In the simplest terms, the EV market remains uncertain. We have seen progress in the new car market with EV adoption on the rise, and EVs taking a 22% share of registrations this year to date, up from 18% last year. However, these marginal gains have been made against a backdrop of market volatility, residual value uncertainty and a complex regulatory outlook.

In the following section of our quarterly market report, we’ll explore where the UK EV market is today and the factors that are influencing its performance, taking a deeper dive into how EV residual values are performing and the factors causing their decline.

EV residual values have declined as a sharper rate than hybrid, petrol or diesel models. Despite used EVs selling at a greater volume than seen in previous years, they are selling for notably lower prices. Marketcheck data reveals the average used EV price has dropped by £5,214.

Looking at age profiles across the EV sector using Cox Automotive data, we can see sharp declines among younger models:

22%

EVs taking a 22% share of registrations this year to date, up from 18% last year.

Between October 2022 and October 2025:

- EVs under 12 months saw their residual values decline by 29%

- EVs between one to two years old saw their residual values decline by 37%

- EVs between two to four years old saw their residual values decline by 22%

BEVs Trade Sale Value as a Percentage of Original Cost New (%OCN)

Source: Cox Automotive

Cox Automotive’s residual value data is calculated using our proprietary wholesale vehicle sales data from Manheim Auctions. We report on residual values as the price vehicles sell to trade as a percentage of their original cost new (OCN).

Although EV residual values are performing at a lower rate than other fuel types, we are seeing signs of stabilisation. EVs under 12 months old have seen improvement this year, starting at 52% of original cost new (OCN) in January and rising to 56% in October.

This improvement has been driven by earlier market corrections and modest confidence among retailers and consumers in used EVs. A handful of asset holders have held back from defleeting their vehicles to soften the depreciation impact on the balance sheet, whilst replacing and adjusting their residual values to offset some earlier losses.

EV market forecast

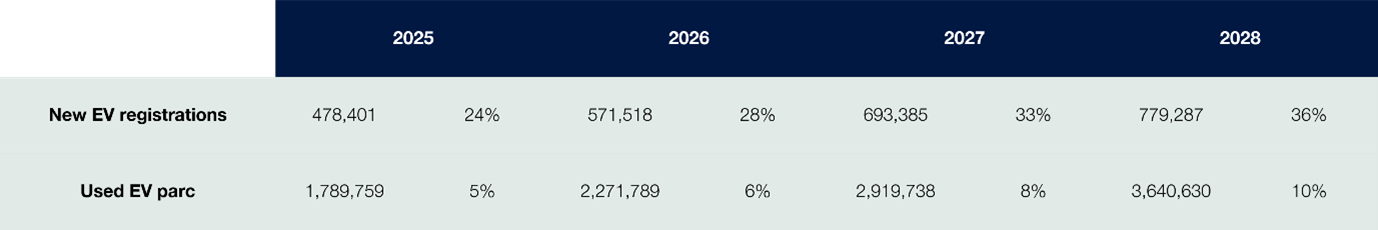

If the market follows the same trajectory as the current EV adoption rate, we can expect EVs to achieve a 36% share of registrations and 10% of the used car parc by 2028.

EV Adoption Rate

Source: Cox Automotive

While this forecast indicates a positive trajectory for the UK EV market, it is not adequate to keep pace with the targets laid out in the Zero Emission Vehicle (ZEV) mandate. In 2028, the ZEV mandate targets 52% of sales being EVs, a feat which feels increasingly unrealistic. Without clear long-term incentives and consistent government support, we risk undermining recovery and stalling momentum in the transition to zero-emission vehicles.

What these electric vehicle insights mean for the UK automotive market

The transition to sustainable transport is crucial, and the automotive industry has a vital role to play in this. However, the UK automotive market needs an approach which will help it achieve this without cannibalising profitability and performance. Our key takeaways from these latest auto industry trends are outlined below.

- EV residual values are expected to remain volatile as supply, demand and pricing strategies continue to adjust across brands and models.

- Early used volumes from new entrants will begin to return in 2026, providing valuable insight into their true residual value performance. This will enable clearer benchmarking of performance against established manufacturers.

- New entrants aren’t necessarily accelerating the move to full electrification, as much of their growth is driven by plug-in hybrids.

Explore more UK automotive data

Want to explore more automotive market data? Check out the other sections in our Insight Quarterly report for auto industry trends covering the new and used car markets.