- Typical overhead absorption rates have dropped down to the 50-60% level in major markets.

- The direction of travel is clear, and there is time to pivot, innovate and consolidate to counter the shifting dynamic.

- A growing proportion of the workshop and bodyshop load will effectively be fleet business with reduced margins on labour and parts.

- The aftersales market has shown a consistent openness to adjust course amidst shifts and pursue fresh prospects.

With the car aftermarket's most lucrative profit generator - the oil change - set to become a thing of the past, automotive retail is on the brink of a new era.

Writing in the latest AutoFocus, Cox Automotive’s quarterly insight update, Steve Young, managing director of ICDP, a specialist automotive retail and aftersales consulting business, says that retailers must develop new business models to thrive in the age of electrification.

“For many years, the aftersales department has provided a major part of dealer profits in many markets,” he comments. “The traditional target used to be that the full overhead of the dealership would be covered by aftersales. However, at a time when margins on new cars are under pressure through electrification and moves by some manufacturers towards agency agreements rather than franchise, many dealers are focusing on aftersales as the way in which they can maintain their overall profitability. Whilst we would totally agree that this is a sensible route to follow, there are other pressures which mean that the outcome is far from assured in the long term.”

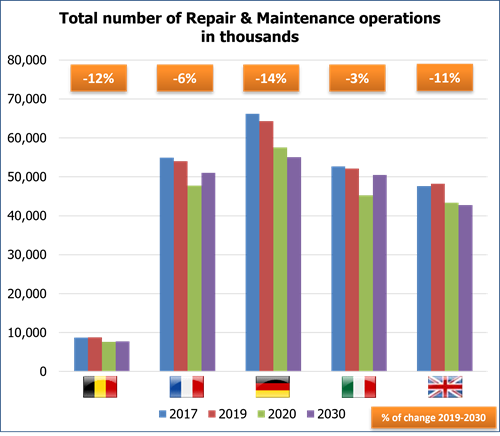

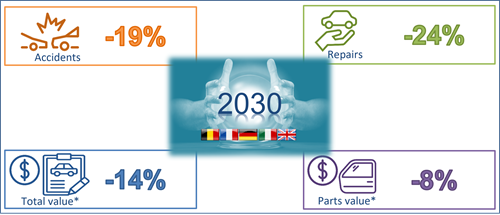

ICDP highlight how the total aftermarket has been in decline in real terms for at least a decade, influenced by reducing distance driven, greater car reliability, longer service intervals, reduced service content and lower collision rates due to more sophisticated safety systems. Value has been less affected because of higher parts prices and labour rate inflation. Still, in combination with higher dealership fixed costs, typical overhead absorption rates have dropped down to the 50-60% level in major markets.

Steve Young continues: “This decline has now been accelerated by electrification, where not only are many service operations no longer required, but the real profit generator – the oil change – has gone completely. Tyres are the only repair type that grows due to higher wear rates on BEVs.”

ICDP advise the impact is generally modest currently because, other than in markets like Norway, BEV penetration is still relatively low, and franchised dealers are still working mainly on ICE or hybrid products. Independent repairers are further protected by the fact that they tend to work on older cars, so the BEV mix within their workshops is even lower. However, as the mix within the parc increases, the reduced workload and profit from repair and maintenance will greatly impact dealers’ profitability. Unless there were corrective actions such as higher labour rates, then the dealer as a whole would not be viable at a 100% BEV mix.

Philip Nothard, Insight and Strategy Director at Cox Automotive, comments: “We value ICDP’s contribution to our market analysis and commentary and share their view the aftermarket faces a period of change. However, it’s not necessarily a doom and gloom scenario. The direction of travel is clear, and there is time to pivot, innovate and consolidate to counter the shifting dynamic. Just as vehicle retailers had to adapt and evolve during the pandemic, aftermarket departments will also have to show innovation if they are to profit from the EV age. Indeed, many are already embracing new business models, such as mobile repair and on-the-drive servicing.”

Opportunities to reimagine business models

Two factors are adding to the current squeeze on dealership profits: car manufacturers' more direct relationships with end users and the reduced aftersales workloads of EVs.

Steve Young continues: “Most manufacturers have a strategic objective to be closer to their customers, and the trend towards agency agreements rather than franchises is part of that overall strategy. In addition, they want to retain the customer for repeat sales and aftersales through leasing or subscription and some form of bundled or inclusive service packages.

“The intention is that the customer will return to the authorised repair network for any work required, and the bill payer will be the manufacturer or their captive finance organisation rather than the car's driver. Consequently, a growing proportion of the workshop and bodyshop load will effectively be fleet business with reduced margins on labour and parts.”

An increasing level of repair and maintenance work which is carried out through over-the-air updates. The scope for this increases as the implementation of electronic systems and electronic controls increases and mechanical content reduces. There are also technical changes in the calibration of ADAS systems, so the increased workload that bodyshops have seen in recent years to perform calibration will decrease as more ADAS systems become self-calibrating. The effects of these changes will be a combination of fewer workshop visits and lower work content when the visits are required.

But the parc mix has a stabilising impact on aftersales, with change impacting on different players at different times related to their focus within the parc. So, for example, a dealer who is focused on the zero to three-year-old part of the parc and is tightly integrated with the leasing and service plan programmes of their manufacturer is going to be affected faster than one who has already taken steps to increase their share of the older parc and developed some areas of their business which are not so impacted by manufacturers' strategies and programmes. Both will, in turn, be significantly more affected than an independent repairer who is typically working mainly on cars that are no longer subject to new car warranties and are covered by independent service plans.

Steve Young concludes: “Beyond 2035, the impact will be more broadly felt, and it will be impossible to look to aftersales to cross-subsidise other parts of a dealer business. Whilst that may not be the highest priority challenge in these current times, it will soon start to come within the planning horizon for new facilities and the skills development roadmap of new technicians, so it cannot be completely ignored.”

Philip Nothard adds: “Although the aftermarket faces ongoing economic hurdles, the dynamic and ever-evolving automotive industry also offers opportunities to revolutionise business models and remain lucrative. The aftersales market has shown a consistent openness to adjust course amidst shifts and pursue fresh prospects. “

ICDP’s complete analysis can be found in Cox Automotive’s AutoFocus insight update