Current used van market realignment set to stay

- September 2020’s used van values were 34% higher year-on-year (YoY)

- Average online auction events have seen a 29% growth in attendance levels year-on-year

- Demand for Euro 6 remained exceptionally strong during September

Manheim, the UK’s number one CV auction company, has delivered its fifth consecutive month of record-breaking LCV sales performance in September and believes the current market performances are set to remain strong.

In its latest ‘Market Tracker for LCV, Manheim reported that September 2020’s used van values were 34% higher year-on-year (YoY) up from £6,257 in the same month of 2019 to £8,390. This despite age being identical and mileage only being 6% (4,200 miles) lower in September 2020 versus the same month in 2019.

According to Matt Davock, Manheim’s director of CV, September’s unprecedented price bounce is not due to a lack of wholesale supply.

“The volume of vans for sale in Manheim are only tracking 11% behind September 2019. First-time conversion rates remain strong, standing for a second consecutive month at 87%; up 11% compared to the same month last year,” commented Davock.

Manheim’s latest insight proves this market realignment kicked in from June as the automotive sector began to re-open. Comparing Q3 to Q1 2020, the average selling price has jumped by a third (32.3%), despite average age and mileage being near-identical pre-lockdown.

Demand for Euro 6 remained exceptionally strong during September. Average selling price jumped from August to September by 6.3% (up £728 to £12,140) despite volumes sold increasing slightly in September. Age and mileage were similar for both periods. Euro 5 and older vans showed greater stability month on month, up in September by a modest £51 or 0.9%.

Davock continued: “Dealers are potentially concerned that the ‘bubble may burst’ as has happened in times of recession before or times of volume de-fleet. One thing has remained constant since lockdown - the shift in consumer shopping activity from physical to online retail. CV’s remain the lifeblood of UK business and post lockdown demand proves this. Speaking to our vendors, there are no significant volumes of van de-fleet in the pipeline. That makes sense as extensions reflect both the lead time issues and deferred replacement programmes.”

Davock concluded: “Average online auction events have seen a 29% growth in attendance levels year-on-year. The active buyer audiences are growing month on month and vendors are liquidating stock faster for optimum values. The average days to sell through our daily virtual lane via Simulcast events is just 11 days; going back a year that was 14 and the year prior 19. This underlines the value of the investments Manheim has made in digital wholesale. Although we may be approaching the ceiling of used Euro 5 and pre-Euro 5 wholesale values, Euro 6 will track increases in list prices considering the new supply shortage. We believe a significant number of ghost listings are being employed by dealers to attract a retail enquiry; only to convert to an alternative example.”

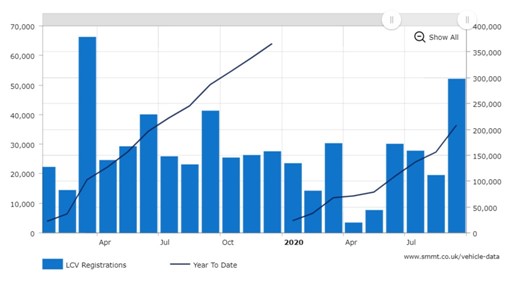

James Davis, customer insight director, Cox Automotive, added: “September’s new van market was up 26.4% year-on-year. Last year, we saw tactical registrations with the Brexit and WLTP deadlines. Much of half two’s new van pipeline was brought forward and delivered in half one 2019. The new van market has not had a typical flow, adding to the shortage of de-fleeted stock. Comparing 2020 to the 2019 year to date we are around 80,000 vans, a third, down on new registrations and with business uncertainty there are many fleets in short term extension; either waiting for new vans to arrive or having deferred their replacement order entirely.”

Comparison of 2019 and 2020 New LCV Registrations – annual and monthly (Source: SMMT)

Comparison of 2019 and 2020 New LCV Registrations – annual and monthly (Source: SMMT)

Davis concludes: “There are many macro factors impacting the CV market currently. Lead times are extended as manufacturers and suppliers suffer productivity challenges due to COVID safe working practices. This will continue to impact the global supply chain for the next 12 months; only the global delivery of a vaccine will change this situation. Brexit negotiations are threatening the list price position of new vehicles in terms of tariffs. We are in a supply-led recession; a very different landscape than typical recessions we have suffered from liquidity crisis and demand-led recessionary pressures. We remain in uncharted territory.”

“With new and used supply constraints in place for the majority of 2021, demand is likely to track and build month-on-month. Quarter Four, typically one of the busiest in terms of the build-up to the festive period, indicates there will be record shortages of new and used vans. We expect to see used van demand and values climb to new records during a typical seasonal cooling off period. Whatever the ultimate reduction in new supply, the used van volume pipeline is severely constrained in the coming years, long after our economy and society recover.”