IQ

Insight

Quarterly

Q1 | 2025

The new market: A world in flux

New Cars

Used Cars

7 min read

Over the last decade, the new car industry has become well-adjusted to volatility. The roller-coaster of geopolitical, economic, and supply chain shifts shows no signs of slowing down. Instead, we must brace ourselves for the next series of twists and turns. In an attempt to plan for tomorrow and make sense of today, we can start by analysing recent trends from across the globe, which reveal cause for cautious optimism regarding electric vehicle adoption and highlight opportunities for growth.

New global production reality settles in

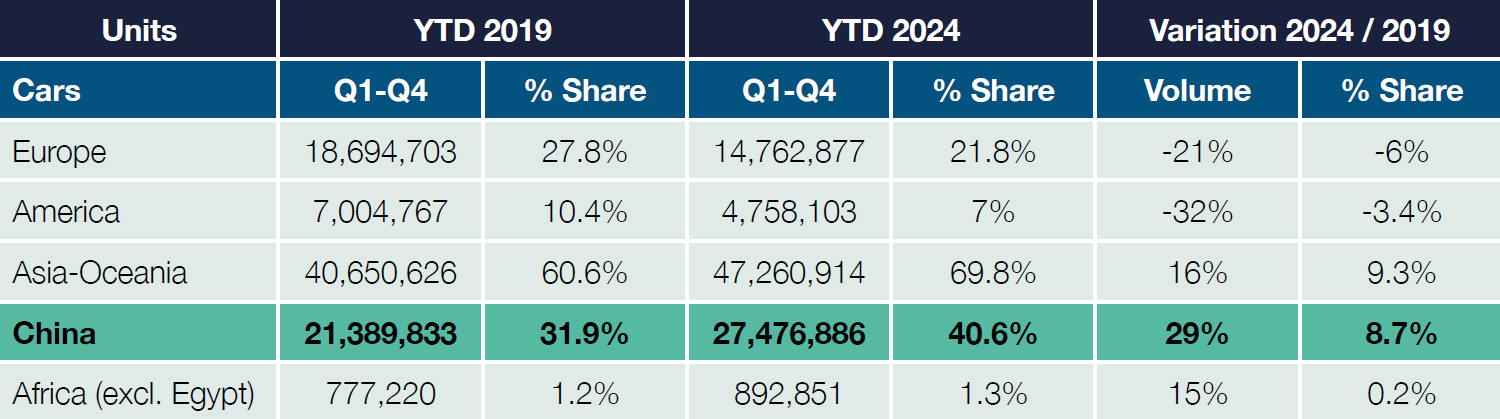

The make-up of the world’s automotive production has undergone a monumental shift over the last 18 months. Data comparing output in 2019 and 2024 reveals the true scale of China’s meteoric rise in global passenger car production, with its output rising 29%, gaining an 8.7% share in the market. In 2024, it accounted for 40.6% of global production, while the EU27 and the UK saw production decrease by 21%, losing 5.1% of their global share.

Further, 2024 demonstrated China’s strong domestic production capacity, only importing 3% of its total vehicle sales, which equates to around 750,000 units within a total of 25 million. In contrast, the United States imported nearly 48% of vehicles sold domestically.

Looking ahead, the global production forecast for passenger cars and light commercial vehicles has been revised down by 3% to 89,069,177 units. This reflects the industry’s caution in the face of ongoing political uncertainty and supply chain disruption. Manufacturers are taking stock and redefining priorities to shield themselves as much as possible in the coming months. For the UK, this adjustment equates to new car registrations representing 2.34% of total global production volumes.

Global Automotive Production Landscape

Source: OICA

UK market sees strong start for 2025

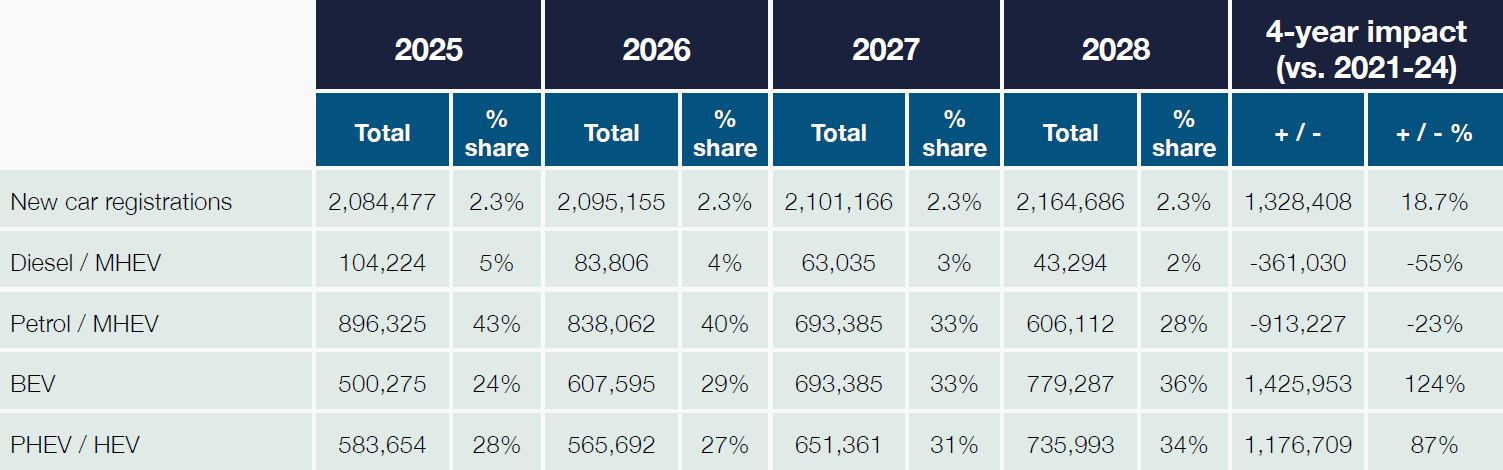

The UK’s new car market rebounded in March with over 580,000 registrations, marking the best performance seen since 2019 and signalling renewed momentum across the sector. While much of the growth came from fleet registrations, there were also positive signs of recovery among private retail buyers. This year, our forecasts predict modest growth in private registrations, rising by 2% to 47% of registrations, while fleet will still dominate at 50% of transactions.

2,084,477

Our new car forecasts predict 2,084,477 new car registrations this year

With this positive performance, our new car forecasts predict that the UK will exceed 2 million new car registrations this year, 2,084,477 to be precise. This would represent a 9.8% decline compared to 2019 performance; however, it is a significant 29.1% increase from the market low point in 2022.

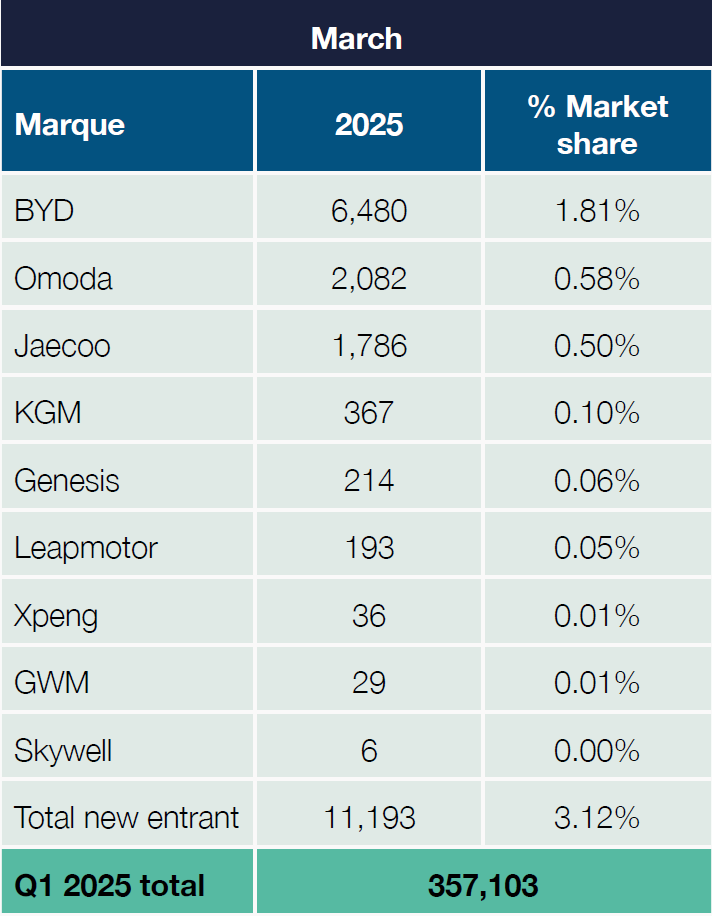

This forecast is strongly dependent on the continued uptake of new entrant brands by buyers in the UK, alongside the success of these brands in forging effective partnerships with the region’s dealership networks. If these brands continue the momentum they have enjoyed over the past 12 months, this milestone should be achieved in 2025.

New Car Registration Forecast 2025 – 2028 by Fuel Type Share

Source: Cox Automotive

Competitive landscape gets a shake-up

The most recent registration figures reveal shifts in the make-up of the UK’s car brands. BYD especially made notable strides in the market with continued expansion across its local dealership network, building greater consumer recognition. This has resulted in a very strong start to the year for the Chinese brand, securing a 1.6% market share and delivering an impressive 625% year-on-year growth. These results even saw the brand outperform several long-established brands, including Honda, SEAT, Citroën, and Fiat. This trend is set to continue with growth plans in place for its premium brand, Denza, in 2026. Meanwhile, Jaecoo and Omoda, which arrived slightly later in the market, have already secured a foothold. These developments underpin growing disruption in the UK’s automotive brand hierarchy, driven by changing consumer demands and increased competition.

New Entrant Marques Market Share Q1 2025

Source: Society of Motor Manufacturers and Traders

Key takeaways for the industry

As new entrants work to establish their identity and infrastructure, legacy manufacturers are reassessing their strategies in response to a rapidly evolving market landscape. The right brand partnerships will be crucial in navigating these changes effectively. UK stakeholders must adapt their sourcing, logistics, and partnerships to reflect Asia’s growing influence. This includes preparing for reduced European supply and accommodating more diverse product standards.

As the market chases volume, often at the expense of profitability, margin protection remains essential. Consumers increasingly seek guidance and reassurance when transitioning to electrified vehicles, making product expertise, infrastructure insight, and trusted advice more critical than ever.