2026 UK EV adoption and perceptions report

This is the first annual Cox Automotive Europe EV adoption and perceptions report, based on a nationally representative survey of 2,008 UK drivers conducted in late 2025.

1) Introduction: UK EV adoption trends and barriers in 2026

Cox Automotive Europe recently surveyed 2,008 UK drivers, 36% of whom own or lease an EV. The results show cost perception, battery myths and charging confidence still slow adoption, but experience and education convert – 95% of EV drivers say they would choose electric again.

Understanding EV adoption rates in 2026

EV adoption in the UK is accelerating. More than 473,000 new battery electric cars were registered in 2025, accounting for 23.4% market share and a 23.9% increase on the previous year.

Adoption rates climbing steadily year-on-year, marks a pivotal moment in the UK’s commitment to zero-emission vehicles. However, barriers like cost perceptions, battery confidence, charging infrastructure, anxiety and sustainability concerns remain.

While new EV purchase incentives and more public charging investment from the Autumn Budget 2025 are supportive, the new pay-per-mile road tax offers more confusion to an already complex total cost of ownership conversation.

Our report makes one thing clear though. Removing these barriers is critical for driving consumer confidence; the catalyst in ensuring the UK market can achieve mass EV ownership and meet national sustainability targets.

Why we created this report

Our 2026 UK EV adoption and perceptions report is designed to address two core questions for the automotive market:

- Who is driving EVs in 2026. Broken down by age, region and experience cohort (owners, test-drivers, interested and not interested), we explain the current appetite for electric vehicle in the UK.

- What’s next for EV adoption in the next 12 months and beyond. The blockers and enablers that will shape the next phase of electrification and how the industry can drive it forward.

Across the 2,008 UK drivers surveyed, it’s clear that education and real-life experience remain the most powerful levers of adoption. Those who have made the switch or have test-driven an electric vehicle are consistently more confident than those who haven’t. Yet, many drivers are still hesitant about the true cost of ownership, battery lifespan and charging network reliability.

Closing these knowledge gaps, prioritising experience and showcasing the 95% repeat-intent among current EV owners is essential for ensuring long-term trust and meeting challenging zero-emission goals.

"Experience continues to be the biggest driver of EV adoption. The more people who get behind the wheel of an electric vehicle, the faster confidence grows."

– Karoline Baumann, Strategy & New Growth Director at Cox Automotive Europe

Turning insight into action

This report aims to provide the automotive industry with the insights needed to accelerate EV market growth and improve consumer engagement. By understanding current perceptions and ongoing barriers, OEMs, retailers and fleet operators can tailor their strategies to meet consumer needs and improve the real-world experience of switching to electric vehicles.

For dealers this means comprehensive communications about the cost of ownership, and reality of battery health and vehicle maintenance costs, while OEMs prioritise transparent data on EV resale values and available incentives. When it comes to fleet operators, it reinforces the importance of fleet electrification in achieving wider adoption targets.

EV adoption trends: Key takeaways

- UK EV adoption is accelerating but barriers like cost perceptions, charging infrastructure and battery confidence persist.

- EV adoption trends show that experience and education are key drivers of consumer confidence in 2026.

- OEMs and dealers must focus on education and experience to support EV market growth.

2) EV ownership in the UK: Buyer perceptions, demographics and market trends (2026)

Our survey shows that EV ownership in the UK continues to grow in 2026, led by drivers aged 25-34. Those who have test driven an EV are more likely to purchase in the next three years, while a lack of confidence continues to hinder wider adoption.

Who currently owns an electric vehicle?

EV ownership has surpassed early adopters and entered the mainstream. As of November 2025, EVs make up around 5.2% of cars on the road, with almost one in two (49%) drivers we surveyed haven driven an electric vehicle, and more than one in three (36%) currently owning or leasing one.

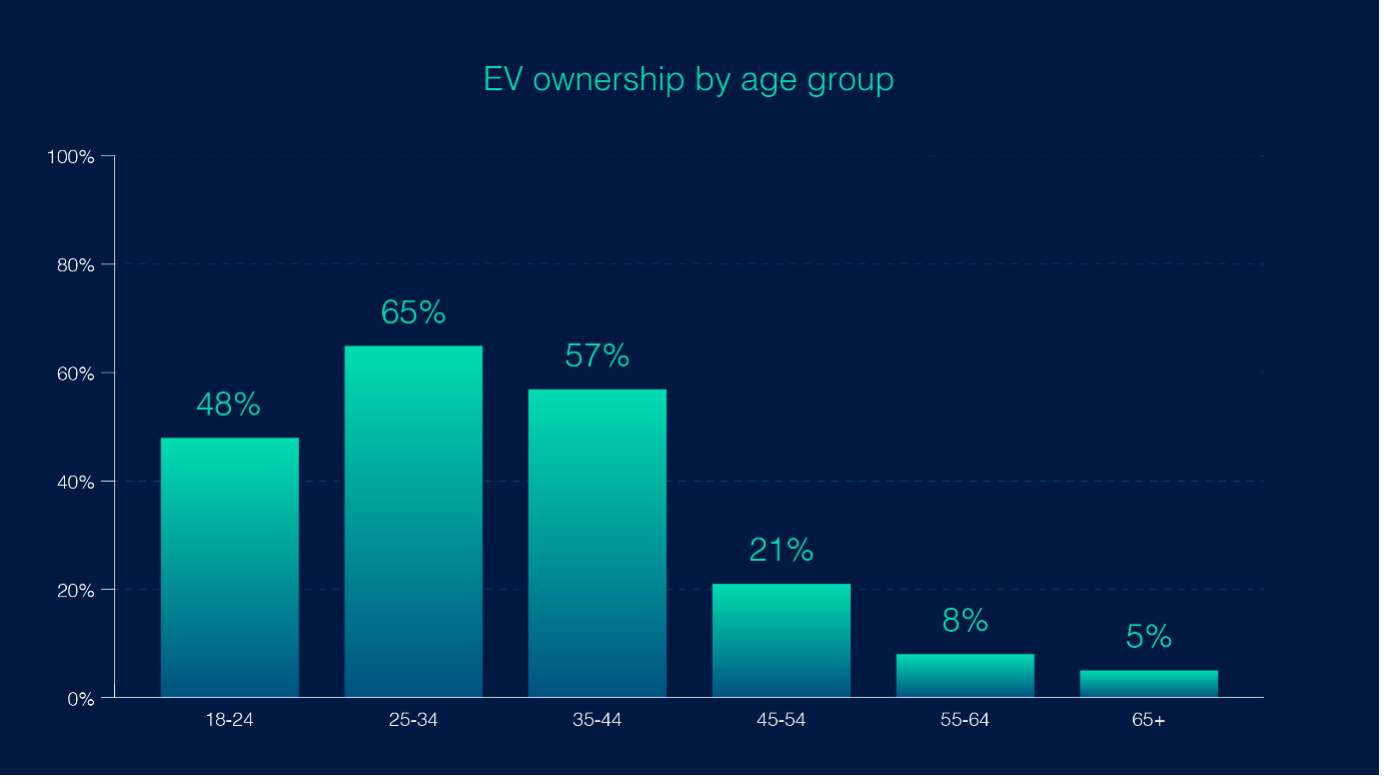

Our results indicate that EV ownership is highest amongst 25–34-year-olds (65%), followed by those aged 34–44 (57%), and 18-24 (48%), with older drivers being slower to switch.

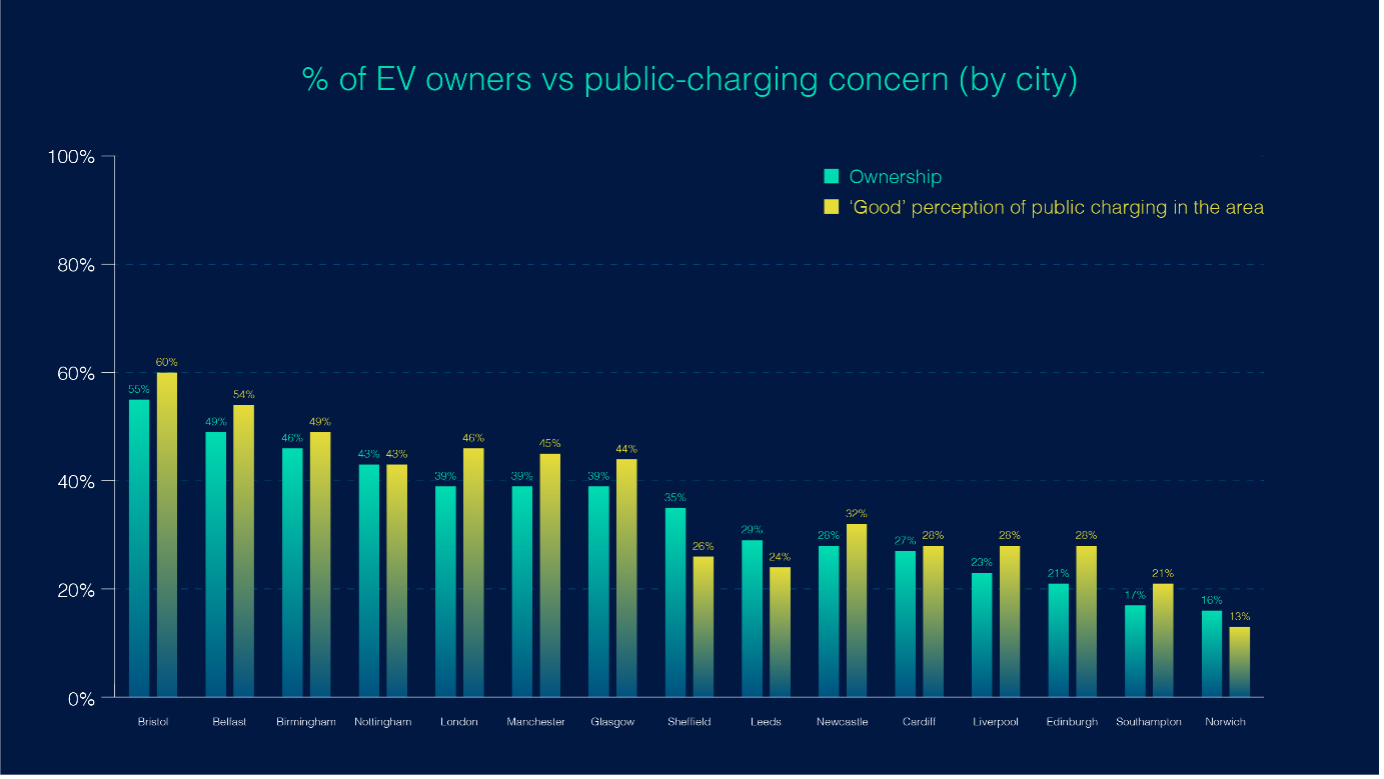

When it comes to regional EV adoption rates, Bristol has the highest percentage of EV drivers among respondents at 55%, followed by Belfast (49%), Birmingham (46%), Nottingham (43%) and London (39%). Likely due to recent charging infrastructure investment in these areas and Clean Air Zones bringing down the cost of ownership.

How informed do UK drivers feel about EV ownership?

Despite growing ownership, our data shows an EV education gap is still impacting wider adoption. More than half (56%) of those who have never driven an EV, feel they don’t have enough information on owning an electric vehicle. Falling to 30% among those who have test driven an EV, and to 3% of EV owners.

This highlights that EV experience translates into confidence. Dealers and OEMs play a pivotal role in bridging this divide. Prioritising test drives and accessible EV education on running costs, sustainability, charging infrastructure and battery lifespan, is essential for turning curiosity into confidence.

"Drivers who’ve been behind the wheel of an EV don’t just understand the technology, they trust it."

– Paul Humphreys, Managing Director of Retail at Cox Automotive Europe

Experience drives EV purchase intent

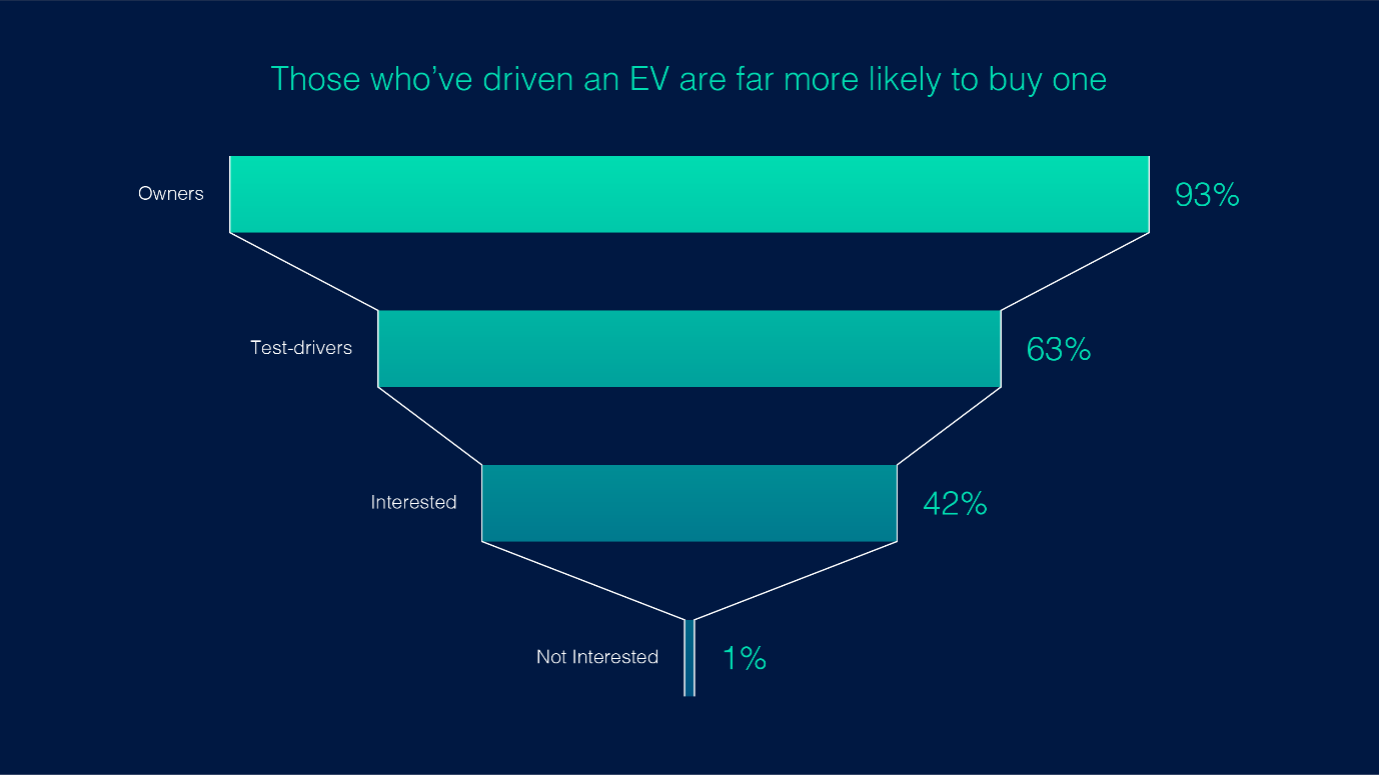

The same experience effect shows up in purchase intent. Nearly all (95%) of EV drivers surveyed say they’d choose electric again in the next three years, dropping to 63% of those who have test-driven an EV, and 24% of non-EV drivers without real-life experience. In simple terms, intent is higher with experience, and lower without it.

What types of EVs are drivers interested in purchasing?

When asked the electric models they’d consider purchasing, the majority of respondents leaned towards established manufacturers, yet one in eight (12%) respondents selected at least one new market entrant.

This interest in new manufacturers is led by 18–24-year-olds, of which 25% of the cohort selected at least one new entrant in their preferred list of EV manufacturers. Established brands were still the dominant choice among all age groups.

Comparing new vs used, and battery EVs (BEVs) vs hybrid options, most drivers (28%) interested in purchasing an electric vehicle, cited new battery EVs as their top purchasing choice. Alongside new plug-in hybrids (25%) and used battery EVs (23%), making up their top three choices.

Opinions on pre-owned seem to shift once drivers experience EVs however, with the majority (47%) of used EV drivers, saying that’s where their interest remains, and 30% of new EV drivers being interested in the used EV market in the future.

EV ownership: Key takeaways

- EV ownership in the UK is expanding rapidly, led by younger drivers

- EV satisfaction is high: 95% of EV owners say they would choose electric again

- Experience matters: those who’ve test driven an EV are more likely to buy one

- Education gaps persist: Non-EV drivers remain uncertain about the realities of owning an electric vehicle

- Established manufacturers retain trust, but new entrants are gaining interest among younger buyers

3) EV Battery myths: The biggest adoption roadblock

EV battery myths including lifespan, safety, range and charging best practice, remain the biggest barriers to adoption in 2026. Owners report higher confidence, signalling the reality doesn’t match the myth.

Why EV battery myths continue to dominate consumer perceptions

While the UK has shown great progress in EV adoption, persistent EV battery myths continue to shape consumer decisions. From EV battery safety and battery lifespan, to charging myths and range anxiety, misinformation and lack of real-life experience are creating a confidence gap.

Our data shows that the more experience a driver has, the stronger the confidence in EV batteries:

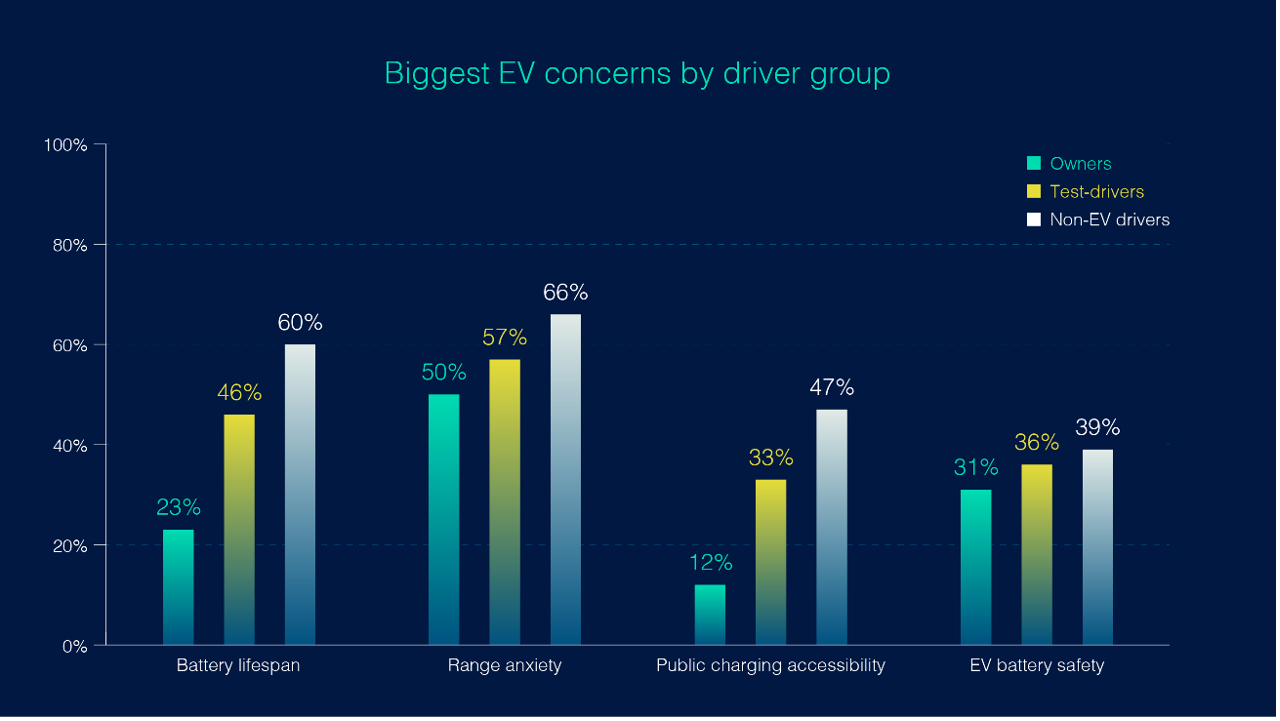

- 60% of those who haven’t driven an EV, cite battery lifespan as a concern. Compared to 46% of those who have test-driven an electric vehicle and 23% of EV owners.

- Two thirds (66%) of non-EV drivers have range anxiety, dropping to 57% among test drivers, and again for EV owners (50%).

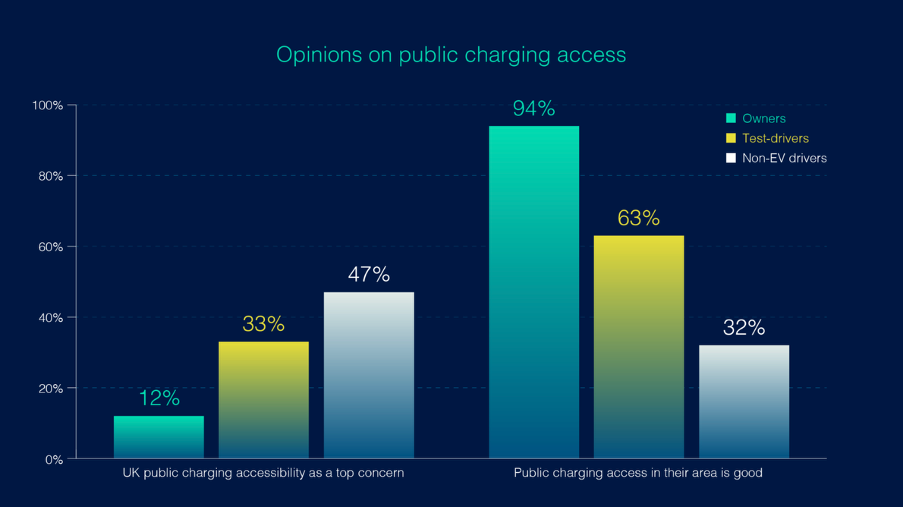

- 47% of non-EV drivers admit concerns about public charging accessibility, compared to a third (33%) of those who have test driven an EV, and only 12% of EV owners.

- Two in five (39%) of non-EV drivers flagged concerns around EV battery safety, dropping to 36% among those who have test driven, and 31% among EV owners.

It’s clear then, that while experience does drive confidence, common EV battery myths still impact perceptions in those who have driven or own an electric vehicle, particularly around EV battery safety and range anxiety.

OEMs and dealers have a critical role to play in debunking these battery myths and highlighting the reality of EV battery packs during the marketing and sales process. Focuses should include public charging infrastructure, battery degradation, charging best practice, battery replacement costs and EV reliability.

Common EV battery myths and the reality

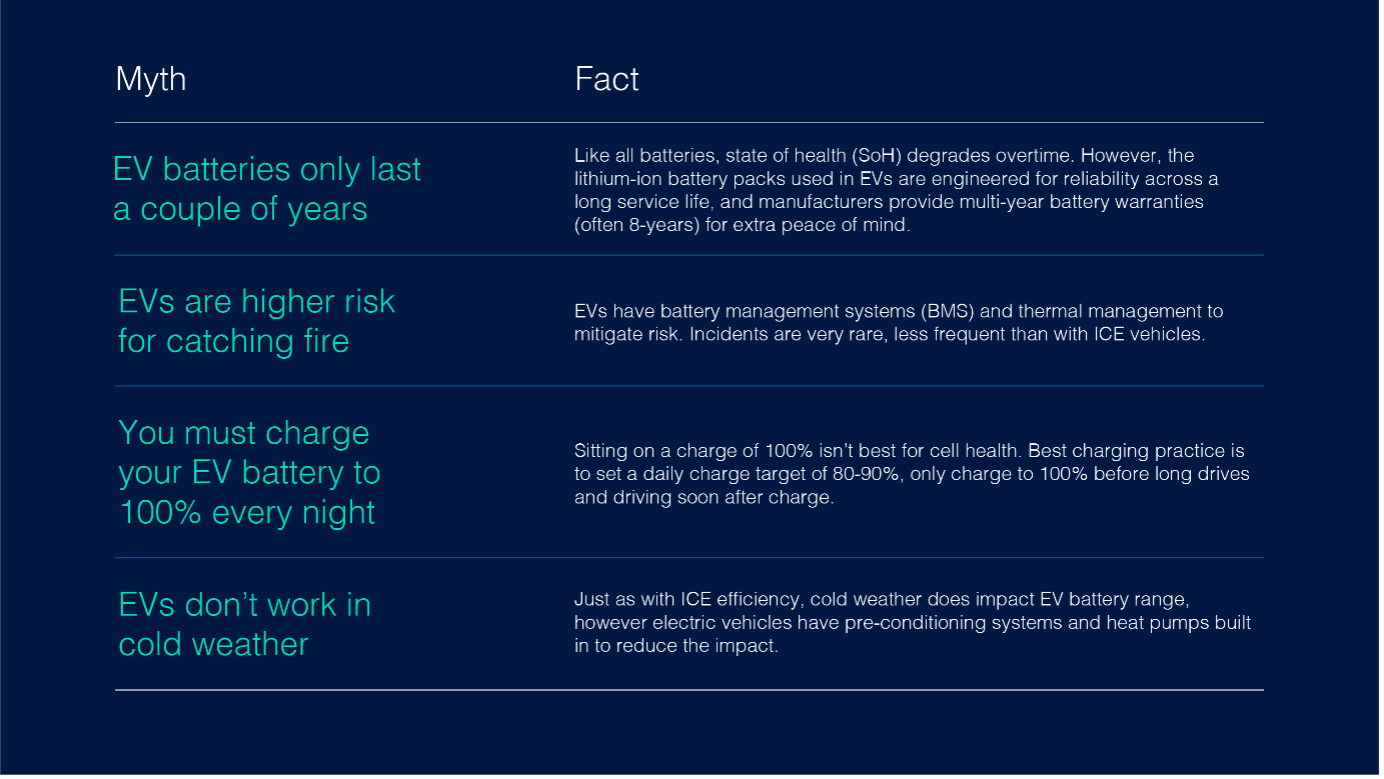

Myth: EV batteries only last a couple of years

Fact: Like all batteries, state of health (SoH) degrades over time. However, EV battery packs are engineered for reliability across a long service life – up to 20 years - with battery warranties often covering the first eight. In comparison, ICE vehicles generally start to become uneconomical at 16-18 years and warranties generally only cover the first three years.

Myth: EVs are higher risk for catching fire

Fact: EVs have battery management systems (BMS) and thermal management to mitigate risk and incidents are very rare. Compared to ICE vehicles, the statistics vary, yet it’s believed ICE vehicles are 20 times more likely to catch fire.

Myth: You must charge your EV battery to 100% every night

Fact: Sitting on a charge of 100% isn’t best for cell health. Best charging practice is to set a daily charge target of 80-90%. Only charge to 100% before long drives and set off soon after.

Myth: EVs don’t work in cold weather

Fact: Just as with ICE MPG efficiency, cold weather does impact EV battery range. However, in countries like Norway where temperatures are often below sub-zero, the number of EVs on the road surpass the number of ICE vehicles, suggesting the range impact is minimal.

EV battery myths: Key takeaways

- EV battery myths around lifespan, safety, range and charging concerns remain the most persistent barriers to EV adoption.

- Data shows that with more experience comes more confidence in EV reliability and battery health.

- Even with experience, more education is needed on the reality of EV battery reliability and best charging practice.

- Dealers and OEMs should focus their EV sales messaging on battery myth busting, ownership comparisons with ICE, extended warranties covering the entire vehicle, encouraging test-drive experiences and supplying battery health reports to drive conversions.

EV battery myths FAQs

Do EV batteries only last a couple of years?

No. EV battery packs are engineered for a long service life, up to 20 years, with manufacturer warranties covering the first eight. Compared to ICE vehicles which start to become uneconomical between 16-18 years-old and have warranties that only cover the first three years. Like all batteries however, state of health (SoH) declines gradually over time. Charging best practice and thermal management systems help preserve EV battery capacity.

Are EVs at higher risk of catching fire?

Reported EV fire incidents are very rare. Battery packs are made to extensive safety standards and include battery management systems (BMS) and thermal management to reduce EV fire risks.

Should I charge an EV battery to 100% every night?

No, not for daily use. Just like with your mobile phone, best charging practice is to charge to 80-90%, saving 100% charges for long trips. Avoid leaving EVs at 0% or 100% for long periods of time to maintain battery health.

Do EV batteries work in cold weather?

Yes. Cold weather reduces battery range, just as it impacts ICE miles-per-gallon (MPG), but pre-conditioning and heat pumps keep winter driving practical.

See our consumer-ready guide on EV battery lifespan to help shape your marketing and sales messaging on battery health.

4) Economic pressures remain high: Price, incentives and the true cost of EV ownership

EV cost of ownership remains a perceived barrier to adoption in the UK, despite falling purchase prices, EV incentives and lower maintenance costs. Two in three (65%) UK drivers surveyed view total cost of ownership (TCO) as higher than ICE, despite owners citing fewer maintenance costs.

EV cost of ownership vs. ICE: The mental barrier that persists after purchase

From upfront EV prices to maintenance costs and charging fees, EV cost of ownership is the biggest barrier to adoption after battery reliability. Two in three (65%) UK drivers believe the cost of ownership is higher than for ICE vehicles, while only 10% believe it’s cheaper, and 16% believe it’s equal.

Unlike with battery reliability, the higher cost perception remains high across non-EV drivers, test drivers and owners alike. Our data shows 86% of electric vehicle owners still say total cost of ownership feels ‘more expensive’, while 56% of test-drivers and 60% of non-EV drivers agree.

This suggests that price-led mental barriers persist even after purchase. Likely driven by common misconceptions in the media, upfront costs, fear of future costs like battery replacements and maintenance fees, and residual value instability impacting monthly payments.

Similarly, the proposed pay-per-mile tax from the 2025 Autumn budget will likely feel like an additional cost to the driver, regardless of it being an EV replacement for fuel-duty which is paid at the pump for ICE vehicles. That perception can inflate the ‘EVs feel more expensive’ narrative unless retailers show direct total cost of ownership comparisons, including fuel duty vs. pay-per-mile costs.

Perception vs reality: EV prices and maintenance costs

Cost perception isn’t reality for most owners, however. EV purchase prices / monthly payments were noted the biggest cost of ownership concern among total respondents (40%). Only 23% of EV drivers agreed however, versus more than half (53%) of non-EV drivers, and 32% of test-drivers.

Similarly, repair and EV maintenance costs were a concern for a third (34%) of all respondents - with only one in five (19%) EV drivers in agreement, compared to 46% of non-EV drivers, and 34% of test drivers.

The reality though is that with fewer moving parts, an EV generally costs less than an ICE vehicle to service and maintain on average. A fact supported by our survey, which shows 43% of EV drivers surveyed marked lower running costs as a benefit of EV ownership.

Just like with battery myths, this data enforces that experience and education are essential for driving confidence in cost of ownership.

To remedy misconceptions on EV prices, maintenance and running costs, OEMs and dealers should:

- Create transparent total cost of EV ownership vs. ICE vehicles at the point of sale and in marketing communications. Presented as monthly spending tables.

- Show total cost of ownership vs. ICE in one clear visual, including charging per mile (home vs. public), routine maintenance items and their costs, Clean Air Zone (CAZ) and Ultra Low Emission Zone (ULEZ) savings, and the likely price ranges for insurance and tax payments.

- Personalise the expected charging costs based on customer’s needs (home vs. public). For example, based on today’s averages, cost-per-mile using a rapid charger is similar to 30-45 mpg for a diesel, compared to home off-peak charging at 160mpg.

- Show salary-sacrifice or benefit-in-kind impacts where relevant to highlight further savings.

- Add battery health reports and lead with warranty coverage to reduce the fear of future costs.

"Owners quickly realise that running an EV quickly counteracts the upfront costs."

– Paul Humphreys, Managing Director of Retail at Cox Automotive Europe

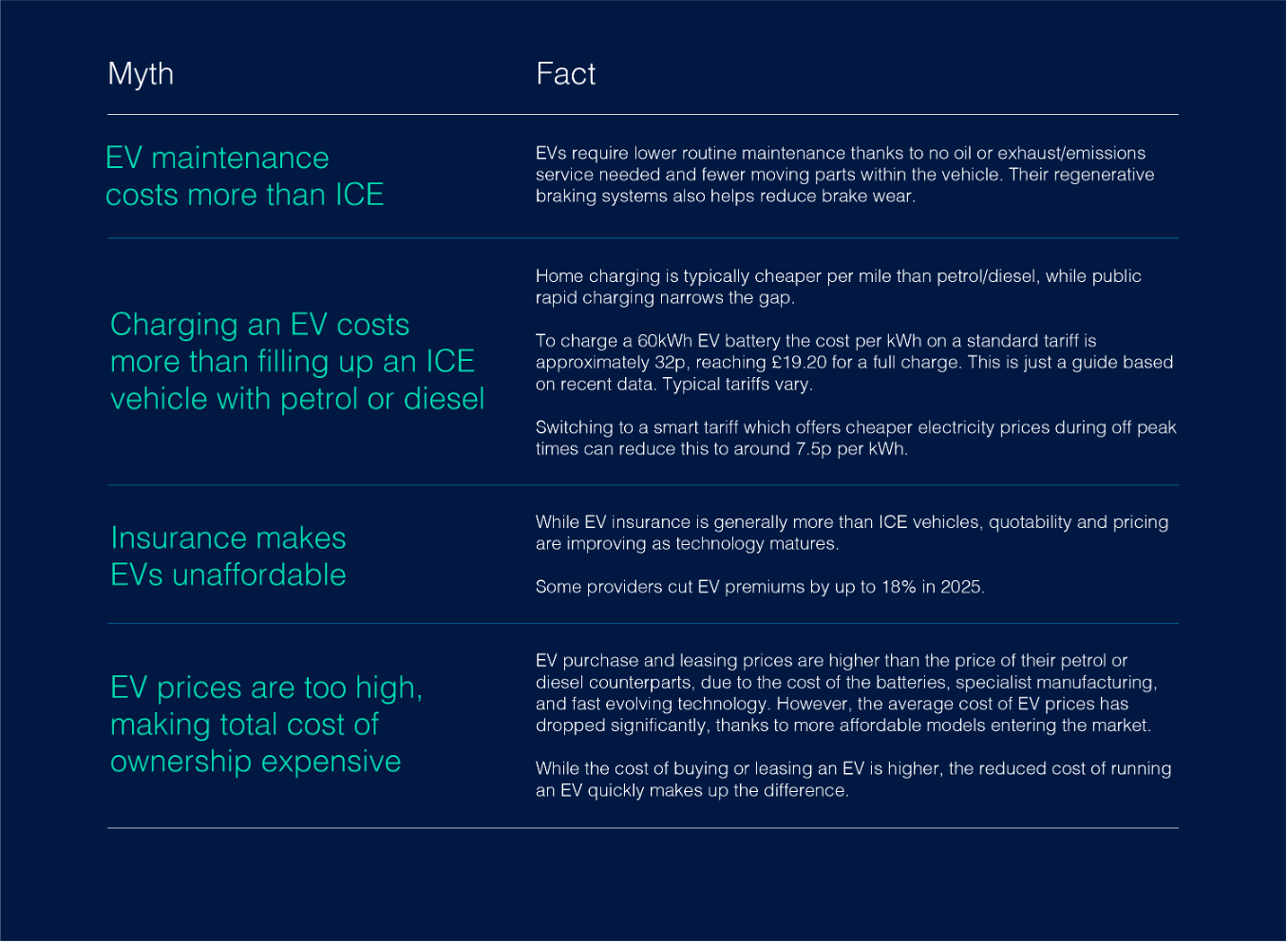

Common EV cost of ownership myths and the reality

Myth: EV maintenance costs more than ICE

Fact: EVs require lower routine maintenance thanks to no oil or exhaust/emissions and fewer moving parts within the vehicle. While tyre and suspension wear is higher, their regenerative braking systems helps reduce brake wear. Therefore, the cost is generally lower compared to ICE vehicles.

Myth: Charging an EV costs more than filling up an ICE vehicle with petrol or diesel

Fact: Home charging is typically cheaper per mile than petrol/diesel, at an average of 8p per mile, while public rapid charging narrows the gap at 14p per mile. This is just a guide based on recent data. Typical tariffs vary.

Switching to a smart tariff which offers cheaper electricity prices during off peak times can reduce this further

Myth: Insurance makes EVs unaffordable

Fact: While EV insurance is generally more expensive than ICE vehicles (54% higher than ICE vehicles at an average of £996 per year for EVs), quotability and pricing are improving as technology matures. For example, some providers cut EV premiums by up to 18% in 2025.

Myth: EV prices are too high, making total cost of ownership expensive

Fact: EV purchase and leasing prices are higher than petrol or diesel equivalents, due to battery costs, specialist manufacturing, and fast evolving technology. However, average EV prices have fallen as more affordable models enter the market.

While the cost of buying or leasing an EV is higher, the reduced cost of running an EV quickly makes up the difference. That said, residual value volatility matters. Cautious RVs can lift monthly payment costs, while making used EVs strong value for money, due to much of the depreciation already priced in.

Are EV incentives doing enough to move the dial?

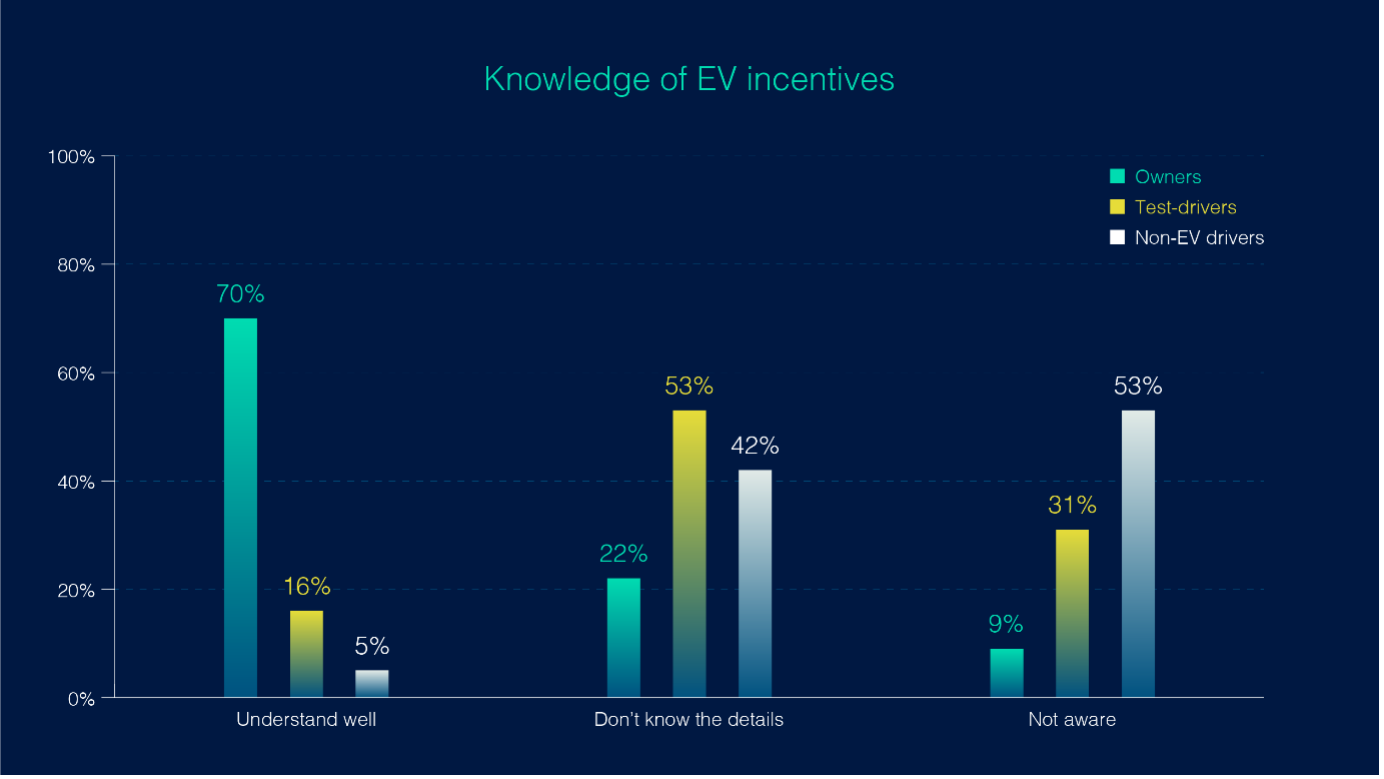

While more EV purchase incentives coming into effect after the Autumn Budget 2025 is welcomed, our report shows that awareness of new EV incentives is broad, but shallow – meaning there’s more to be done in communicating these incentives clearly.

More than one in four (29%) of survey respondents said they understand available incentives well, compared to 37% who are aware but don’t know the details, and 34% are not aware at all.

EV incentive literacy tracks with experience:

- 70% of EV owners say they understand incentives well, 22% don’t know the details and 9% are unaware

- 16% of EV test drivers understand incentives, 53% aren’t aware of the details, while 31% are unaware completely

- 5% of non-EV drivers understand incentives, 42% don’t know the details, and 53% are unaware

This confirms the familiar pattern throughout our report: experience reduces uncertainty.

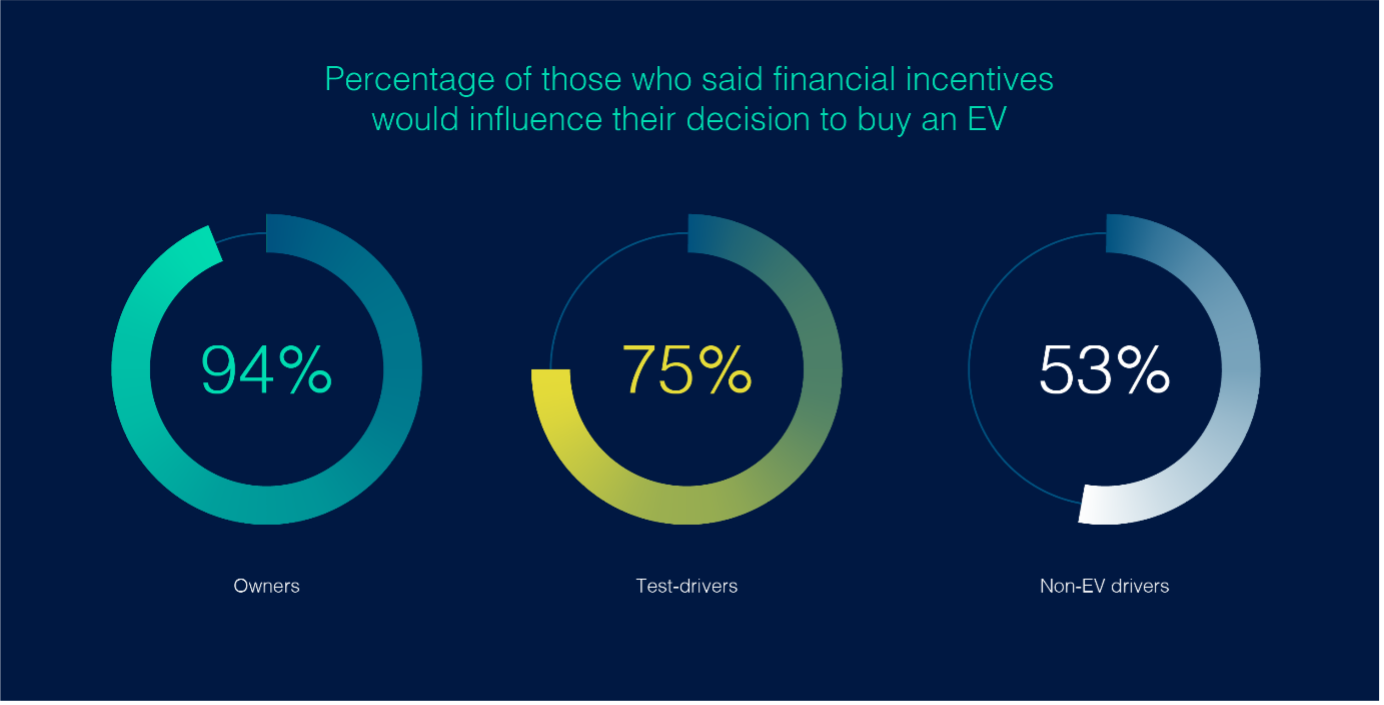

The data goes on to prove that EV incentive education is pivotal for influencing purchase intent, with 71% of respondents claiming incentives would influence them to switch to electric. Breaking this down by cohort, 94% of EV drivers agree, vs 75% of test-drivers and 53% of non-EV drivers.

OEMs and dealers should prioritise making EV incentives personalised and visible early on:

- Put incentives at the front of the journey: Headline EV incentives on model pages, not hidden in FAQs or checkouts.

- Show “after-incentive” monthly price comparisons vs. ICE vehicles: Bake in salary sacrifice / benefit-in-kind savings where applicable.

- Personalise benefits based on the consumer: Home location, journey types, workplace charging, local ULEZ and CAZ savings and home-charging support.

- Target communications: Specifically low-awareness customer segments with simple explainer panels and a test-drive CTA.

- One-screen explainer: Add an “incentives you may qualify for” eligibility checklist at point of sale.

EV Resale values are an industry concern, not consumer blocker

EV residual values (RVs) are a pivotal concern for retailers and fleets, and rightly so. They help set monthly payments, influence stock turn and shape remarketing performance.

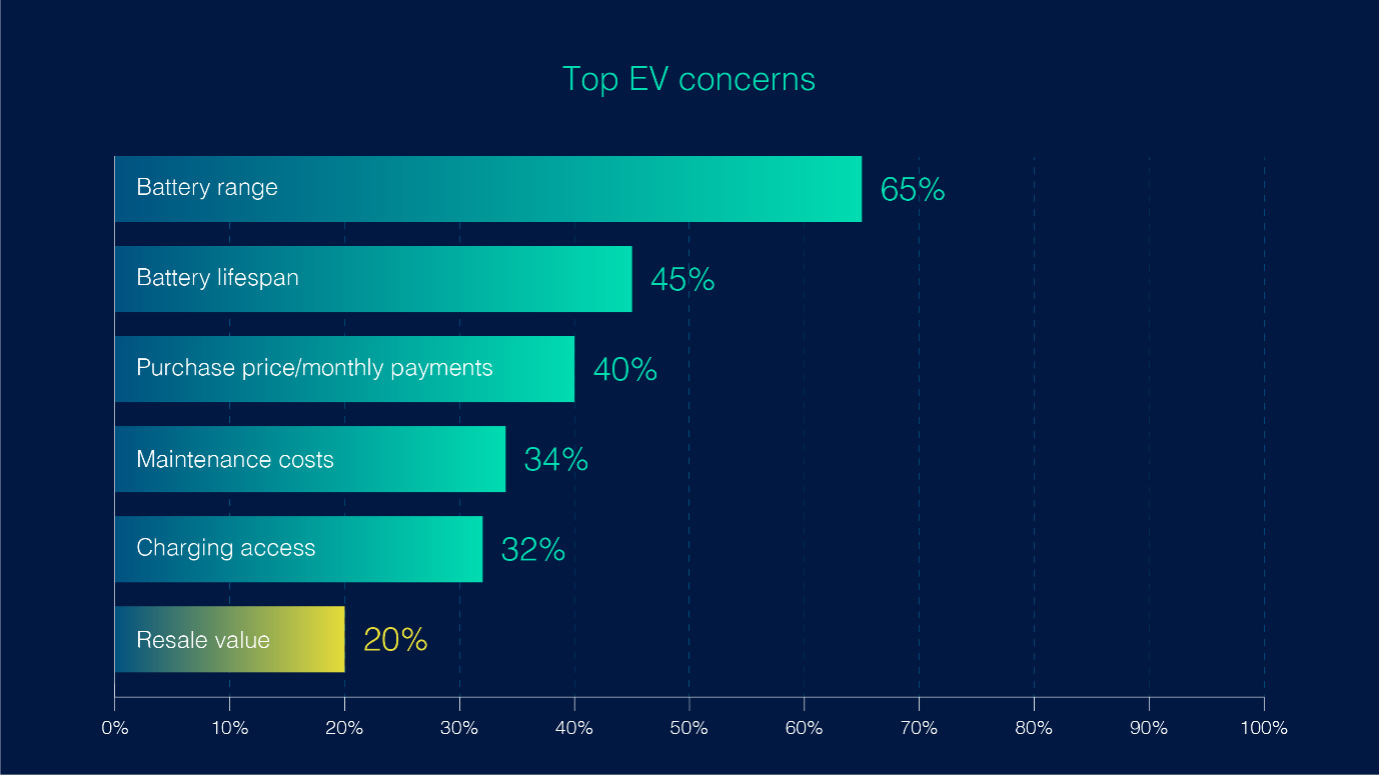

For drivers however, our data shows EV resale values are not a huge priority, with only 20% stating it as a top concern, below battery range (65%), battery lifespan (45%), purchase price/monthly payments (40%), maintenance cost (34%), and charging access (32%). However, resale value remains a core input into TCO and monthly pricing, both of which are causing hesitancy today. It’s likely then that consumer anxiety may surface later down the line when battery health could affect resale at the 8–10-year mark.

Even though resale values aren’t one of the biggest influences when it comes to decisions to purchase, one in five (20%) drivers still flagged it. It’s still vital then for OEMs and dealers to educate consumers on factors that protect value, such as charging history and best practice, service records, and keeping on top of software updates.

"Consumers buy based on monthly prices; but those in the industry live by the residual value"

– Liam Quegan, Managing Director of Wholesale at Cox Automotive Europe

EV cost of ownership: Key takeaways

- Price perception remains even after purchase: 65% of UK drivers believe EV cost of ownership is higher than ICE.

- Experience shrinks the gap but doesn’t remove the mental block: Even after switching, owners still believe EVs are “more expensive”, despite acknowledging fewer maintenance and monthly payment worries.

- Incentives can tip the decision: 71% of UK drivers say EV incentives would influence them to purchase, yet 42% of non-EV drivers aren’t aware of the details, and 53% don’t know what’s available at all.

- Resale values drive TCO: While only 20% of respondents cite resale values as a top concern today, they directly shape concerns they do have, including total cost of ownership and monthly payments.

Check out our consumer-ready guides on EV cost of ownership, EV servicing, EV insurance and EV incentives for more insights.

Cost of EV ownership FAQs

The following cost of EV ownership FAQs help dealers and OEMs reassure buyers of EV savings, while addressing shifting aftersales strategies.

Do EVs cost more to maintain than petrol/diesel vehicles?

Typically, no. EVs have fewer moving parts and no oil or exhaust service requirements, as well as utilising regenerative braking to reduce brake wear. Drivers still have to maintain things like tyres and brake fluid, but day-to-day maintenance is generally simpler and less frequent.

Do lower maintenance costs mean less opportunity for after sale strategies?

Not necessarily. Rather than removing opportunity, it shifts the focus. Dealers can benefit from warranty products, tyres, brakes, cabin filters, brake fluid, coolant, safety checks, charging support and installation, software updates and battery state of health (SoH) checks to drive aftersales.

Is charging an EV more expensive than filling up with petrol or diesel?

Home charging is typically cheaper per mile compared to petrol/diesel and can typically add around 25-30 miles of range per hour. Public rapid/ultra-rapid charging narrows the gap as you pay for speed and convenience. Actual costs depend on your tariff (kWh cost), efficiency (kWh/100km) and how much public charging you use.

Are EVs more expensive to insure?

On average, EV insurance costs more than ICE vehicles, but quotability and pricing improved in 2025 as repair networks and data matured. Drivers can expect pricing to vary by vehicle, driver profile, parts availability and repairer network.

If EV prices are higher, doesn’t that make cost of ownership worse?

Upfront EV prices can be higher, but running-cost savings such as energy per mile, simpler maintenance and ULEZ/CAZ advantages often offset the difference. This is especially true considering most car journeys are between 5-20 miles, meaning many drivers see comparable or lower total cost of ownership.

5) UK EV charging infrastructure: The accessibility challenge

Despite a 22% UK public network growth since October 2024, perceptions of EV charging infrastructure remain mixed in 2026. Our data shows concerns about public charging are highest among non-EV drivers, with owners reporting fewer issues.

Access and perception: Public vs home charging

Like battery and cost perceptions, concern about EV public charging is higher among those with the least electric vehicle experience, suggesting that charging anxiety, not network reliability, is the blocker.

Our results show that as drivers gain experience, trust in the UK’s EV charging infrastructure rises:

- Only 12% of EV owners marked UK public charging accessibility as a top concern, vs. 33% of test drivers and 47% of non-EV drivers.

- 94% of EV drivers said the public charging access in their area is good, compared to 63% of test drivers, and 32% of non-EV drivers.

Home charging is a well-known barrier for those with only on-street parking access. The data proves this, with most EV drivers having access to home charging either on a private driveway or garage (47%), or in a shared parking area (41%).

Luckily, 54% of test drivers and 48% of non-EV drivers say they could install a home charger, but ability isn’t the only barrier. Installation costs can be an issue, and for renters, the investment is ‘dead money’. For drivers unable to install home charging, confidence grows in knowing EV public charging reliability is strong among EV owners, with 10% relying entirely on public charging. On-street options are also improving with safe cross-pavement cables solutions and lamp-post chargers making residential charging more accessible.

OEMs and dealers can bolster confidence in public charging, by educating consumers on charging frequency, time to 80% (the recommended level), average costs in the area, and AC vs DC public charging (DC charging is faster but more expensive).

Regional EV rollout directly correlates with public charging perceptions

It’s easy to assume that positive public charging perceptions correlate with the areas that have a higher number of chargers. However, our data shows that’s not always the case. Out of the top six cities with positive perceptions on local public charging in our findings (Belfast, Birmingham, Bristol, Glasgow, London and Manchester), only half fall into the regions with the highest number of EV chargers.

Instead, the correlation is with the percentage of EV ownership in each city. Indicating again that real-life experience helps drive confidence and remove barriers.

UK EV charging infrastructure: Key takeaways

- 94% of EV owners say local public charging access is good, compared to 63% of test drivers, and 32% of non-EV drivers. Highlighting that confidence rises sharply with experience.

- Access to home EV charging is a barrier to some but can be solved via smart on-street charging, and workplace charging options.

- OEMs and dealers should work to understand home charging capabilities early on, while educating on the public charging options in the area.

Shape your marketing and sales content using out full breakdown of home, public and workplace EV charging in our consumer-ready guides.

6) EV sustainability: Motivation or myth?

The majority of UK drivers cite environmental benefits as a key purchasing motivator, yet older drivers remain sceptical about the impact of EVs vs ICE. Clear EV sustainability messaging on the benefits beyond tailpipe emissions is essential for closing the sustainability confidence gap.

Perceived environmental benefit of EVs

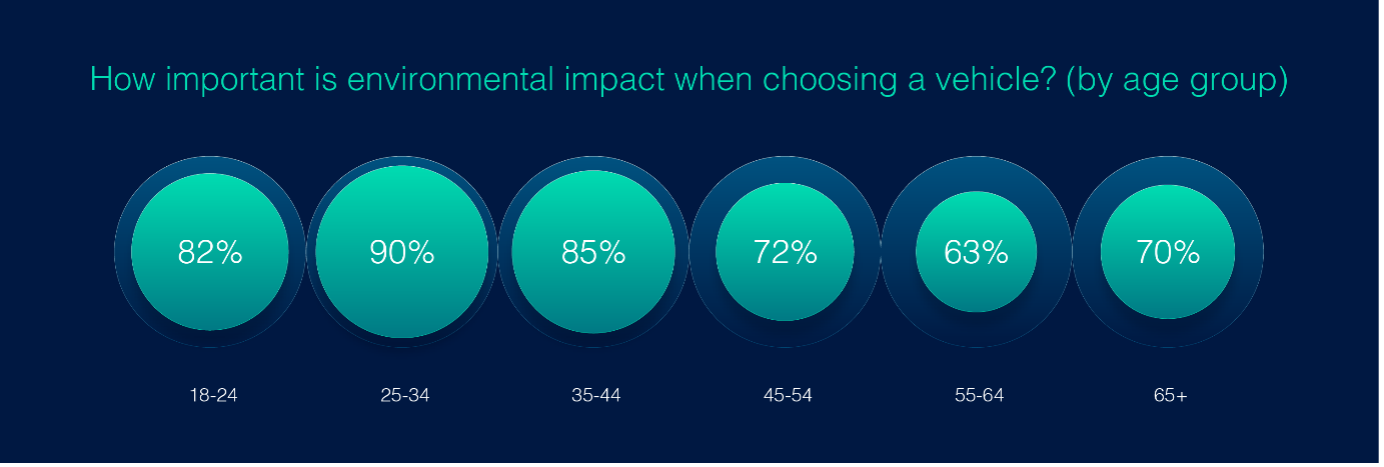

When purchasing a vehicle, three in four (78%) drivers consider environmental impact an important factor, a sentiment particularly true for younger cohorts. Older drivers by no means discredit the importance, with the majority (63-72%) still citing it as an important factor at the point of purchase.

Despite interest in environmental factors of a vehicle, scepticism on the environmental impact of EVs vs. ICE is more prominent among older cohorts.

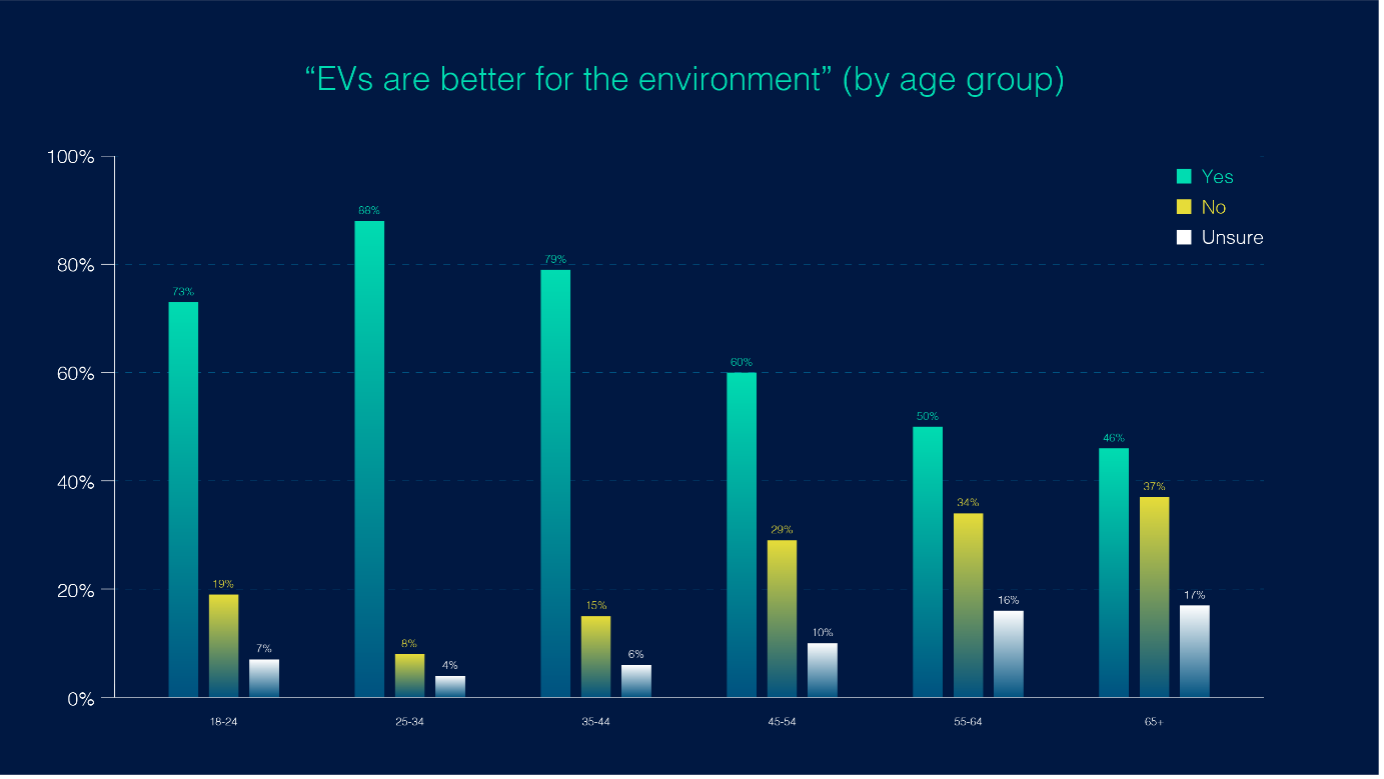

Overall, two in three (67%) UK drivers surveyed believe EVs are better for the environment, but more than one in three (37%) respondents aged 65+ disagree - higher than any other age group. Those aged 55-64 and 45-44 follow suit, with 34% and 29% respectively.

Among younger drivers, scepticism drops significantly with only one in five (19%) 18-24-year-olds questioning EV environmental benefits vs. ICE, followed by 15% of 35-44-year-olds and 8% of 25-34-year-olds.

Looking at the data on an EV experience level, confidence grows with more exposure, yet again. The majority of EV drivers (95%) consider electric vehicles better for the environment than ICE, versus 66% of test drivers and 50% of non-EV drivers.

Context matters here. Today’s EV drivers include a high share of early adopters, who are generally more sustainably aware. As EVs move into the mainstream, the environmental impact is a critical part of the messaging that risks being diluted by noise around cost and charging.

The industry should therefore focus on refocusing on the ‘why’ behind electrification:

- Lead with air quality as an immediate benefit

- Highlight how lifetime emissions support a greener grid long-term and what that means to the average person

- Show the circular economy in one clear visual, including how battery repair, remanufacturing and recycling, plus renewable energy charging options create a cleaner grid

- Pair cost messaging with sustainability benefit, to keep it forefront of the consumer’s mind

"Environmental impact motivates the majority of drivers; yet the sustainability confidence gap is holding adoption back."

– Karoline Baumann, Strategy & New Growth Director at Cox Automotive Europe

Closing the EV sustainability confidence gap

The challenge with the ‘are EVs better for the environment’ question, appears to be their long-term impact, likely due to the more complex process of building EV batteries generating high emissions.

It’s true that manufacturing an EV causes more emissions vs. an ICE vehicle, largely due to the battery pack requiring more materials, the energy used in mining the natural materials, and their energy-intensive cell production. However, findings show that an EV emits about half that of an equivalent ICE over its lifetime. This is because as soon as the vehicle hits the road, they soon make up for the energy used in the manufacturing process thanks to zero tailpipe emissions. Even more than that, the longer EVs are on the road, the cleaner the UK grid becomes thanks to the addition of renewable energy.

Manufacturers can keep EVs on the road for longer with partners like EV Battery Solutions who repair and remanufacture battery packs to extend life and recover materials to reduce the embodied carbon of the next battery.

EV sustainability messaging for OEMs and dealers

To help drive EV sustainability confidence, OEMs and dealers should prioritise lifecycle emissions education for their sales team. Allowing them to reassure consumers with sustainability concerns at the point of sale. This education should focus on the total EV carbon footprint over time:

- Lifecycle assessment (LCA): Explain lifecycle emissions with a simple visual: manufacture → use → end-of-life.

- UK grid decarbonisation: Highlight that as the grid adds renewables, it gets cleaner and emissions keep falling. Improving the EV carbon footprint over time.

- Battery recycling and second life: Explain recycling and second-life pathways shaping a circular economy.

- Renewable electricity in practice: Explain the concept of charging with renewables, including smart tariffs that cut use-phase CO₂ and reduce charging costs.

- Highlight how regenerative braking cuts brake dust particulates and reduces overall emissions.

- Air quality benefits: Regardless of upstream electricity, zero tailpipe emissions mean immediate health benefits where people live and work.

EV environmental benefits: Key takeaways

- Most UK drivers are motivated by sustainability when purchasing a vehicle.

- Older drivers need educating on lifecycle emissions and EV environmental benefits to overcome scepticism.

- OEMs and dealers should frame EV sustainability as local air quality now, and lifecycle carbon footprint improving with UK grid decarbonisation over time.

- Make EV environmental benefits clear with real life examples, such as charging with renewables supporting a cleaner grid and reducing charging costs with smart tariffs.

For more messaging on EV sustainability vs ICE to use in your sales process, see our ‘are EV’s more sustainable’ and ‘EV battery lifecycle explained’ consumer-ready guides

7) Conclusion: The future of EV adoption in the UK (2026 and beyond)

Our data shows UK EV adoption is rising, but cost perceptions, battery myths and charging infrastructure continue to slow growth. Experience and education help close the gap. OEMs and dealers that make total cost of ownership (TCO), charging and sustainability tangible will accelerate wider adoption.

The latest EV adoption and consumer perceptions from our 2026 survey shows that:

- Experience converts: EV ownership and test drives clearly reduce hesitancy and misconceptions around sustainability, battery myths, cost of ownership and charging anxiety.

- Cost perceptions are difficult to shift: 65% of drivers view EV total cost of ownership as higher than ICE. EV owners carry price anchors despite admitting less worries about maintenance costs and purchase price/monthly payments.

- EV incentives change intent – if understood: 71% of respondents say incentives would influence them to purchase, but awareness is shallow.

- Charging confidence is driven by exposure: Concern falls from 41% among those who have never driven an EV, to 12% of owners. Home access remains a key barrier, but public charging infrastructure reliability messaging and on-street / workplace options can help.

- Sustainability motivates, but scepticism continues to block adoption among older drivers: Younger drivers and early adopters are less sceptical of an EV’s carbon footprint. Education on lifecycle emissions, battery recycling, second life, UK grid decarbonisation and the circular economy is essential for converting hesitant drivers.

How the automotive industry can drive the future of EV adoption in 2026

- Lead with monthly cost breakdowns: Create a clear EV vs ICE total cost of ownership chart. Include everything from the pay-per-mile tax due in 2028 vs. fuel duty paid at the pump, maintenance and insurances costs vs ICE, ULEZ/CAZ savings, and home vs public charging costs per mile.

- Make incentives front-of-house: Automatically apply EV incentives, salary sacrifice / BIK savings to show an ‘after-incentives’ monthly cost of ownership vs. ICE.

- Prioritise experience: Scale structured test drives and demonstrate route planning, AC vs DC charging costs and time-to-80%, to drive real-life experience confidence.

Personalise charging requirements: Ask about driveway and garage access early on, present home, on-street, workplace and public charging options based on each driver’s unique requirements, as well as when rapid charging can support (with realistic price and time-to-80%). - Focus on debunking battery myths: Lead with battery warranty information and issue battery SoH reports for all EVs. Demonstrate best charging practice, while showing how far a 100% and 80% charge will take each vehicle depending on driving habits (urban vs. long distance driving).

- Own the sustainability journey: Use lifecycle assessment (LCA) graphics, renewable charging guidance and the circular economy to highlight long-term carbon footprint and UK grid decarbonisation.

EV ownership resources

Want to know how the automotive industry is tackling the future of EV adoption? From the ZEV mandate, residual values and supply chain challenges, stay up to date with more insights from Cox Automotive Europe on our EV hub.