The used market has remained a stabilising force throughout a year marked with uncertainty and volatility. While they have not been immune to the challenges that face the rest of the market, used car sales remain healthy for now, while retailers remain cautious. Looking at the long term, upcoming regulatory changes and tactical registrations from the new car market could dampen the market and exert further pressure on used car prices.

In the following section of our quarterly market report, we’ll explore where the used car market is today and the factors that are influencing its performance, with details around residual values and the potential impacts of changing regulations on the industry. We also set out our forecasts for the market in 2026 and an outlook for 2028.

The latest data from the Society of Motor Manufacturers & Traders (SMMT) reveals that the used car market grew by 2.8% in Q3 2025, the third-best quarter on record since 2021 and an 11-quarter growth streak. This is a positive result for the sector, however, stability in Q4 will depend on government clarity and consumer confidence amid economic challenges.

Dynamics in the new car market have begun to filter into the UK used car market. Most notable is the impact of tactical registrations flooding the marketplace, with around 100,000 new cars registered in the final four days of September. This influx of vehicles into the market is putting immense pressure on the nearly new market in the used sector, creating oversupply, depressing values, and tying up dealer forecourts and credit capacity.

2.8%

Society of Motor Manufacturers & Traders (SMMT) reveals that the used car market grew by 2.8% in Q3 2025

ICE vehicle values between 1-2 years old

Source: Cox Automotive

BEV values between 1-2 years old

Source: Cox Automotive

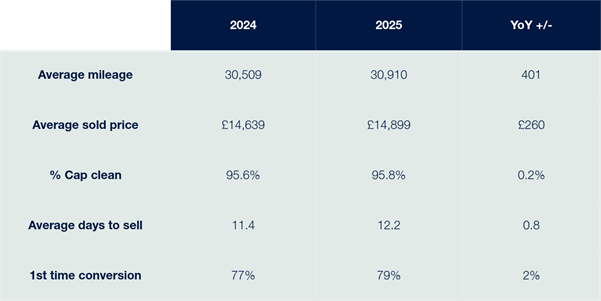

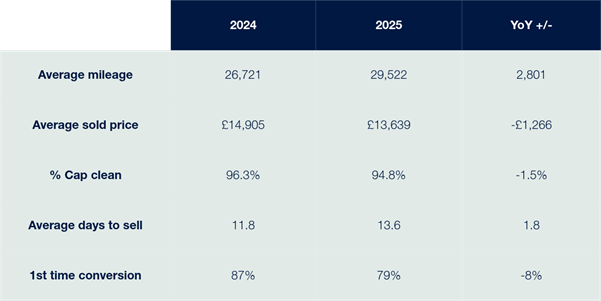

Margin retention remains a key priority for the used vehicle market. Petrol, diesel and hybrid models between three to five years old remain in demand across the market as their trade values hold firm while their supply is limited.

These dynamics do mean that retailers are acting with caution. Questions remain about the future of consumer demand, as we have seen a slowdown in retail activity, which is only exacerbated by an uncertain political and economic environment in the run-up to the 2025 Autumn budget. Altogether, this is putting significant pressure on retailers’ balance sheets and long-term investments.

The UK used car market has seen steady performance throughout 2025. Still, retailers are approaching year-end cautiously as oversupply challenges the nearly new market and consumer demand softens, with the risk of pressure on residual values.

Margin retention remains a key priority for the used vehicle market. Petrol, diesel and hybrid models between three to five years old remain in demand across the market as their trade values hold firm while their supply is limited.

These dynamics do mean that retailers are acting with caution. Questions remain about the future of consumer demand, as we have seen a slowdown in retail activity, which is only exacerbated by an uncertain political and economic environment in the run-up to the 2025 Autumn budget. Altogether, this is putting significant pressure on retailers’ balance sheets and long-term investments.

The UK used car market has seen steady performance throughout 2025. Still, retailers are approaching year-end cautiously as oversupply challenges the nearly new market and consumer demand softens, with the risk of pressure on residual values.

"We are witnessing the strongest used van marketplace since 2021. Over the past 12 months, average selling prices have grown by 10.8%, and buyer demand has been nothing short of fierce. This momentum is being felt across our lanes, physical and digital, with record-breaking conversion rates and price performance. It’s a clear signal of confidence from trade and retail buyers, and a testament to the strength of the used commercial vehicle sector right now."

Matthew Davock, Director of Commercial Vehicles

Pricing trends and car depreciation data

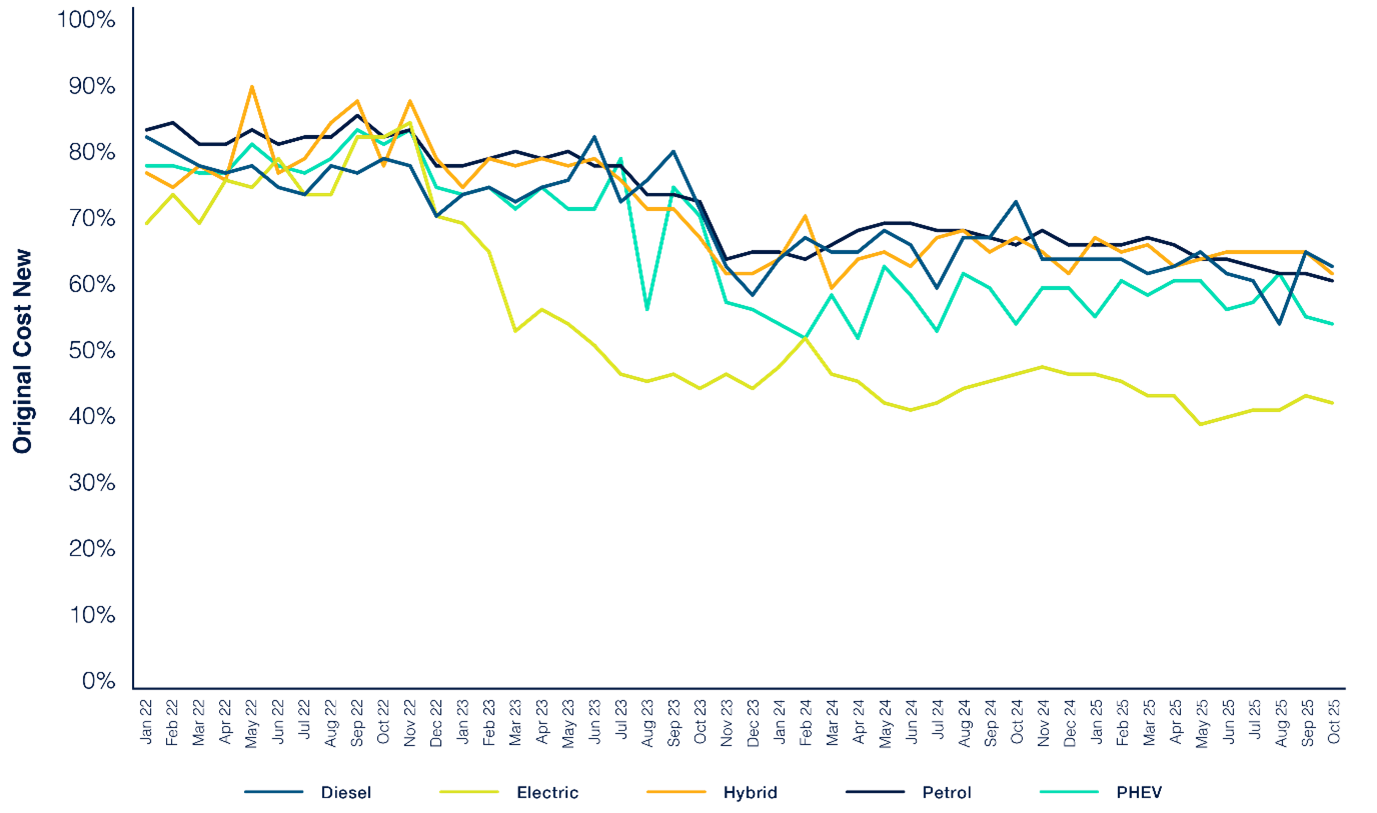

Electric vehicle (EV) values had already seen a decline after their post-pandemic ‘bounce’, especially for those under two years old, which remain below all other fuel types. We have seen the sharpest decline for one to two-year-old EVs, declining by 37% between October 2022 and October 2025. It is not only EV depreciation that has been impacted in this way. If you look at all fuel types except EVs, residual values for vehicles between one to two-years old have declined by 19%, while those under 12 months have dropped by 22%. This illustrates the impact of an oversupplied new car market on the used vehicle market, as retail buyers compare heavily discounted new cars with nearly new alternatives.

Original Cost New (%OCN) 1-2 by Fuel Type

Source: Cox Automotive

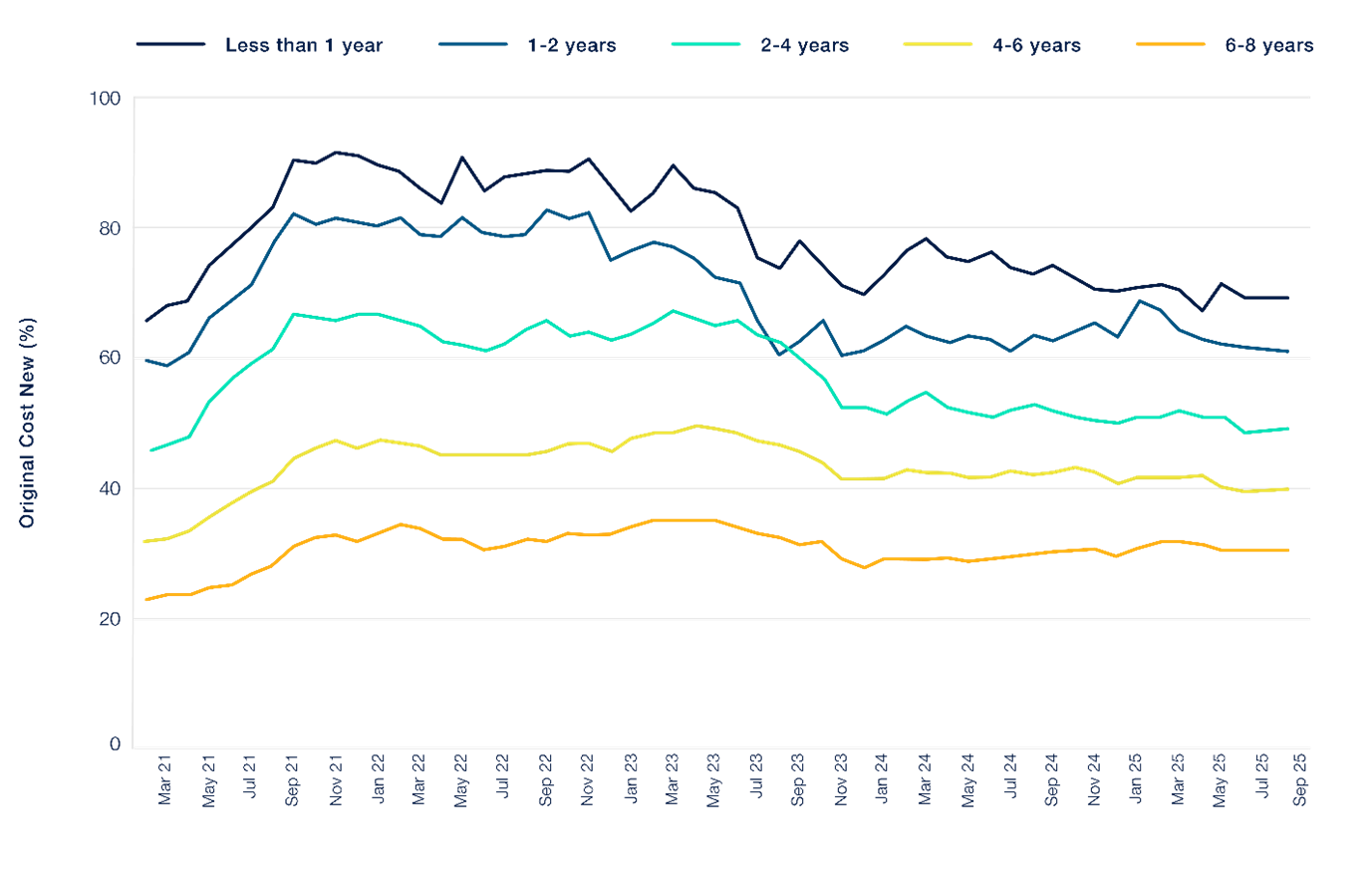

How much have used car prices changed in the past three years?

- Cars under 12 months old have declined by -22%

- Cars between one to two years old have declined by -23%

- Cars between two to four years old have declined by -14%

Used Car Trade Sale Value as a Percentage of Original Cost New (%OCN)

Source: Cox Automotive

The decline in used car prices has also been impacted by ongoing defleet and rental returns. Over-reliance on these sales channels in recent years have inflated volumes of specific models and fuel types, particularly EVs and compact SUVs, which are now re-entering a subdued market.

Meanwhile, values in sectors of the used car market facing constrained stock supply are performing better. For instance, reduced availability of diesel models is sustaining strong values. Many dealers are also operating leaner inventories, which is further constraining demand in some sectors and influencing guide value movements.

All these factors contribute to the overall health of the market, which, for the first time, we are presenting a measure for. Cox Automotive’s new wholesale market health metric tracks supply and demand in the used car market and benchmarks the industry’s performance on a scale of one to 100. Currently, the UK’s market is scored at 84.

With used car values for vehicles under 12 months old dropping by 22%, it is clear to see the impact of short-cycle activity is having on the used car market, flooding the marketplace with discounted new models.

Regulatory risks threaten the UK used car market supply

Government policy changes are impacting used car supply in the UK. The removal of the Employee Car Ownership Scheme (ECOS) will significantly reduce the number of high-spec cars entering the used car market, as the scheme is responsible for 10% of annual registrations. The same applies to changes to the Motability Scheme, which delivers a further 200-300,000 vehicles to the market annually. This comes at a time when retailers depend on this stock source to counter the negative effects of dynamics in the new market.

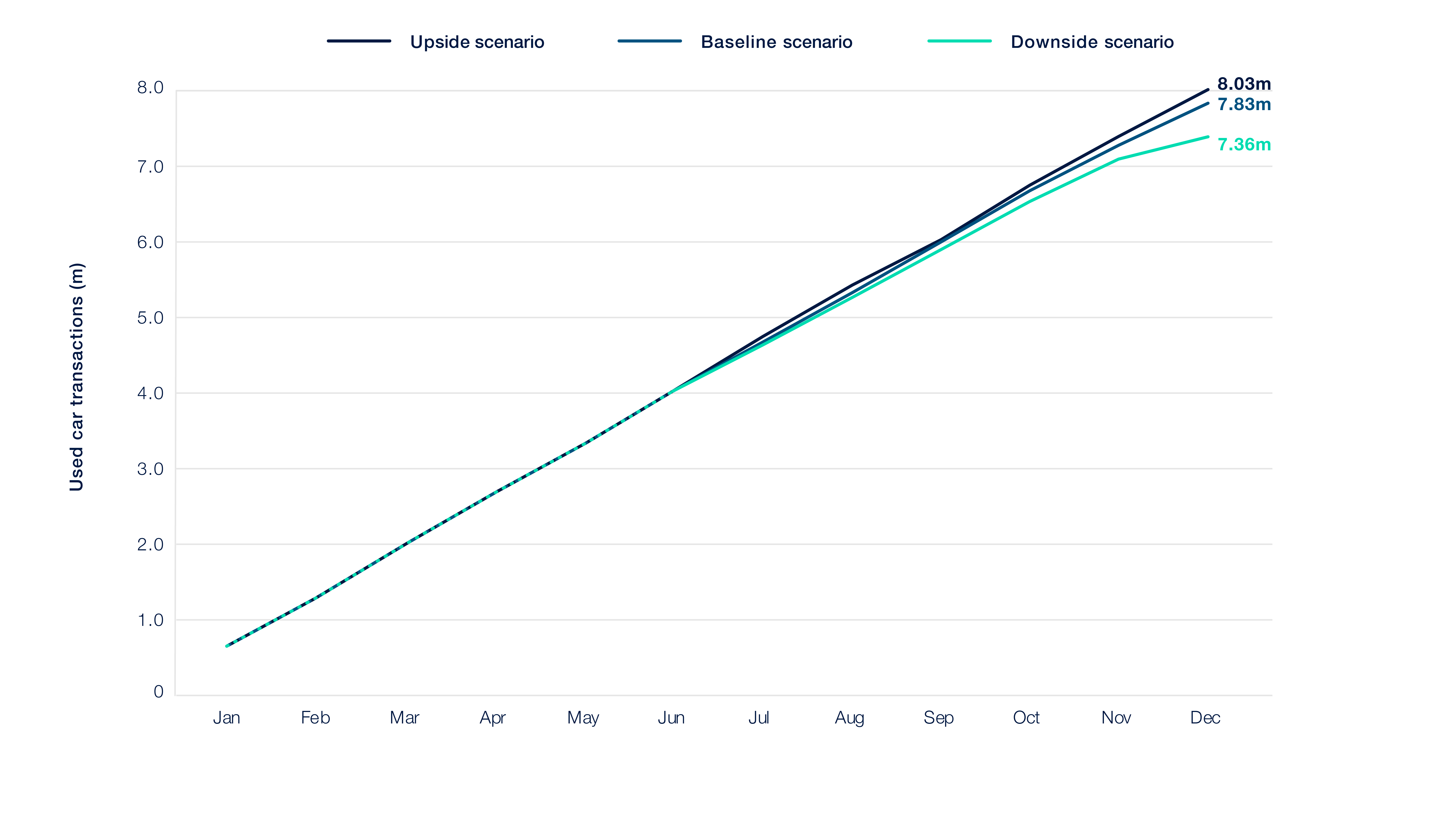

Used Car Transaction Forecast

Source Cox Automotive

Used Car Transaction Forecast

Source Cox Automotive

7.83 million units

We forecast that the used car market will reach 7.83 million units in 2026.

Used car market forecasts

Every quarter, we combine our proprietary market insights with the latest used vehicle data to create our used car market forecast: three scenarios which forecast the industry’s performance for the next 12 months. These include an upside, baseline and downside scenario, each reflecting different macroeconomic, policy and industry conditions that could shape the remainder of the year. Together, these scenarios provide a structured framework to help stakeholders plan for the possibilities that may unfold in the year ahead for the used car market.

We forecast that the used car market will reach 7.83 million units in 2026, which is a slight 0.9% increase versus 2025 and 6.1% above historical norms.

Upside scenario

In this optimistic outlook, the UK economy outperforms expectations after the Autumn Budget, with easing inflation, lower interest rates and rising consumer confidence supporting a stronger used-vehicle market throughout 2026. Increased economic stability and a more predictable policy environment lift retail and fleet activity, leading to multiple quarters exceeding two million used-car transactions.

- Retailers benefit from higher part-exchange volumes and returning fleet stock as new-vehicle supply normalises.

- A more apparent shift in consumer attitudes towards EVs emerges, supported by more competitive pricing, improved choice and added momentum from the Electric Car Grant.

- Dealers fine-tune their stock and pricing strategies to meet growing EV demand, enhancing conversion rates across wholesale and retail channels.

- Depreciation stabilises across core segments, strengthening residual values as supply-chain pressures ease.

Baseline scenario

In this balanced outlook, the UK used-vehicle market delivers marginal but stable growth through 2026. Despite continued economic and regulatory headwinds, steady demand, improving stock availability and modest financial stabilisation support a broadly positive, though restrained, year for the sector. Margin retention and tighter cost control remain central to performance in a still-challenging operating environment.

- Used vehicle transactions rise slightly as consumer confidence steadies and retailers maintain disciplined pricing to protect margins.

- Stock supply improves as new-vehicle registrations continue to recover, though affordability pressures and rising costs constrain stronger demand.

- Retailers place greater emphasis on operational efficiency, leveraging digital optimisation, cost reductions, and tighter inventory management to protect profitability.

- The potential end of the ECOS scheme in October, alongside other incentive withdrawals, adds uncertainty, with the eventual market impact yet to be fully understood.

Downside scenario

In this pessimistic outlook, the UK used-vehicle market faces a difficult 2026 as economic pressures intensify and the effects of the Autumn Budget weigh heavily on consumers and retailers alike. Weak confidence, rising costs and regulatory disruption combine to suppress retail and fleet activity, pushing the sector into a year of subdued transactions and margin pressure.

- Used-vehicle demand softens significantly as high living costs, stubborn inflation and limited real wage growth continue to erode household purchasing power and reduce discretionary spending.

- Stock levels remain inconsistent: while some new-vehicle supply returns, affordability constraints and weaker part-exchange activity tighten availability in key segments.

- Retailers face declining margins as increased operating costs, higher cost-of-carrying stock and aggressive discounting strategies put pressure on profitability.

- The end of the ECOS scheme in October, alongside potential cuts to other efficiency-focused incentives, removes valuable support mechanisms, further dampening demand, and destabilising fleet replacement cycles.

What does the used car market look like in 2028?

- The used car parc grows modestly to 37.09 million, a 3% increase, which indicates overall stability despite challenges in the new car market.

- Petrol will remain the dominant fuel type in the used car market, but it will still experience a loss of 1.44 million units, dropping to 52.8% of the total used car parc.

- The EV parc will surge to 3.64 million, occupying 10% of the total parc. This 172% increase will be driven by increasing electric vehicle adoption.

- Hybrid vehicles’ share in the market will also grow by 1.95 million units, up 90% from 2025. This will be driven by manufacturers’ hybrid strategies and consumer preference towards transitional technologies.

- Diesel’s share in the market will decline sharply, down from 31% in 2025 to 26%, a loss of 1.88 million units, as regulatory dynamics and consumer preferences push new diesel registrations down.

What this means for the UK automotive market

Despite a rocky outlook, there are still plenty of opportunities in the UK used car market. We’ve outlined the key considerations for the UK automotive market, especially retailers defining their 2026 used car strategies and planning for the next 12 months.

Used vehicle supply should improve...

- As the new car market levels out to 2 million annual registrations, vehicle supply is showing signs of improvement.

- We expect the market to shift from scarcity-driven pricing to efficient stock management and improved operational performance.

- Stock sourcing strategies must factor in the impact of upcoming regulatory changes to the market.

Economic pressures will remain in the near term...

- Consumers are facing affordability concerns, not only regarding the price of vehicles but also rising insurance and finance costs.

- Retailers must consider new ways to make ownership and mobility solutions more accessible.

- Used car leasing, especially for EVs, offers a significant opportunity for growth in the used vehicle market.

Younger vehicle residual values will remain under pressure...

- As manufacturers pursue market share and sales targets, younger vehicles in the used market will continue to experience depreciation.

- For those vehicles still undersupplied, values will remain strong. In 2026, these vehicles will be between four to six years old.

Building consumer confidence in EVs is imperative...

- Investing in education around the EV driving experience and offering a wider range of electric models is vital to bolster the market.

- Regulation will continue to impact used car supply, as zero emission mandates, clean air zones and EU CO₂ targets will shape manufacturer strategy and residual value performance.

The used car market will continue to face challenges regarding volatile residual values, an uncertain regulatory environment and rocky dynamics in the new market, however, vehicle supply is showing early signs of improvement. This means that we should start to see some stabilisation in prices filter through.

Explore more UK automotive market data

Want to explore more automotive market data? Check out the other sections in our Insight Quarterly report for auto industry trends covering the new car market, a deeper dive into EV residual values and contributions from automotive industry experts.