Growth in the new car market remains fragile. Modest gains seen in new car registrations have been achieved against a backdrop of global and domestic pressures. New market entrants continue to shake up the market, and the ever-changing regulatory environment keeps the industry in reactive mode.

This section covers the dynamics shaping the UK car market. We’ll look at the trends shaping the performance of the sector before outlining our forecasts for new car sales in 2026 and providing a longer view of the market in 2028.

Performance and New Car Registrations

The latest data from the Society of Motor Manufacturers & Traders (SMMT) reveals that new car registrations are seeing marginal growth, with a 0.5% year-on-year growth.

We’ve seen several new market entrants officially launch in the UK in 2025, changing the face of the UK’s model mix with new launches hitting the market from Omoda, Jaecoo, Chery and Changan. This has changed the make-up of the market significantly, with over 70 manufacturers available in the market today and rising, up from 41 in 2019. To date, these brands now occupy 4.78% of the UK car market, which is up from 0.48% in 2024, and growing with every month.

4.78%

Omoda, Jaecoo, Chery and Changan now occupy 4.78% of the UK car market, which is up from 0.48% in 2024.

Tactical activity has been a trend throughout 2025. We saw 32% of September’s new car registrations processed in the final four days of the month as manufacturers pursue lofty sales targets and regulatory mandates. Rental and manufacturer channels are rebounding, with rental up 40% year-to-date and manufacturer registrations up nearly 25% by September, which are supporting the return to tactical and short-term channels.

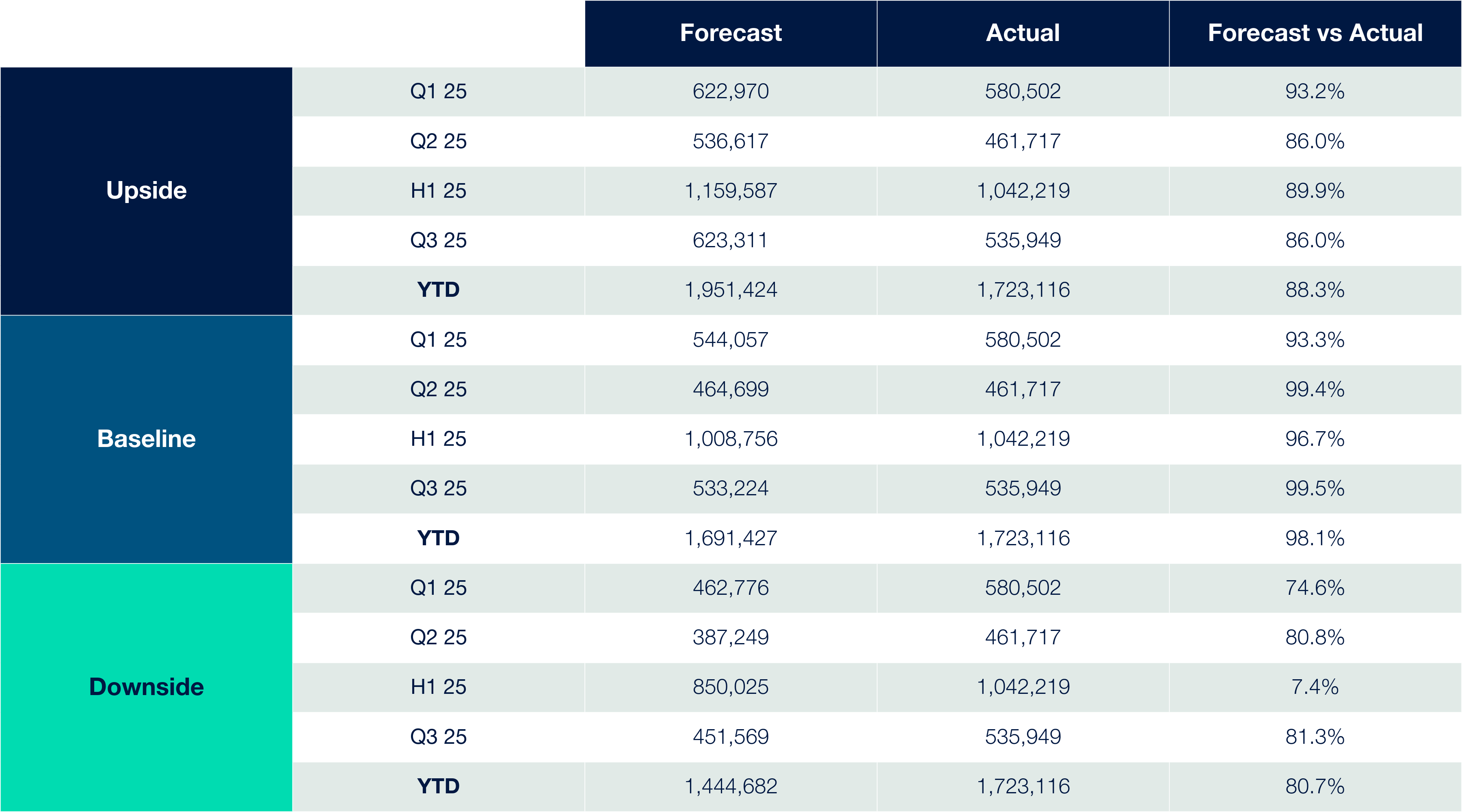

Cox Automotive’s New Car Registration Forecast vs. Actual

Source: Cox Automotive

New Car Registrations 2017-2020 vs 2021-2024

Source: Cox Automotive

The New Van Market

“While the used van market remains incredibly buoyant, we’re seeing the complete opposite in the new van sector. Manufacturers are currently facing an oversupply issue, heavily impacted by duplication of vehicle derivatives in the small and medium panel van segments. An alarming level of pre-registration activity is being forced, which is now affecting nearly-new versus new van sales.

“Adaptation remains a challenge, with major fleet and rental customers choosing to extend existing assets rather than replace them. SMMT data shows that new light commercial vehicle registrations fell by 12.1% year-to-date, with the largest vans down 14.8% and medium vans down 20.9%. Despite a 30.7% rise in small van registrations, the overall market continues to decline, marking the worst first-half performance since 2022. It’s a complex and evolving landscape that requires close attention as we move into 2026."

Matthew Davock, Director of Commercial Vehicles

Electric Impact on New Car Trends

Achieving the targets set out by the Zero Emission Vehicle (ZEV) mandate looms large over the industry. Currently, 22.4% of new car sales this year were electric against a target of 28%; the 2026 target of 33% feels like a huge leap. The industry still wrangles with supply chain challenges, inconsistent consumer demand and regulatory oversight.

The introduction of the Electric Car Grant has added further complications to the electric market. The launch of the scheme in July caught many manufacturers off guard. With a slow and unstructured rollout, the market resulted in an unwelcome ‘EV war’, as those brands excluded from the grant responded with their own equivalent discounts and incentives, causing profit pressures for retailers and further residual value volatility.

2.08 million

We forecast that the new car market will reach 2.08 million units in 2026.

New Car Market Forecast

Every quarter, we combine our proprietary market insights with the latest new car registration data to create three new car market forecast scenarios for the next 12 months. These include an upside, baseline and downside scenario, each reflecting different macroeconomic, policy and industry conditions that could shape the outlook for the remainder of the year. These scenarios provide a structured framework to help stakeholders plan for the possibilities that may unfold in the year ahead.

We forecast that the new car market will reach 2.08 million units in 2026, a modest 2.2% increase versus 2025 and signalling the industry’s return to its natural rhythm. This still falls 10.1% below the long-term average seen since 2000, which illustrates a slow rebound.

Upside scenario

A stronger-than-expected economic rebound following the autumn Budget restores confidence across consumers, fleets, and investors, setting the foundation for a more buoyant UK new car market in 2026. Improved economic conditions, combined with targeted incentives, accelerate EV adoption and support growth for both established brands and new entrants.

- A faster economic recovery lifts consumer confidence and draws increased domestic and international investment into the UK automotive sector.

- Strengthening demand across retail and fleet channels boosts volumes for both traditional OEMs and new market entrants.

- Well-aligned government and manufacturer incentives accelerate progress towards achieving the 33% ZEV mandate for cars.

- Earlier-than-expected reductions in inflation and a cut to the Bank of England base rate stimulate household spending, fleet renewal, and wider acquisition activity.

- A potential 'payout' linked to proposed redress schemes, while challenging for parts of the sector, injects short-term liquidity that increases consumer spending and drives additional sales.

Baseline scenario

The baseline outlook points to a steady yet cautious 2026, with the UK new car market stabilising but showing limited momentum. Growth remains modest, supported by a resilient fleet and consumer demand, yet tempered by regulatory pressures and ongoing economic uncertainty.

- New car registrations edge slightly above the two-million mark, reflecting marginal improvements in consumer and business confidence.

- Structural and regulatory pressures, including ZEV mandate obligations and the operational impact of new commission disclosure rules, continue to weigh on both OEMs and retailers.

- Gradual reductions in the Bank of England base rate and stabilising inflation modestly support household and business budgets but are insufficient to trigger a stronger recovery.

- New entrants expand and take market share without measurable overall market gains. While established brands focus on operational efficiency and incremental innovation, the market stabilises but remains below pre-2020 levels.

Downside scenario

In this more pessimistic outlook, the UK automotive market faces a stalled recovery in 2026 as economic headwinds and fallout from the autumn Budget suppress activity across both retail and fleet channels. Policy uncertainty weakened household finances, and rising operational pressures combine to undermine market confidence.

- New vehicle registrations remain subdued as high living costs, persistent inflation and sluggish wage growth reduce discretionary spending and weaken consumer confidence.

- Limited government support fails to stimulate meaningful EV demand, while the implications of the Supreme Court's commission-disclosure ruling further erode retailer profitability and increase operational complexity.

- Ongoing uncertainty around the ZEV mandate delays manufacturer investment decisions, slows product planning, and restricts progress in charging infrastructure rollout.

- New entrants struggle to build brand trust, while some legacy brands lose share due to pricing pressures and slower innovation, leaving retail and fleet markets subdued with tightening margins and a slower transition towards zero-emission vehicles.

New Car Registration Forecast

Source: Cox Automotive

New Car Registration Forecast

Source: Cox Automotive

What do new car registrations look like in 2028?

- Fleet sales will remain dominant, holding a 52% share of new car registrations, although volumes will decline slightly, indicating stability but limited growth. Private sales will also grow steadily to 45% in 2028, which would reflect a gradual return to retail demand.

- Business sales will be a small but growing segment, rising to 54,744 units in 2028. This is a 38% increase compared to 2021-24, suggesting renewed SME confidence.

- Our forecasts predict that, on its current trajectory, consumer demand will boost electric’s share of the market to 36% in 2028. This is a positive jump, however, significantly behind the ZEV mandate target of 55%.

- Internal combustion engines will continue to decline, with petrol dropping to 28% and diesel to only 2% in 2028, as electrification drives these technologies out.

- Hybrid cars will also continue their growth journey in 2028, occupying 34% of new car registrations in 2028, a 78% increase which reinforces hybrid as a transitional technology.

What These New Car Trends Mean for the Industry

The UK car market faces a whole host of challenges to navigate in the next 12 months, which change by the moment. We’ve outlined the key considerations for the automotive industry, especially retailers, planning for the next 12 months.

- Consumer preferences towards brands and ownership models are changing...

- As drivers’ priorities for their vehicles change, we are seeing a shift away from traditional brand loyalty. This is evident by the rise in new market entrant registrations.

- Consumer demand for leasing will likely continue to grow as an attractive, cost-effective and heavily incentivised model.

- Further, it provides a risk-averse approach to EV ownership for those interested in making the switch but not entirely sold on the proposition.

- Current EV adoption rates aren’t enough to keep pace with ZEV mandate targets...

- With EVs’ current market share of 22.4% against a target of 28%, the industry is clearly struggling to keep pace with targets.

- Looking ahead to 2026, the 33% target feels almost implausible.

- Chasing these targets has the potential to impact profitability and drive further depreciation with the continual ‘plate-push’ end-of-month tactical registrations.

- New entrants to the UK market will continue to disrupt the landscape...

- If 2026 returns to the standard 2 million annual registration rate, it will be a very different picture than previous years, as it will be divided between significantly more manufacturers.

- We will continue to see a greater push into the UK market from new entrants, especially Chinese brands whose domestic market is under pressure.

- Retailers looking to navigate this new landscape need to carefully manage the relationship between volume, targets and profit retention, whether that is through existing manufacturer partnerships or new entrants.

- Changes to the ECOS could force buyers out of the new car market...

- With the Employee Car Ownership Scheme (ECOS) set to conclude in October 2026, the UK car market could lose up to 10% of its annual registrations.

- The end of the ECOS may push buyers toward used cars or out of the market entirely.

Explore More UK Automotive Market Insights

Want to explore more automotive data? Check out the other sections in our Insight Quarterly report for auto industry trends covering the used car market, a deeper dive into EV residual values and contributions from UK automotive market experts.