Welcome to the latest edition of Cox Automotive’s Insight Quarterly (IQ), our comprehensive analysis of the trends shaping the future of the UK automotive market.

In this report, we’ll combine data-led analysis with automotive industry insight across the new, used and EV markets. In a market rocked by regulatory challenges, waning consumer confidence and new market entrants, these insights can help shed light across the industry and reveal the trends industry leaders need to monitor over the next 12 months.

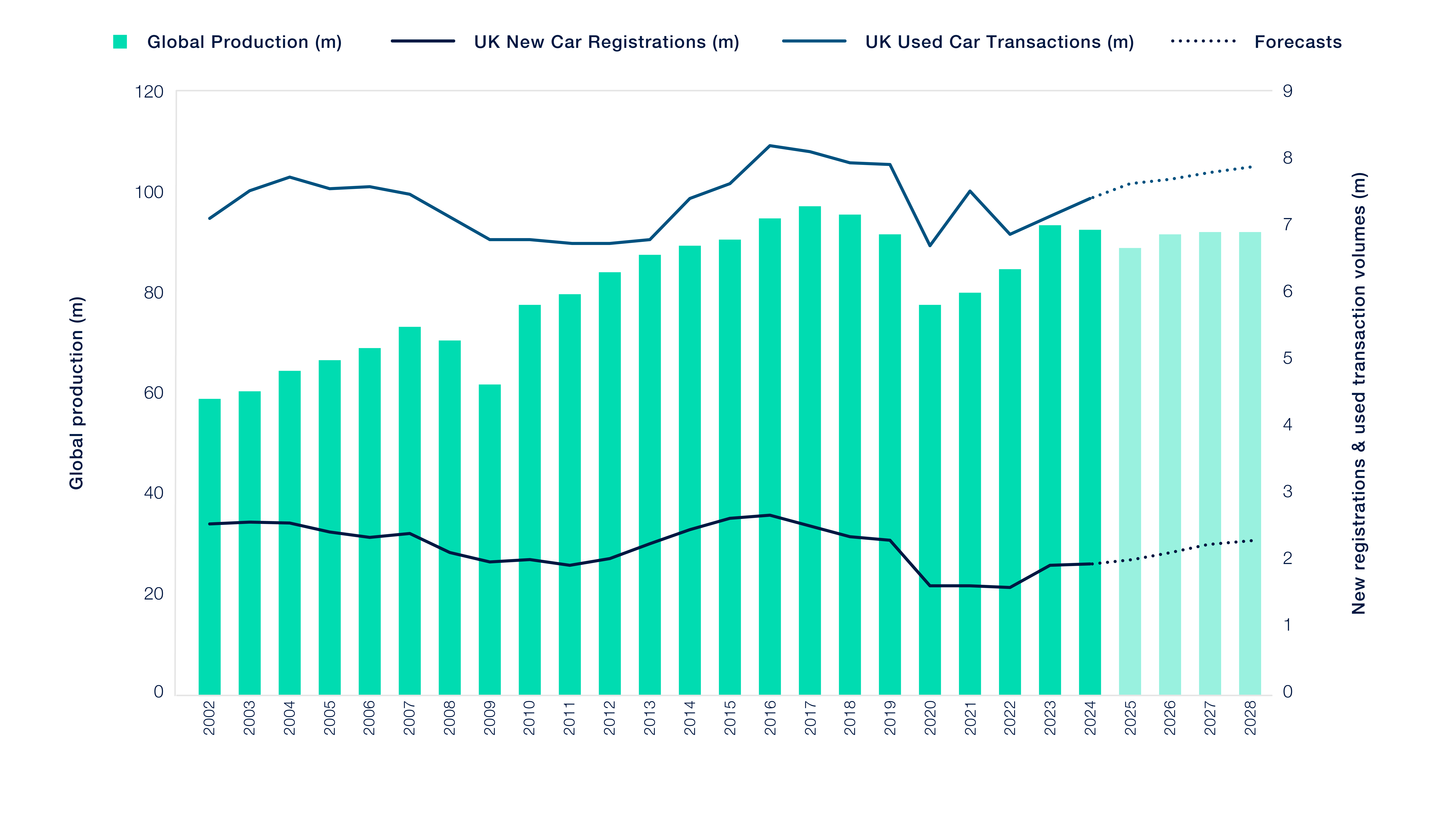

New and Used Sales vs Global Production

Source: SMMT / OICA / DVLA / Cox Automotive

Automotive industry insights and market drivers

Over the last three months, we saw continued disruption across the new and used markets. New market entrants continue to disrupt the new car market, gaining significant ground in the past 12 months and pushing more established manufacturers to rethink their sales strategies. To rise to the challenge of these new brands and keep pace with regulatory mandates, we continued to see the impact of tactical registrations, with high volumes of vehicles being registered in the final days of each month.

New Car Registrations 2017-2020 vs 2021-2024

Source: Cox Automotive

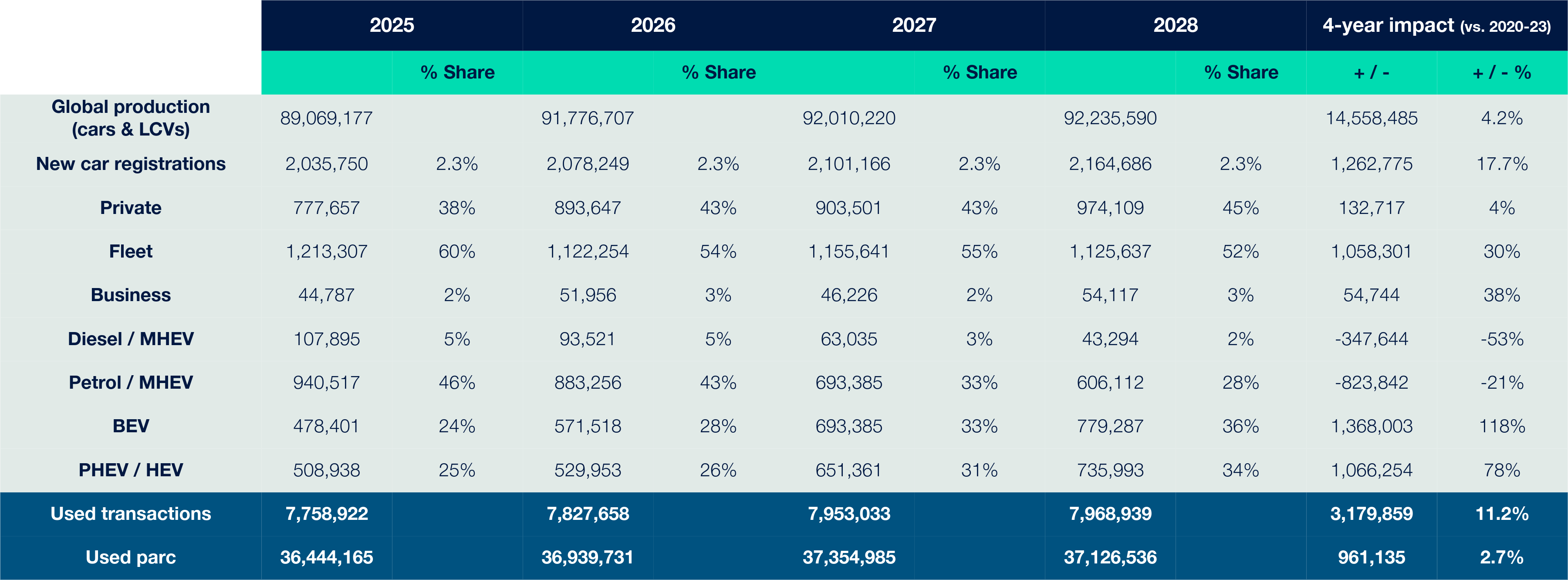

New Car Registration Forecast 2025 – 2028

Source: Cox Automotive

Explore market-by-market analysis

- In the new car market, we’ll evaluate how new market entrants have reshaped registrations, pushing more retailers and manufacturers towards tactical registration strategies.

- For the used car sector, we look at residual values across fuel types to understand how the market is performing in the face of an influx of new, discounted vehicles in from the new sector.

- In the EV market, we analyse the factors that are influencing its performance, taking a deeper dive into how EV residual values are performing and the factors causing their decline.

Outlook for the UK automotive industry

Auto industry trends suggest improved supply will see improved used vehicle availability in the next 12 months, but affordability pressures could reshape demand. EV adoption remains behind ZEV mandate targets, making the 33% goal for 2026 difficult to achieve. New entrants and short-cycle tactics will continue to disrupt pricing and residual values. Retailers must prepare for a market defined by tighter margins, evolving ownership models, and the need to build consumer confidence in electrification as we move into early 2026.