IQ

Insight

Quarterly

Q2 | 2025

New car report Q2 2025: Industry fragility revealed underneath heavy incentives

We begin our insight deep dive with our new car report Q2 2025, which reveals a delicate balance between manufacturer-led incentives and inconsistent consumer demand. As the year started on a positive note, the tone has changed for the new car industry in the second quarter of the year.

Click here to jump to:

New car registrations Q2 2025: Where are we now?

At the half-year point, registrations from OEM target pressures hit their highest point for any single month since 2018. Further, industry new car registration data indicates that 30% of all new car registrations in June were processed on the final day of the month.

So, what’s driving this? This new car industry trend is indicative of a significant uptick in the end-of-quarter tactical and short-cycle activity, suggesting that car manufacturers were under heavy pressure to meet sales targets. The surge of new car registrations on 30 June highlights the scale of last-minute sales pushes across the network. Underlying all of this is the mounting pressure and stress on the system, with tactical volume pushing and sales target adjustments, highlighting the fragility of the industry in an increasingly margin-sensitive and supply-constrained environment.

The first three months of the year showed promise for the industry, with cautious optimism felt across the board, so what changed? Although persistent challenges, such as national interest increases, interest rates and waning consumer demand, have remained consistent since the start of the year, the impact of these on the market was temporarily masked by manufacturer-led incentives and a short-term pull-forward effect related to Vehicle Excise Duty (VED) charges.

After March, many car manufacturers appeared overly confident about these initial results and pulled back or withdrew incentives. This confidence was quickly undermined as showroom activity saw a rapid downturn, exposing the fragility of retail demand.

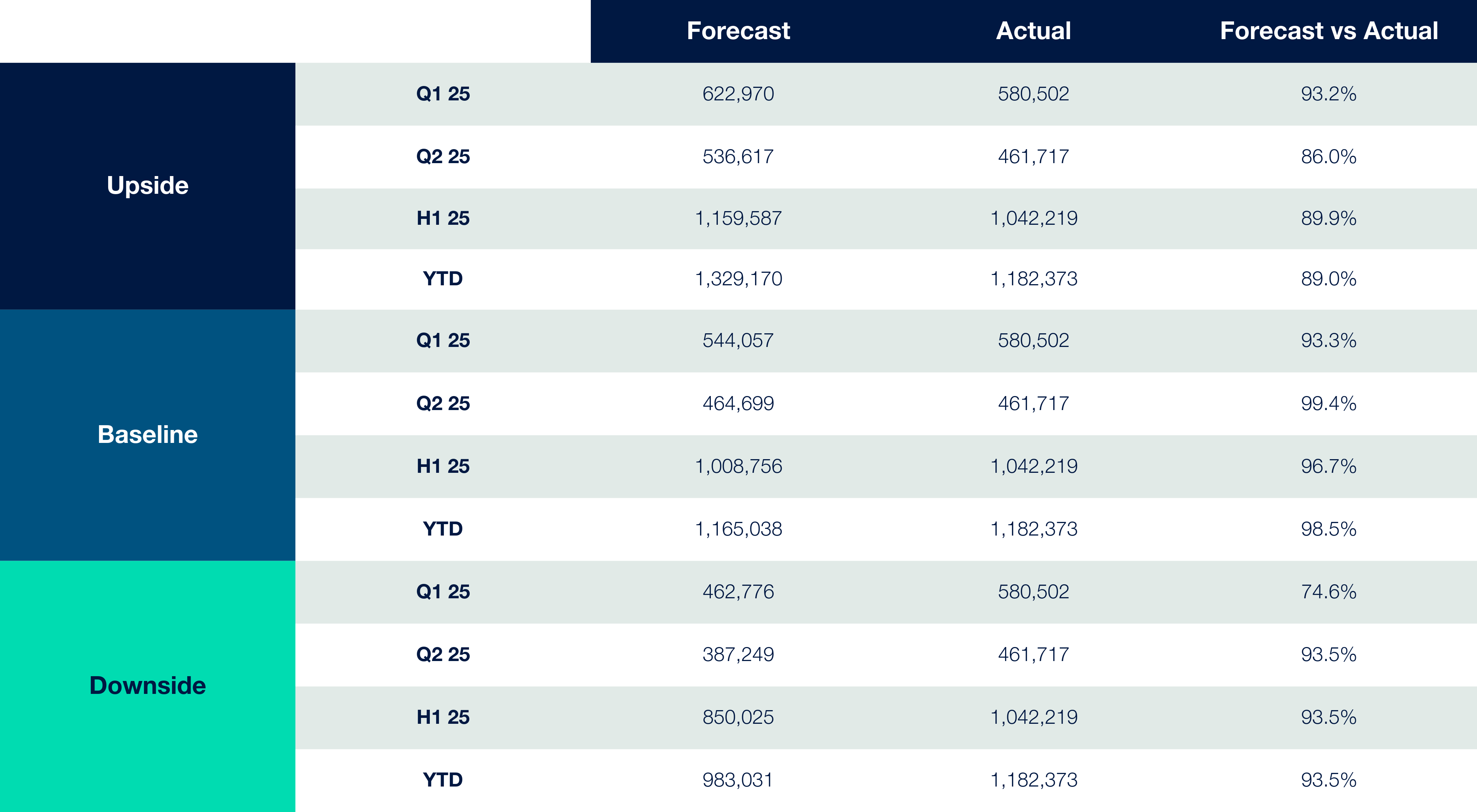

Cox Automotive New Car Registration Forecast vs Actuals

Source: Cox Automotive

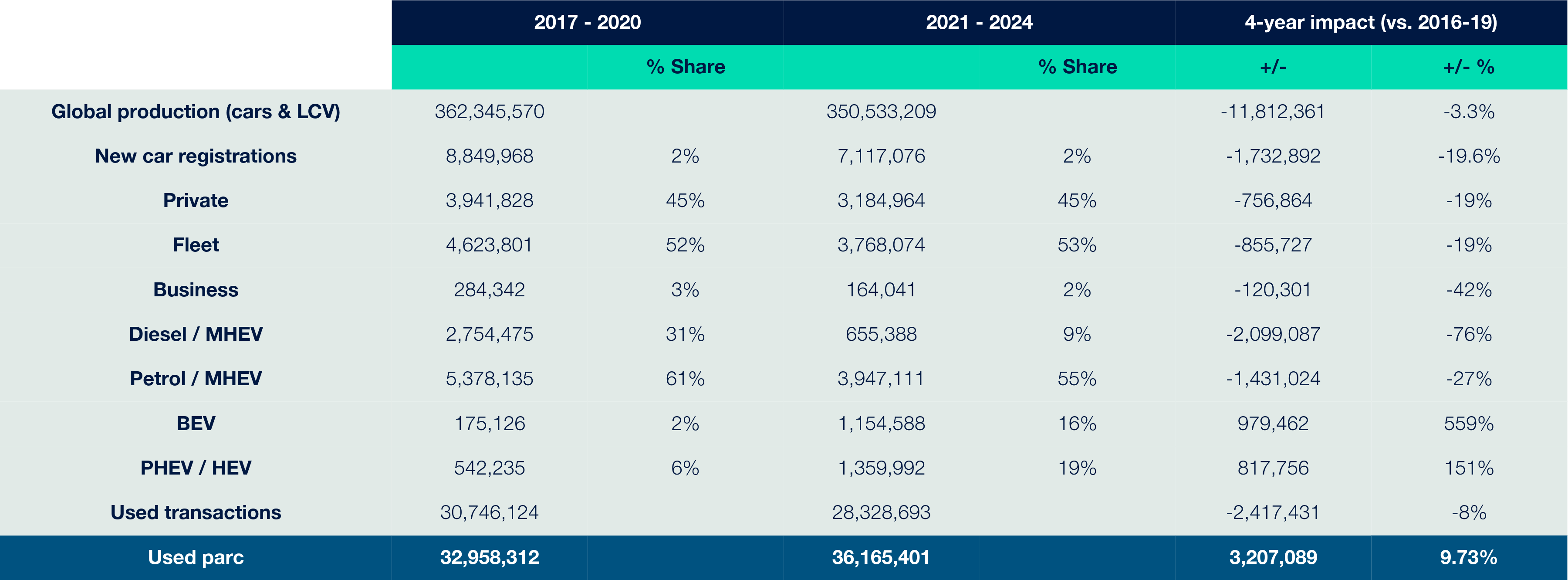

New Car Registrations 2017-2020 vs 2021-2024

Source: Cox Automotive

New entrant car manufacturers are making their mark

Meanwhile, new entrant manufacturers continued to make inroads into the UK new car market, accounting for 3.5% of total new car registrations (around 36,500 units) in the year. This represents a staggering 475% year-on-year increase. Automotive OEMs such as Skywell and Xpeng are making gradual gains, while BYD is clearly leading the pack with a 1.86% market share, with Omoda and Jaecoo following in hot pursuit. A raft of new model launches in the UK from the likes of Chery, Chang’an and Geely will likely see further progress made in the next 12 to 24 months.

Source: SMMT

Van registrations Q2 2025: What’s happening in the new van market?

The new van market is facing a similarly rocky outlook. New van registrations fell by 11.3% this year, with 179,481 units registered in the first seven months of 2025. This marks the eighth consecutive monthly decline for new van registrations. Demand for both medium and large vans dropped by 18.4% and 13.5% respectively. Small vans were the only segment to see growth, with new van registrations up by 20.6%.

On the other hand, we have seen positive results in the electric van market. Electric van registrations rose by 55.5% year to date, with 15,954 units registered. Following this latest uplift, electric vans now account for 8.8% of the new van market, however, this still lags behind the ZEV mandate target of 16% market share for 2025. Plug-in van grants remain crucial to encouraging electric van adoption, but infrastructure and grid connection delays continue to block further progress.

Looking forward, new van registrations may remain subdued due to economic pressures, but we anticipate that electric van uptake will continue to grow as supply improves and new models are launched.

Where is the UK's new car industry going?

What’s to come for the UK's new car industry for the remainder of 2025? Manufacturers have to strike a balance between annual market share targets, and quotas set out by the Zero Emission Vehicle (ZEV) and Vehicle Emissions Trading Scheme (VETs) mandates. These competing priorities will likely result in an increase in both consumer incentives and forced new car registrations, particularly in the latter part of the year. While this may deliver short-term volume increases, it also carries the risk of further margin compression for retailers, especially when discounting and forced registrations are required to meet compliance thresholds.

The retail market continues to face historically weak conditions and is widely regarded as one of the most challenging trading environments seen in over two decades. This is compounded by the growing influence of Chinese brands in the UK, as they have the potential to reshape traditional dynamics around pricing, brand loyalty and supply strategies in both the volume and value sectors.

While our Q2 2025 new car market report reveals challenges within the landscape, we encourage optimism wherever possible. As an industry, we have to rally together to overcome the bleak prospect ahead of us. Working to refine business models, enhance customer value propositions and supercharge operational efficiency will be crucial to overcome the waves of uncertainty across the new car industry. Rather than sink into these challenging times, retailers must rise to the challenge and take hold of the opportunities an increasingly competitive market offers to them.

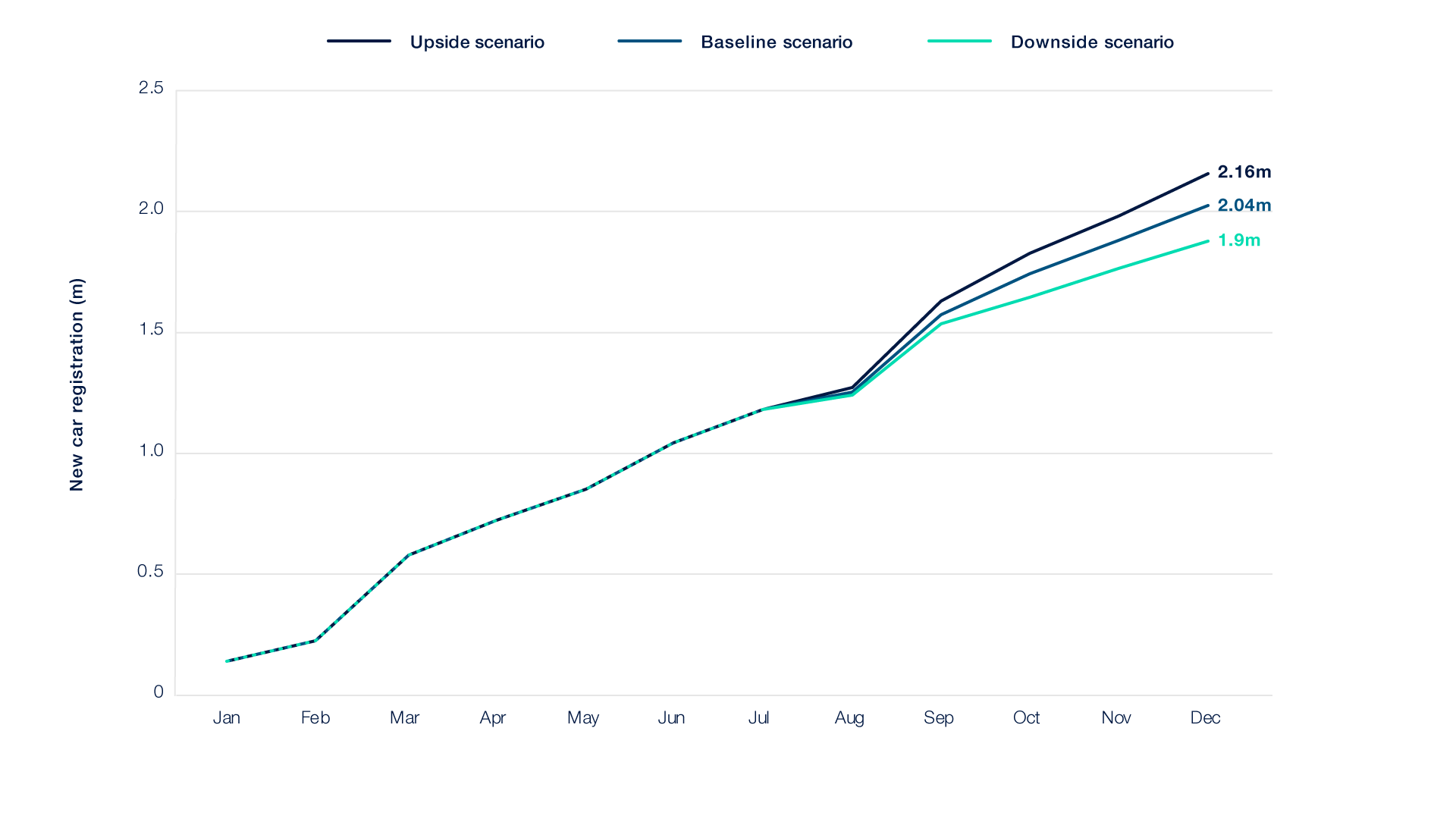

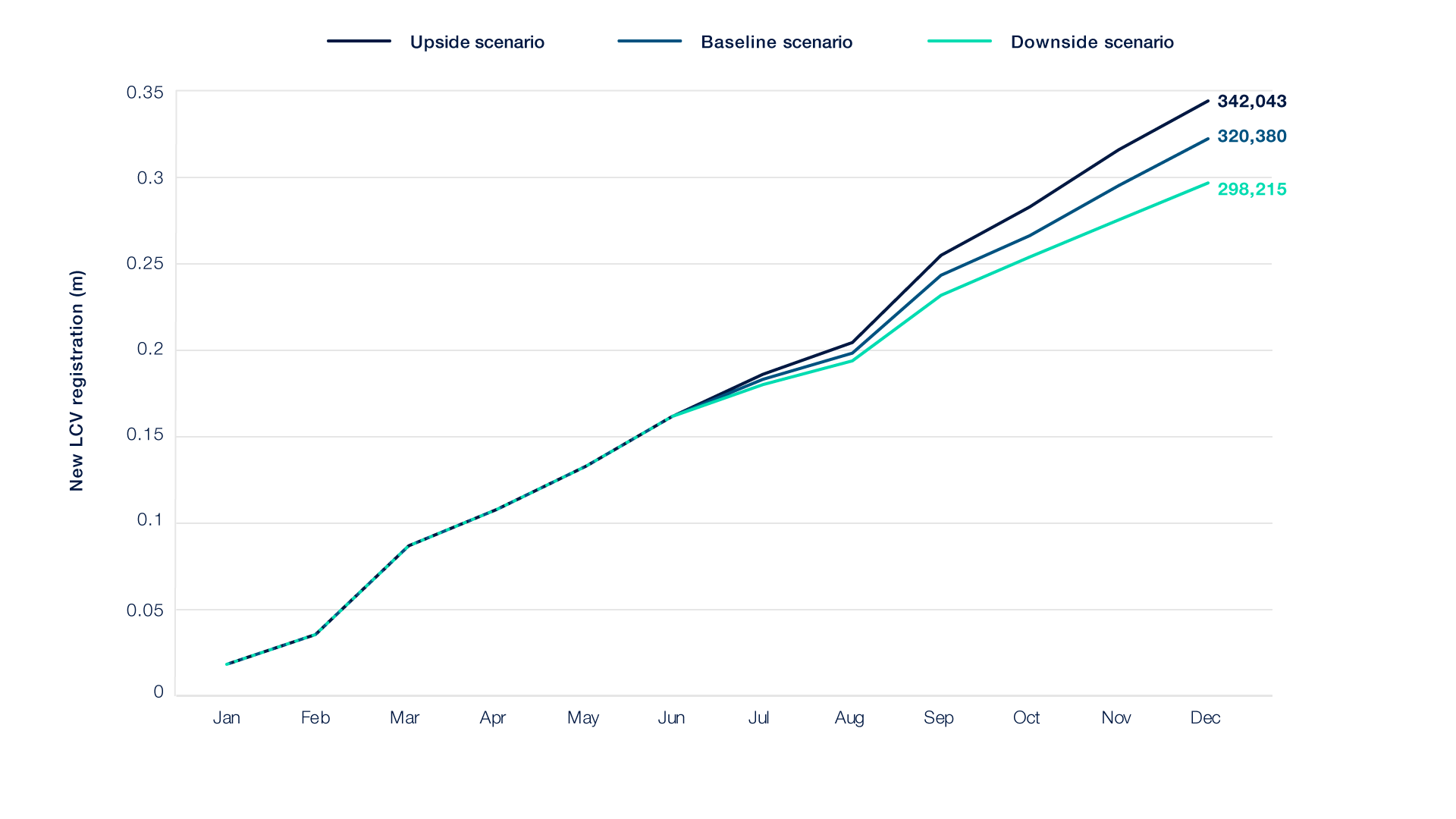

New car market forecast 2025 and beyond

Every quarter, we combine our proprietary market insights with the latest new car registration data to create three new car market forecast scenarios for the next 12 months. These include an upside, baseline and downside scenario, each reflecting different macroeconomic, policy and industry conditions that could shape the outlook for the remainder of the year. A new addition to our latest release is forecasts dedicated to the light commercial vehicle (LCV), or new van market. Together, these scenarios provide a structured framework to help stakeholders plan for the possibilities that may unfold in the year ahead.

New Car Registration Forecast 2025

Source: Cox Automotive

New LCV Registration Forecast 2025

Source: Cox Automotive

Our baseline scenario represents the most likely outcome for 2025, projecting 2,035,750 new car registrations, up 3.2% year on year but 11.9% below the 2000–2019 average. In addition, we anticipate 320,380 LCV or van registrations, representing an 11.3% year-on-year decline and 7.7% below 2023 levels. These figures reflect a modest uplift on earlier forecasts due to stronger-than-expected performance in the first half of the year and a gradual recovery in consumer confidence. However, both markets continue to face challenges, particularly from the requirements of the Zero Emission Vehicle mandate, meaning overall registrations remain well below historic norms.

New Car Registration Forecast

Source: Cox Automotive

New LCV Registration Forecast

Source: Cox Automotive

Upside scenario

In this optimistic outlook, the UK automotive sector benefits from a stronger-than-expected economic rebound in the second half of 2025. An improvement in macroeconomic conditions, including a gradual easing of inflation and a more stable interest rate environment, boost both consumer and business confidence.

- The recent Electric Car Grant (ECG) delivers a significant uplift in EV demand, accelerating the transition to zero-emission vehicles and improving dealer profitability through increased sales volumes and healthier residual values. Combined with greater policy clarity around the ZEV mandate and updated commission disclosure rules, the market experiences renewed trust and transparency, strengthening relationships between manufacturers, retailers and customers.

- With lower interest rates and inflation below 3%, household spending power increases, unlocking renewed demand for vehicles. Retailers and manufacturers benefit from improved margins and a healthier balance of supply and demand, especially in the electric and hybrid segments.

- Meanwhile, new entrants, particularly Chinese brands, expand rapidly, adding choice and competition that drives innovation across the new car sector. Established brands adapt by accelerating investment in technology, electrification, and flexible ownership models, helping to create a more resilient and profitable market as 2025 progresses.

Baseline scenario

In this scenario, the UK automotive market progresses on a steady but cautious path to recovery in the second half of 2025. New car registrations exceed the two million mark, supported by modest improvements in consumer and business confidence, while LCV registrations remain weaker year on year.

- The ECG only provides a limited boost to EV demand, with little change to the overall trajectory of the market. Structural and regulatory challenges, including the ongoing impact of the ZEV mandate and the operational pressures from the new commission disclosure rules, continue to weigh on manufacturer and retailer confidence.

- Gradual reductions in the Bank of England’s base rate and stabilising inflation support a modest improvement in economic conditions. However, high living costs and cautious consumer sentiment prevent a stronger recovery.

- New entrants maintain a slow but steady expansion, while legacy brands focus on incremental innovation and operational efficiency to stay competitive. The result is a new vehicle market showing moderate growth and stabilisation but still operating below pre-2020 levels.

Downside scenario

In this pessimistic outlook, the UK automotive market experiences a stalled recovery, with new vehicle registrations remaining subdued throughout 2025. The combined impact of economic pressures, policy uncertainty, and regulatory challenges creates a volatile environment for both manufacturers and retailers.

- High living costs, persistent inflation and weak wage growth continue to squeeze household budgets, restricting discretionary spending and dampening consumer confidence. The ECG fails to stimulate meaningful EV demand. At the same time, the Supreme Court decision on commission disclosure reduces dealer profitability and increases operational complexity, further undermining confidence across the sector.

- Simultaneously, the ZEV mandate continues to create uncertainty for manufacturers, delaying investment decisions and slowing the rollout of charging infrastructure. New entrants struggle to establish brand trust and achieve significant market share, while some legacy brands lose ground due to a lack of rapid innovation or competitive pricing.

- As a result, the market struggles to gain momentum, and both retail and fleet demand remain weak as the industry faces further pressure on margins and a slower transition to zero-emission vehicles.