IQ

Insight

Quarterly

Q4 | 2025

A tale of two markets: UK used car buyers split between budget and luxury as middle ground shrinks

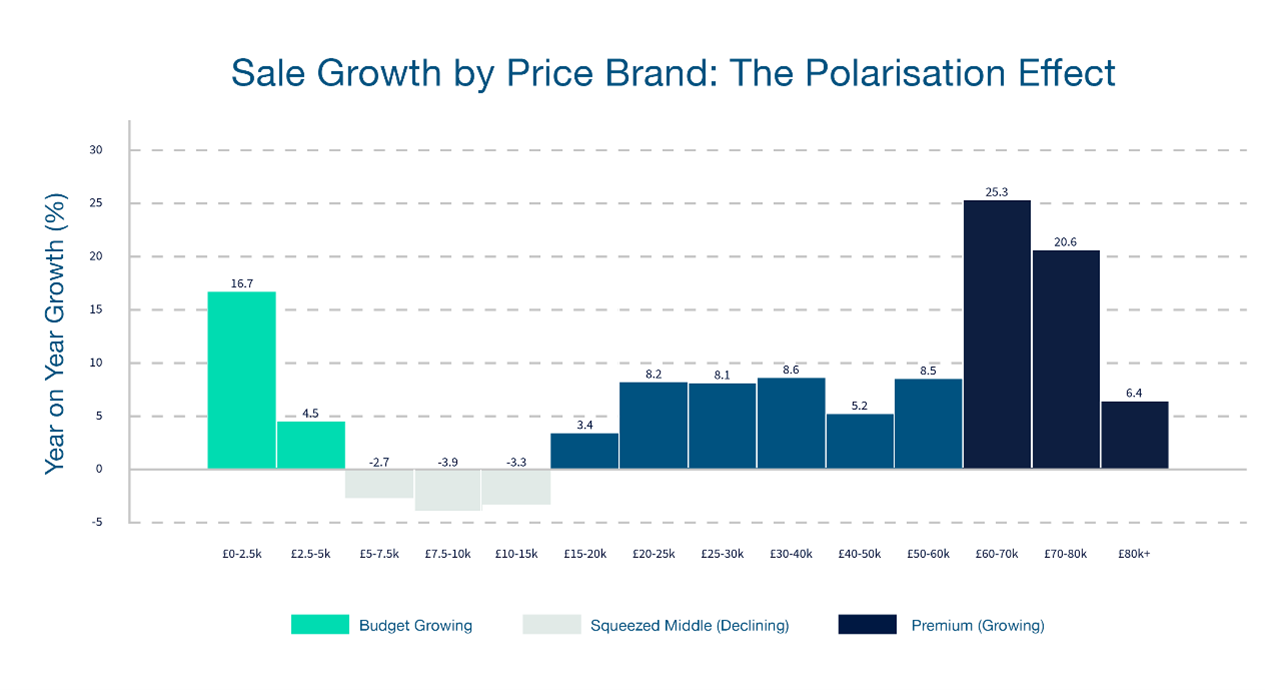

A stark polarisation is reshaping the UK used car market, with buyers increasingly gravitating towards either budget friendly vehicles under £5,000 or premium models above £60,000, while the traditional mid-market shrinks, according to new data from Cox Automotive and MarketCheck.

Analysis of nearly four million used car transactions in 2025 reveals a market splitting into two distinct segments. At one end, cost of living pressures is pushing consumers towards more affordable options. At the other, changing attitudes towards luxury vehicle ownership are driving unprecedented demand for high value used cars.

The numbers paint a clear picture of market bifurcation. Vehicles priced above £60,000 saw sales surge by 14.8%, with the £60,000 to £70,000 bracket alone jumping 25.3% and the £70,000 to £80,000 segment rising 20.6%.

Nearly 63,000 vehicles priced above £60,000 changed hands in 2025. This growth suggests a significant shift in consumer behaviour, with buyers increasingly comfortable making substantial investments in used luxury vehicles rather than facing the high costs and lengthy waiting times associated with new premium models.

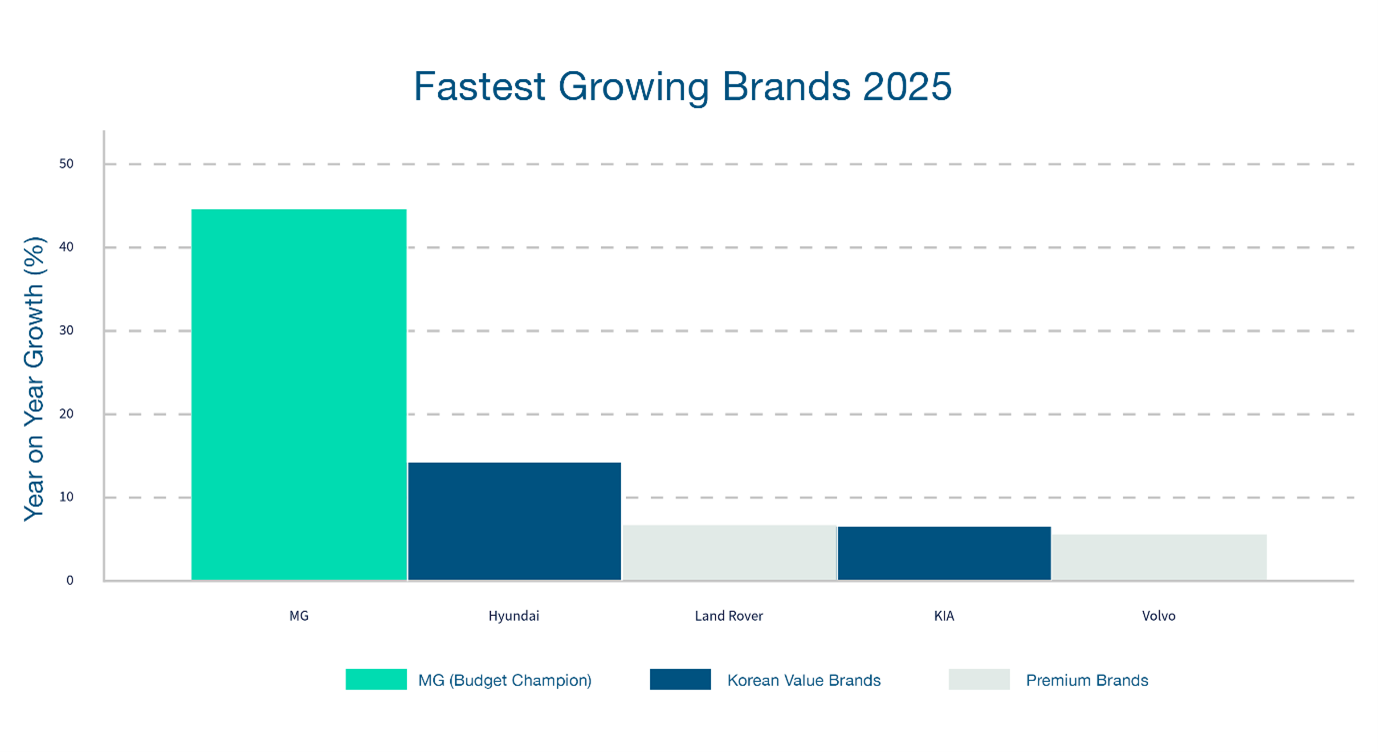

Land Rover, despite its premium positioning, grew 6.7% in the used market, while Volvo rose 5.6%, indicating sustained demand for luxury SUVs and premium Scandinavian brands.

At the opposite end of the spectrum, budget vehicles under £5,000 grew by 7.9%, with entry level cars priced below £2,500 increasing by 16.7%. The growth in budget vehicle sales reflects the ongoing financial pressures facing UK households. Over 542,000 vehicles priced under £5,000 were sold in 2025, up from 502,000 the previous year.

The sub £2,500 category alone accounted for more than 164,000 sales, as consumers sought the most affordable routes to vehicle ownership.

Value focused brands have been the primary beneficiaries of this trend. Chinese manufacturer MG saw used sales rise by 44.6%, up from 48,000 units to nearly 70,000. Korean manufacturers Hyundai and Kia grew 14.2% and 6.5% respectively, with the pair approaching 300,000 combined sales as buyers gravitated towards their reputation for reliability and value.

Meanwhile, the traditional heartland of the used car market is contracting. Vehicles priced between £5,000 and £15,000, historically the most popular price bands for used car buyers, saw sales decline by between 2.7% and 3.9% across all brackets. This marks the first sustained contraction in this core segment since the pandemic recovery period, which signals a structural shift rather than a temporary fluctuation.

We are witnessing a fundamental shift in how consumers approach the used car market. The middle ground that once defined this market is being squeezed from both directions. Budget conscious buyers are trading down to more affordable options, while those with means are increasingly viewing premium used vehicles as a smarter alternative to new car purchases.

Despite this polarisation, the overall used car market demonstrated resilience. Based on 11,000 dealers tracked, total sales reached 3.96 million vehicles, a 2.3% increase year on year. Crucially, vehicles are selling faster than at any point in the past two years, with average days on market falling from 58.8 days in early 2024 to 55.2 days by the end of 2025. This acceleration indicates strong underlying demand across the market, even as the composition of that demand shifts.

This trend is expected to continue into 2026 as economic pressures persist and the premium used market matures further. Dealers and manufacturers will need to adapt their strategies to serve two increasingly distinct customer bases with fundamentally different needs and priorities.