- Seasonality and market easing expected in 2022

- Circa 18% new van list price increases the new price bar to levels never witnessed

- Incoming tsunami of ‘pandemic-worn’ Euro 5 vans will enter wholesale marketplace

- Record selling and buying customers at Manheim in 2021

- Digital sales saw vans sell seven days faster than in 2019

- Biggest price shift witnessed in van average selling prices

The wholesale van marketplace in 2022 will feel quite different from 2021, according to Cox Automotive. While Manheim experienced many record-breaking moments in 2021 with some of the highest selling prices in living memory, the business does expect the market to ease over the next 12 months, returning to something resembling seasonal norms. Furthermore, the van market can look forward to a tsunami of ‘pandemic-worn’ Euro 5 vans this year as supply and demand begins to rebalance, but at a cost.

Matthew Davock, Director of Commercial Vehicles at Cox Automotive, said: “The well-publicised rollout of low emissions zones around the UK will deliver more used Euro 5 vans into the used wholesale marketplace, but at a cost. Despite market softening, buyers will still have to pay higher prices than pre-pandemic levels for ‘pandemic-worn’ vans that have higher miles and lower standards of condition.

Matthew Davock, Director of Commercial Vehicles at Cox Automotive, said: “The well-publicised rollout of low emissions zones around the UK will deliver more used Euro 5 vans into the used wholesale marketplace, but at a cost. Despite market softening, buyers will still have to pay higher prices than pre-pandemic levels for ‘pandemic-worn’ vans that have higher miles and lower standards of condition.

“An increasing awareness of greener, more economical, Euro 6 and electrified vans, will be much higher on the priority list of buyers throughout 2022, due to consumers being more educated and aware of the future landscapes and rollout timescales.”

Manheim 2022 van auction predictions

Davock predicts a very different picture of what age and mileage dynamics will paint in 2022. This year, many fleet and leasing companies will be prioritising even more Euro 5 van returns. Davock adds: “A large proportion of the approximate figure of 2.5 million vans, that are currently Euro 5 or older and operating on UK roads today, have an average age of nine years old. These are vans that have had an extended operating life by fleets during the pandemic. As a result, they will have been worked extremely hard. From this I imagine these vans will be ‘pandemic-worn,’ and have a worse return mileage and condition that will be a concern for wholesale stock quality.”

It’s not unlikely that Manheim will see Euro 6 van performances continue to show strength this year. Not only will Euro 6 stock be fuelled by ULEZ and CAZ acceleration rollout, but most LCV manufacturers have also increased list prices by approximately 18%. Davock expects the new price increases to support the Euro6 market further, as the used price versus new price is showing better price alignment for the consumer.

With the records set over the last year in terms of mileage and condition, Davock predicts this to play a much bigger part in 2022. However, Euro 5 vans and higher mileage Euro 6 van performances will show some signs of easing. It’s also predicted in H2 2022, that as much as 70% of auction catalogues will be dominated with stock having over 100,000 miles. Some reports suggest average vans have covered 40% more miles than previously predicted and contracted, as the overall supply and pandemic challenges become concerning for fleet operators.

Manheim also expects seasonality to play a much bigger part in 2022. Davock adds: “As the significant price rises are matched with reduced market support and financial buoyancy, this will affect some stock profiles for first time auction conversations, when retail activity shows signs of softening.”

Wholesale volumes are not expected to increase in the first half of 2022, but Manheim does expect van returns to be 25-30% higher than 2021 averages by H2 2022. It will come as no surprise to many that these increases are likely to be dominated by Euro 5 van returns. As much as 50% of Manheim’s stock sold during 2022 is predicted to be Euro 5 or older product, compared to 41% seen in 2021. Reports suggest over 405,000 new vans have been ordered and destined for the UK marketplace.

Davock adds: “Most of these vans haven’t yet been built, which will eventually result in a tsunami of new vans arriving that will transform the current market’s future, into one that looks very bright over the next three years from a volume perspective.”

Manheim’s last prediction for 2022, is the expected awareness from buyers, who will become more aware of compliance vehicles that are allowed into low emission zones (ULEZ, CAZ) without paying daily fees. Davock added: “The rollout of low emissions zones in cities around the UK is already having an impact, with many buyers reporting increasing consumer requests for only Euro 6 compliance and electrified vehicles.”

Manheim’s 2021 auction results

2021 was the strongest ever year for the used van marketplace at Manheim auctions. It was a year that saw the auction company sell used vans on behalf of a record 561 sellers, an 18% increase compared to 2019 averages. Additionally, a record 2,771 different buyers purchased a commercial unit from Manheim, a 19% increase compared to 2019 averages.

Meanwhile, 18 months of 100% digital commercial sales at Manheim, led to stock selling 44% quicker, or seven days faster than 2019 averages throughout last year. A record number of sellers and buyers used the Manheim platform, and the highlights of the new era and benefits of digital auction remarketing were witnessed.

The average selling price of a used van last year was £9,907, with the biggest price shifts ever recorded. Values were 30% or £2,282 stronger compared to 2020, when averages were £7,625 and 66% or £3,919 stronger than 2019 records, when the average price of a van was just £5,988.

The average age of a used van last year was 62 months, up from an average of 60 months in 2020 and an average of 61 months in 2019. Meanwhile, the average mileage of a used van last year was 75,897 miles, up from an average of 71,118 miles in 2020, and an average of 76,373 miles in 2019.

The 2021 average first time conversion also increased to 82%, an increase from 78% in 2020, and up from 76% in 2019.

Davock added: “Similarly to the used car market, consumers are paying considerably higher prices than they were even in the first year of the pandemic in 2020, and significantly higher than the last pre-pandemic year of 2019. Not only are consumers paying more for used vans, but they’re also buying older vans with higher mileage, which is not necessarily what they want or need for driving in some cities today.

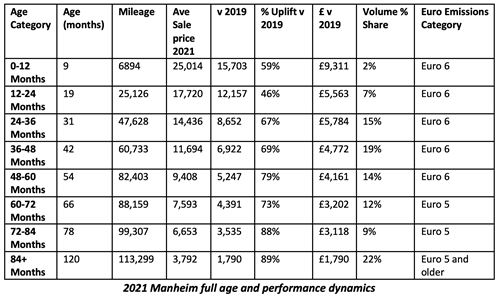

According to Manheim’s full age and performance dynamics data for used vans last year, significant price movements were observed across all bandings. In particular, one-year-old and older product almost reached double growth performance figures, with 59% representing Euro 6 profile and 41% representing Euro 5 or older product.