Welcome to the latest edition of Cox Automotive’s Insight Quarterly (IQ), our comprehensive analysis of the trends shaping the future of the UK automotive market.

In this report, we’ll combine data-led analysis with automotive industry insight across the new, used and EV markets. Our analysis goes beyond headline performance to highlight the underlying forces reshaping the market, and the strategic considerations industry leaders need to reflect on as they navigate the year ahead.

From the growing influence of fleet led demand and tactical volume strategies in the new car market, to the long-term supply constraints still working their way through the used parc, the themes are consistent, complexity is increasing and traditional playbooks are becoming less reliable.

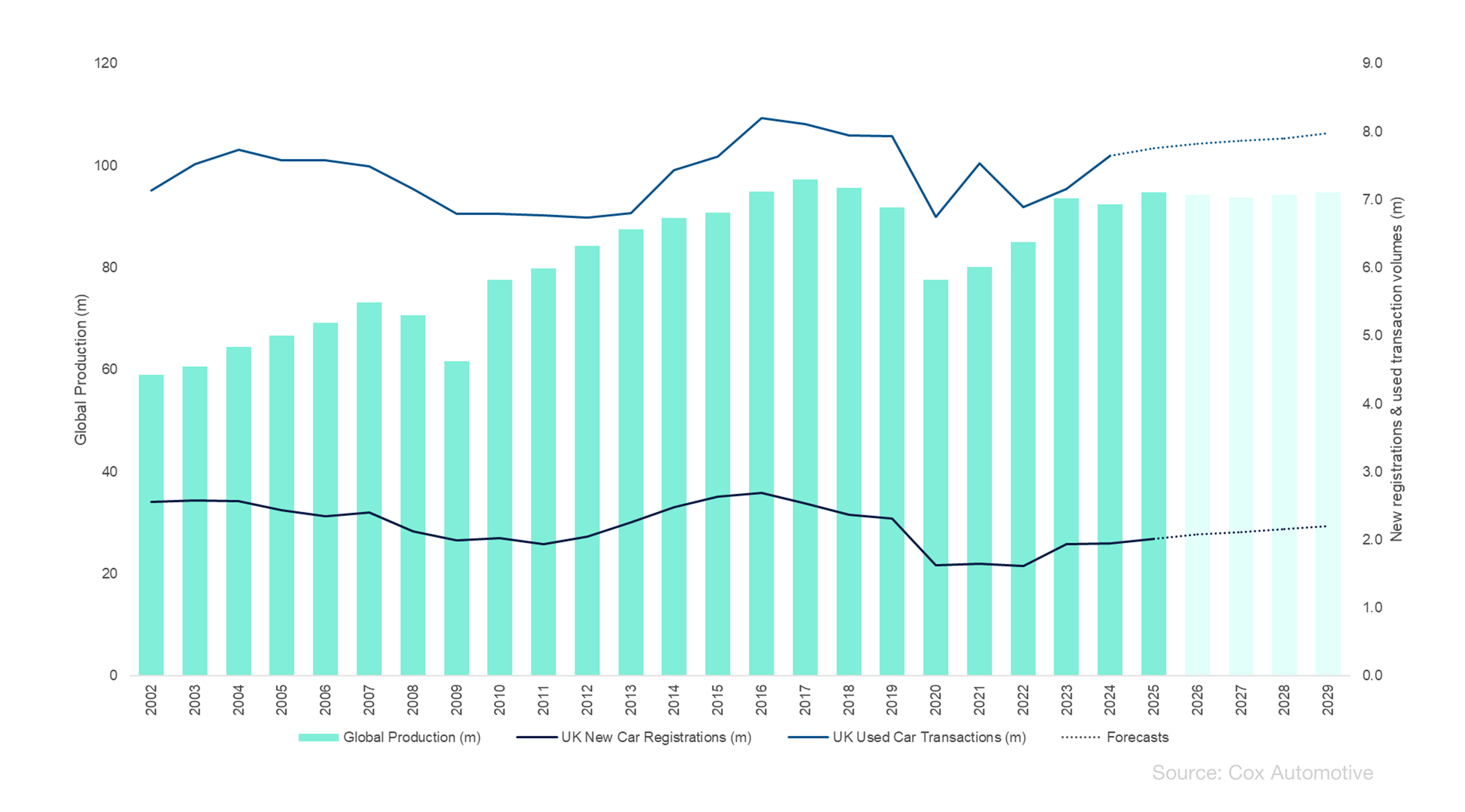

As we begin 2026, the automotive market appears, at first glance, to be finding its feet. New car registrations have crossed the two million mark for the first time this decade, used transactions are holding steady and electric vehicles continue to gain ground. However, look beneath the surface and a far more complex picture emerges.

Many of the conditions that once underpinned a healthy, demand led market have yet to return. Instead, we are seeing a sector reshaped by structural change rather than seasonal cycles. Supply is outpacing demand, private buyers remain cautious and manufacturers are navigating a landscape defined by regulatory pressure, intensifying competition and shifting consumer behaviour.

Electric vehicles remain a central part of this story. 2025 marked another record year for EV registrations, yet affordability concerns, residual value volatility and policy uncertainty continue to weigh on demand, particularly among private buyers. As manufacturers balance ZEV mandate compliance with margin discipline, the risk of short term “push” strategies reshaping market fundamentals remains front of mind.

Alongside our market analysis, this edition is enriched by expert perspectives from NextGear Capital, MarketCheck, IDCP and Interpath, each offering insight into how funding dynamics, data led decision making, risk management and restructuring considerations are evolving in response to today’s market conditions.

As ever, these reports are designed to cut through the noise and focus on what really matters. Whether you’re planning for the year ahead or reassessing longer-term strategy, we hope this edition provides the clarity and confidence needed to navigate a market that is no longer driven by familiar cycles, but by lasting structural change.

New & Used Sales vs Global Production Volume