IQ

Insight

Quarterly

Q3 | 2025

Asset finance facilitates and supports UK businesses to grow

Businesses in the UK, across a number of sectors including automotive and industrial engineering, are facing challenges on multiple fronts. Right now, owners are battling a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs, trade uncertainty and the continued risk of sticky inflation.

Rising costs of employment and borrowing, together with elevated prices for gas, electricity and fuel, have put sustained pressure on margins and consequently the bottom line, all of which has a bearing on plans for capital expenditure and growth. Having a financial solution in place like asset finance could help with navigating these uncertainties and get a business poised for growth and now could be an ideal time for owners to consider their options.

While it seems a long way from home, the row between the U.S. and China, (as China restricted supply of rare earth metals used to manufacture vehicles and other assets) has had ripple effects across the world economy and could continue despite the recent meeting between Presidents Trump & Xi. We’ve already seen goods manufactured in China and originally destined for the U.S. being diverted to European markets, creating oversupply and therefore price pressure.

On the back of this, fleets have been retaining existing vehicles, with light commercial vehicle registrations down 10% between January and September 2025 when compared to the same period in 2024. This, plus the prospect of further tax rises in November’s budget, doesn’t do anything to lighten the mood.

That said there are signs, if you’re prepared to dig deep enough, that some of the pressures on UK businesses may lighten in 2026 and stimulate the desire to make capital investment in assets such as automotives, that could enable businesses to grow.

The recent move towards a ceasefire in the Middle East is a welcome development, which, if it holds could result in longer-term trade prospects looking somewhat brighter. There is no expectation that it will lead to the return of shipping traffic to the Suez Canal in the short-term, but it certainly opens up the prospect of a return at some point during 2026.

A recommencement of shipping through the Suez Canal could lead to a reduction of c14 days to ship containers from China to the UK, improving lead-times for certain products including cars and parts supply.

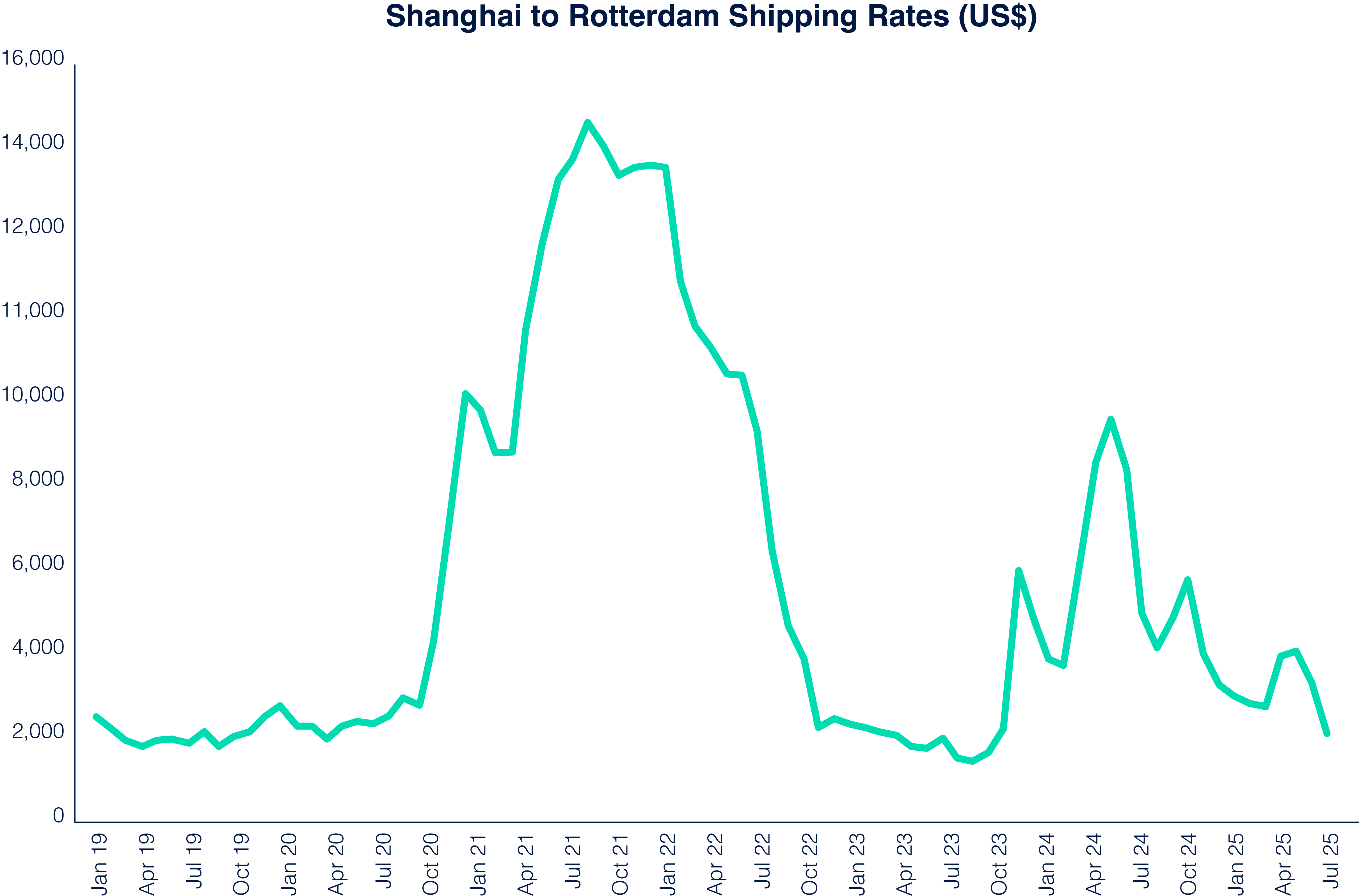

Spot rates to ship a container from Shanghai to Rotterdam are at a low ebb as operators suffer from over capacity versus a slowdown in demand. For context the rate is c800% lower than the peak of $14,558 seen during the covid period in September 2021.

Raw Data Source: World Container Index

The brent crude oil price continues on a downward trajectory with the price of a barrel falling by -9% since July. In addition, with OPEC+ members fast-tracking increases in supply to 137,000 barrels a day for November, matching October’s increase, forecasts are now predicting a record surplus next year. This could help lower wholesale energy and fuel prices for UK business.

The short-term outlook is continuing volatility as heating demand increases, and Europe enters the colder season. However, the expectation is that there will be enough surplus to exceed long-term demand which will keep prices low, which can only come as a welcome relief.

European gas futures have been trading at around €31 per megawatt hour over the last couple of months, over 40% below the February high of €58. EU storage levels now stand at c82.3%, up +1.3% compared to last month. Lower LNG demand in Asia due to lower cooling requirements has freed up supplies for Europe which has supported the drop in price.

Source: Dutch TTF Natural Gas Futures

While continued tension with Russia and potential sanctions on Russian gas could pose a risk to supply, global LNG liquefaction capacity is projected to rise by c+60% by 2030, half from the USA. This does raise concerns about oversupply and, if demand lags, it could lead to lower prices for Asia and Europe. The gas price is important as this is a key factor in driving the price of electricity and will subsequently have a potential knock-on effect on the cost of charging electric vehicles.

None of the above is certain and businesses crave certainty. The outcomes from the November budget are going to be key and Virgin Money Asset Finance stands ready to help businesses plan and invest capital into automotive, plant and machinery. All of which are key assets that when invested in at the optimum time, such as when surplus is high, can be cost effective and help a business grow.