from fleet channels, which would drop to 54%.

Retailers may need to evaluate franchise portfolios, capital allocation and partner relationships as competition intensifies. Data-led decision making, forecasting accuracy and risk management will be vital in an era defined by structural change, as opposed to cyclical market movements. Businesses with flexible operating models and strong integration across fleet, used and aftersales operations are likely to be better positioned to absorb volatility and protect profitability.

Emerging dynamics

When might petrol and diesel vehicles become scarce? Are we approaching an inflexion point in the fleet and rental sector when ICE vehicles could become an investment commodity? With the potential for further penalties on petrol and diesel vehicles, such as increased taxation or the introduction of ULEV zones, supply may see a sharp drop in the market. By investing in these vehicles now, fleet and rental businesses may be able to capitalise on future opportunities.

What should the industry be keeping a close eye on this year?

“The new car market needs to keep a watchful eye on the balance between supply and demand. As competition is only set to intensify throughout the year, with more manufacturers and models launching into the UK and continued pressure from the ZEV mandate.

With over 75 brands now competing for a share of the market, manufacturers are increasingly relying on tactical pricing, incentive support, and channel shifting to move volume and meet regulatory thresholds. If this activity continues, it risks driving short-term behaviours that prioritise compliance and market share over sustainable demand, margin discipline and long-term value creation across the retail and fleet ecosystem.”

The new market: forecasts

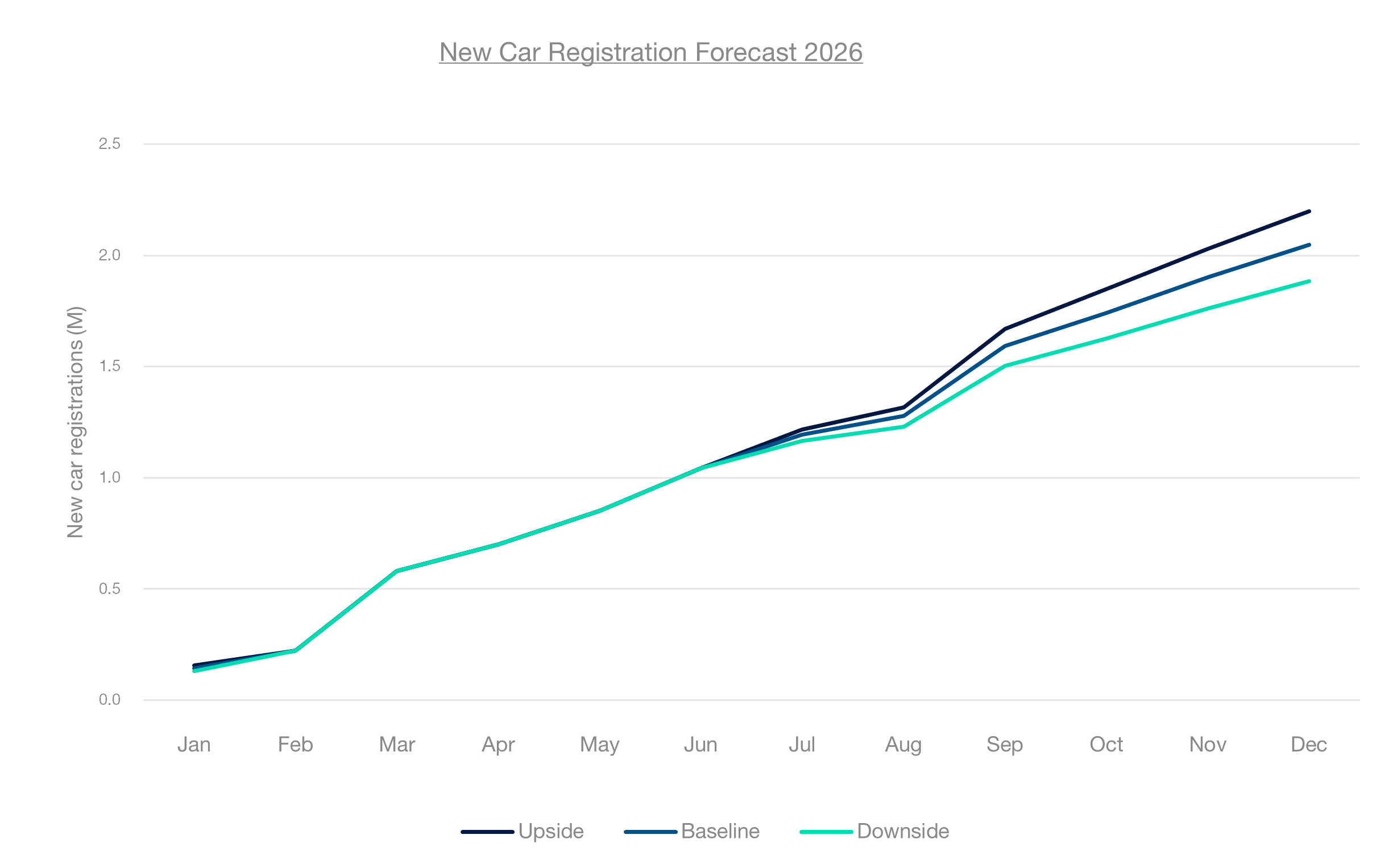

Each quarter, we integrate proprietary market insight with the latest registration data to produce three 12-month outlooks: uplift, baseline and downside. These scenarios reflect differing macroeconomic, policy and industry assumptions, providing a structured framework to support stakeholder planning across a range of potential market outcomes.

Our baseline forecast for 2026 anticipates 2,078,249 new car registrations, representing year-on-year growth of 2.9%, while remaining 10.1% below the 2000–2019 average. This reflects a modest upward revision to earlier projections, underpinned by stronger-than-expected first-half performance and a gradual improvement in consumer confidence. Nevertheless, structural headwinds persist, most notably the requirements of the Zero Emission Vehicle mandate, leaving volumes materially below long-term historical norms.

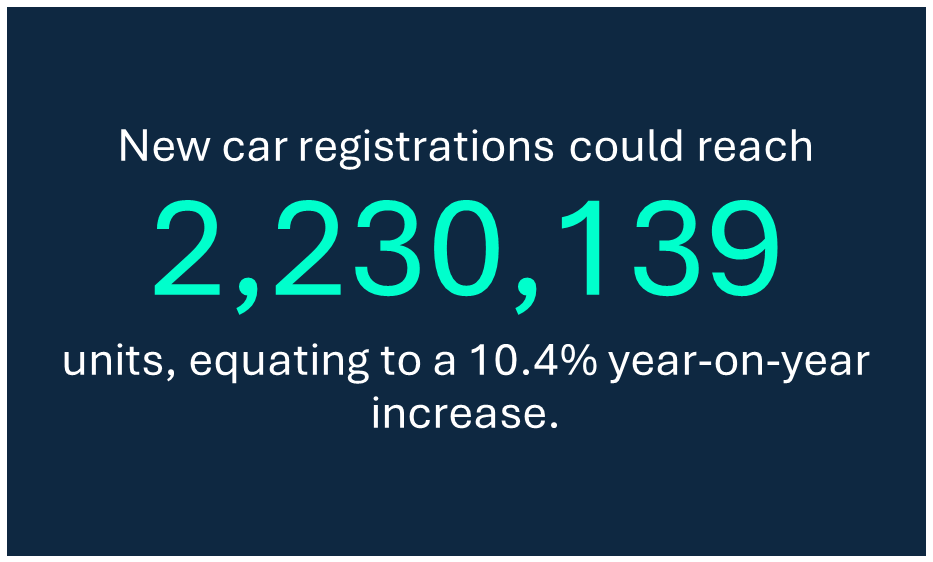

Under a more optimistic (uplift) scenario, registrations could reach 2,230,139 units, equating to a 10.4% year-on-year increase and narrowing the gap to just 3.5% below the 2000–2019 average. This outcome would require sustained economic stability, further easing of cost-of-living pressures and stronger alignment between policy objectives and market demand.

Conversely, our downside scenario projects registrations falling to 1,891,966 units, a 6.4% year-on-year decline and 18.1% below the 2000–2019 average.

This scenario reflects weaker consumer confidence, tighter financial conditions, and increased pressure on manufacturers and retailers to meet regulatory targets in a more challenging demand environment.

Upside scenario

In this more positive scenario, the UK economy performs better than expected in 2026, supporting a firmer recovery in the new-car market. Improved macroeconomic stability, easing inflationary pressures, and a more supportive policy environment help restore confidence across consumers, fleets and investors, translating into stronger demand and higher registration volumes.

- A faster-than-anticipated economic recovery improves consumer sentiment and encourages renewed domestic and international investment in the UK automotive sector.

- Strengthening retail and fleet demand supports volume growth across both established OEMs and new market entrants.

- Better alignment between government policy and manufacturer strategies accelerates EV uptake, supporting progress towards the 33% ZEV mandate for cars.

- Earlier and deeper cuts to the Bank of England base rate stimulate household spending, fleet replacement cycles and broader acquisition activity.

- Any short-term liquidity injections associated with potential redress or compensation mechanisms, while disruptive for parts of the sector, temporarily boost consumer spending and contribute to incremental sales uplift during the year.

Baseline scenario

The baseline outlook for 2026 points to a stabilising but subdued new-car market, characterised by modest growth rather than a full recovery. Demand is supported by relatively resilient fleet activity and improving consumer confidence but remains constrained by regulatory pressures and lingering economic uncertainty.

- New-car registrations move modestly above the two-million-unit threshold, reflecting incremental improvements in consumer and business confidence rather than a step-change in demand.

- Structural and regulatory headwinds, including compliance with the ZEV mandate and the operational implications of new commission disclosure requirements, continue to weigh on OEM and retailer profitability.

- Gradual easing of interest rates and stabilising inflation provide some relief to household and business budgets but are insufficient to materially accelerate market growth.

- New entrants continue to gain share, mainly at the expense of incumbent brands, without generating meaningful overall market expansion. As a result, the market remains structurally below pre-pandemic norms.

Downside scenario

In the downside scenario, the UK new-car market experiences a stalled or weakening recovery through 2026 as economic and policy-related pressures intensify. Persistent uncertainty undermines confidence, constraining both retail and fleet demand and delaying investment decisions across the sector.

- Elevated living costs, stickier inflation and subdued real wage growth continue to suppress discretionary spending, limiting new-car demand.

- Limited or poorly targeted policy support fails to stimulate EV adoption, while the ongoing impact of commission disclosure requirements further erodes retailer margins and increases operational complexity.

- Continued uncertainty around the ZEV mandate discourages manufacturer investment, disrupts product planning and slows progress in charging infrastructure deployment.

- Competitive pressures intensify as new entrants struggle to establish scale and brand trust. In contrast, some established OEMs lose share due to pricing constraints and slower innovation, resulting in subdued volumes, tighter margins and a slower transition towards zero-emission vehicles.

Source: Cox Automotive

To see the data behind the above forecast, please click here to view it in the Appendix.