IQ

Insight

Quarterly

Q4 | 2025

The EV market: progress, pressure and policy uncertainty

Electric vehicles (EVs) had their best year to date in 2025, cementing their place in the mainstream. The year closed with a total of 473,348 new EVs registered, representing 23.9% growth year-on-year and exceeding the total volumes seen in 2021 and 2022 combined.

Growth in the new market has been primarily driven by fleet and business channels, as EVs are still struggling to appeal to private buyers due to affordability concerns.

Growth in the new market has been primarily driven by fleet and business channels, as EVs are still struggling to appeal to private buyers due to affordability concerns. Meanwhile, a mix of increasing competition in the market due to new entrant brands and regulatory pressure continues to drive manufacturers and retailers to apply heavy incentives to their electric models.

EVs are also gaining a stronger foothold in the used market. In 2026, it is predicted that one in five used vehicles under five-years old will be electric, with the total EV vehicle parc forecast to reach 1,882,876 by the end of the year. After a period of volatility, especially across residual value performance, there are positive signs for the used EV market. Pricing and residual values are stabilising, and many models are selling faster than petrol or diesel equivalents.

Regulatory landscape

Despite the success seen in the new car market, registrations still fell short of targets laid out in the ZEV mandate by 3.5%. If the market follows its current trajectory, it is likely to miss targets again in 2026, as EV registrations are forecast to account for 28% of the market. New announcements regarding the future of EV ownership have further complicated matters.

While the additional funds allocated to grants to incentivise electric car adoption and improve charging infrastructure were good news, the new electric pay-per-mile tax threatens to obscure the benefits these will deliver. For consumers and the industry alike, how this tax will be calculated has not yet been disclosed, and the true impact on the total cost of ownership remains unclear. This is especially pertinent as 65% of UK drivers already think that EVs have a higher cost of ownership than petrol and diesel equivalents, and an additional tax is only likely to add to this.

The constant pressure on automotive businesses to meet these targets is steering the industry back toward a ‘push’ market. Tactical activity and incentive-led volume placement become the only viable means to meet sales quotas, whilst the lower-priced new market entrants drive manufacturers to further push their pricing strategies. Further, the extension of the Electric Car Grant was well-intentioned; however, it added further fuel to the fire as brands excluded from the Grant started to offer their own competing incentives.

Short-term considerations

Tactical strategies specifically designed to achieve electric quotas may take a back seat for at least the first few quarters of the year, as manufacturers and retailers tend to deploy this tactic in the final months of the year to close sales gaps. However, volatility will remain a theme throughout the year. Faster days to sell for well-priced, suitably positioned EVs will reward those who adopt accurate pricing and disciplined stock selection, while increased competition from new brands will put pressure on margins across new and used EV channels.

Long-term implications

The trajectory is clear: EVs will continue to carve out a larger share of the used and new markets. As they do so, stakeholders across the industry must be ready to adapt their stocking, funding and remarketing strategies.

While residual values remain uncertain, buyers must pay close attention to trends across models and segments, as performance can vary widely between vehicles.

With further policy shifts on the horizon and Europe dialling back its own emissions rules, the case for an urgent review of the ZEV Mandate is becoming hard to ignore. Industry concerns around the proposed eVED tax also highlight the risk of undermining already-soft EV demand, potentially slowing the UK’s transition at a pivotal time.

What should the industry be keeping a close eye on this year?

“It is important to monitor how ZEV mandate-driven strategies will impact competition. If tactical ‘push’ strategies persist, it may fan the flames of price wars, which will, in turn, feed through to EV residual values. Even though we have seen signs that EV values are stabilising, uneven pricing means new car discounting can quickly rebase nearly-new and ex-fleet performance. This could reshape profitability for manufacturers, fleets and retailers alike.”

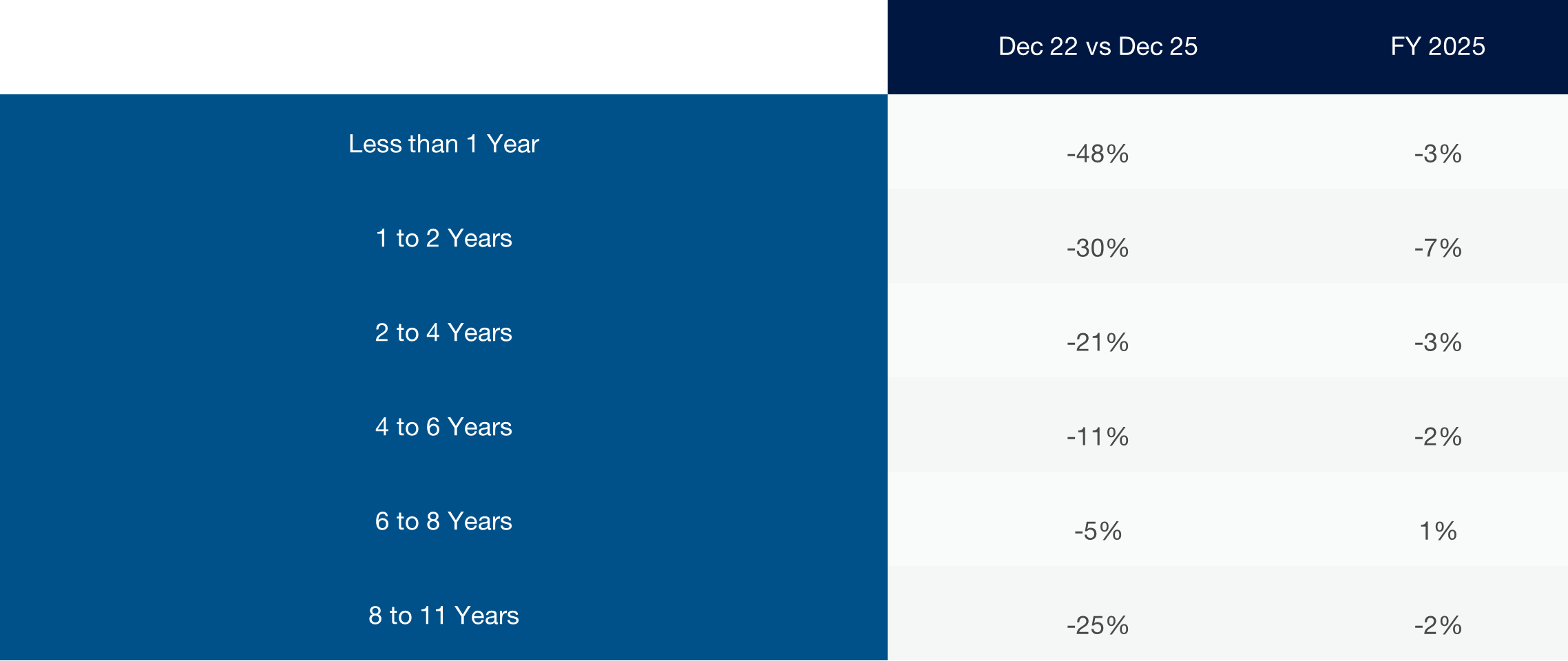

BEV % of Original Cost New

Source: Cox Automotive

To see the data behind the above forecast, please click here to view it in the Appendix.