IQ

Insight

Quarterly

Q2 | 2025

Used car market report: Supply shortages buoy used values

Continuing across the industry, our used car market report looks at the dynamics influencing the outlook for providers across retail, wholesale and funding. The used car industry continues to be a stabilising force amidst a time of uncertainty and volatility for many, driven predominantly by an ongoing supply gap among 3 to 5-year-old vehicles. However, residual values continue to face pressure while heavy discounts are applied in the new car market.

Click here to jump to:

UK used car market: Where are we now?

While the new market continues to be rocked by volatile market dynamics, the used car industry remains resilient. Central to this stability is the continued shortage of 3 to 5-year-old vehicles, stemming from over 3 million new car registrations lost during the pandemic. This supply pressure has sustained a high level of competition in the wholesale market and has kept used values well above typical seasonal averages.

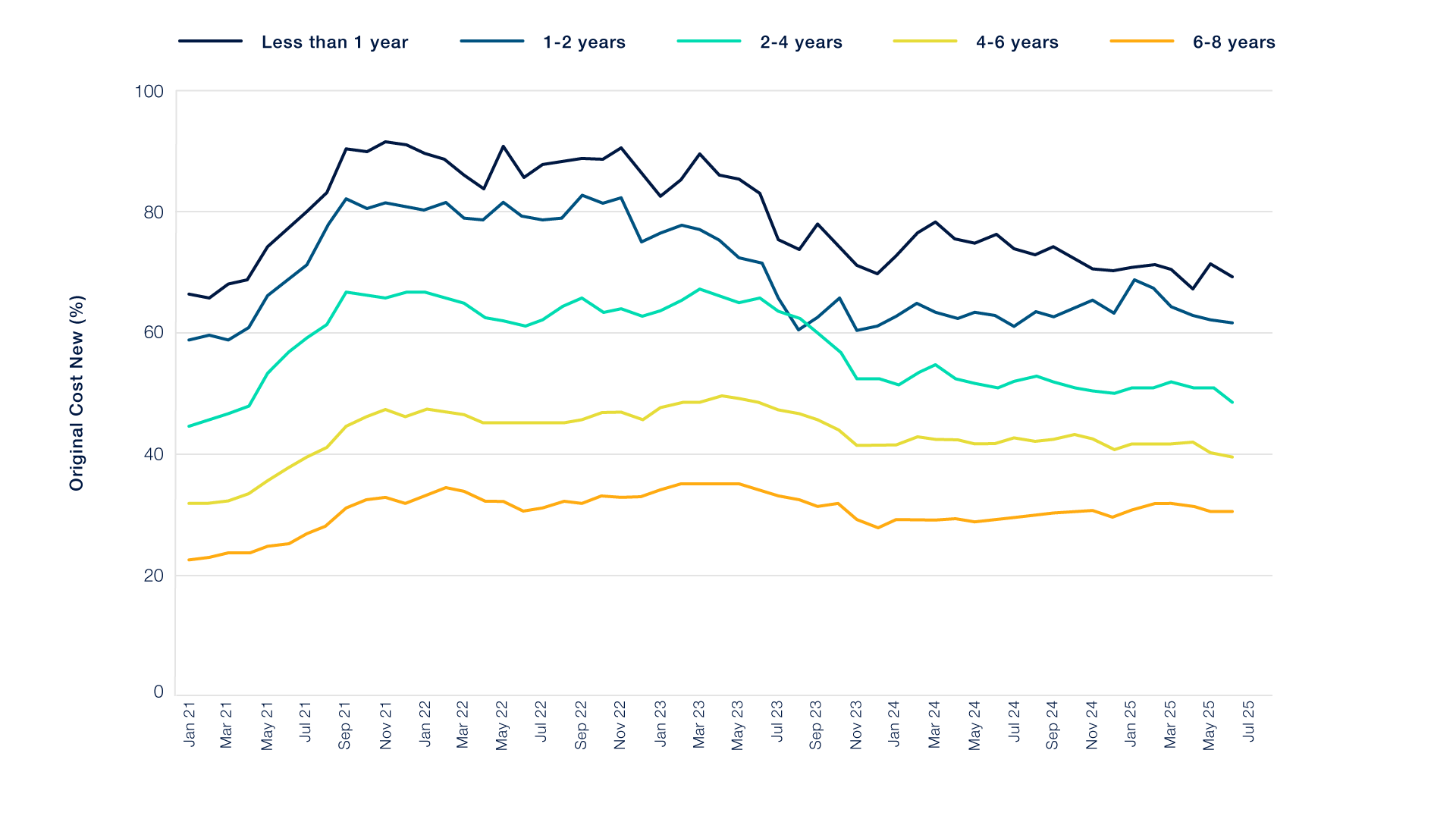

Used Car Trade Sale Value as a Percentage of Original Cost New (%OCN)

Supported by balanced levels of supply and demand, remarketing performance has remained strong. Retail activity, on the other hand, has been slightly more variable after we saw softer performance in the second quarter for the UK used car market, following a solid start to the year, with car supermarkets tending to outperform franchise and independent dealers. Consumer behaviour remained inconsistent. Although drivers continue to face issues with cost-of-living and broader economic uncertainty, affordability challenges in the new car market have sustained demand for well-presented, cost-effective, high-quality used stock.

Auction activity also intensified, with higher throughput and improved conversion rates, a trend we expect to continue into 2025.

What’s happening in the used van market?

“The used van market is facing a raft of challenges. Averages across the industry illustrate shrinking stock availability and declining values. Higher mileage vehicles continue to present a challenge for valuations due to extended fleet replacement cycles and a greater variation in condition. Similarly, the imbalance between supply and demand for some segments, such as large vans, may continue to impact values in the coming months. Currently, the forecast residual values in the used van market has been revised down by an average of 1.5% compared with the previous month, which reflects typical seasonal trends and economic uncertainty. As a business, however, Manheim Auction Services is outperforming the market averages, as we’re seeing strong conversion rates (84% in H1) and a 12% improvement year-on-year in van mileages."

“The used electric van market is a mixed picture. Demand for these vehicles is increasing, and we are seeing an increase in volumes across our sites, but adoption remains below the government’s mandated market share as buyer confidence remains challenged. The values of these vehicles are expected to remain volatile due to limited transaction data, buyer hesitancy and higher running costs.”

Matthew Davock, Director of Commercial Vehicles at Manheim Auction Services

Where is the UK used car market going?

In the short term, the used car industry is likely to remain more stable than the new market, bolstered by continued demand for well-presented, affordable vehicles. However, growing volumes of nearly-new EVs may bring further pricing pressure to the market, especially for mainstream models with weaker brand equity.

Retailers will need to carefully manage their stock mix, monitor battery state of health and communicate vehicle condition and range to protect margins in this evolving segment.

Remarketing ex-fleet and short-cycle vehicles will also be a key trend to watch moving forward. Rising volumes from both stock sources present challenges and opportunities for the used vehicle market, with preparation standards, refurbishment consistency, and accurate pricing strategies vital to maximising returns.

Operationally, rising costs and increased competition are further pressuring used vehicle margins. Digital transformation will be central to sustaining performance, with investment in remote appraisals, online remarketing platforms, and digital retail tools becoming essential for efficiency and customer engagement.

Finally, wider regulatory developments, including changes to Vehicle Excise Duty, Benefit-in-Kind for PHEVs, VAT on public charging, and the FCA’s execution of the Supreme Court’s decision on commission disclosure, will add further complexity. With interest rates and consumer sentiment still sensitive, the short- to medium-term outlook will depend on agile stock management, pricing discipline, and retailers’ ability to navigate an increasingly digital and policy-driven environment.

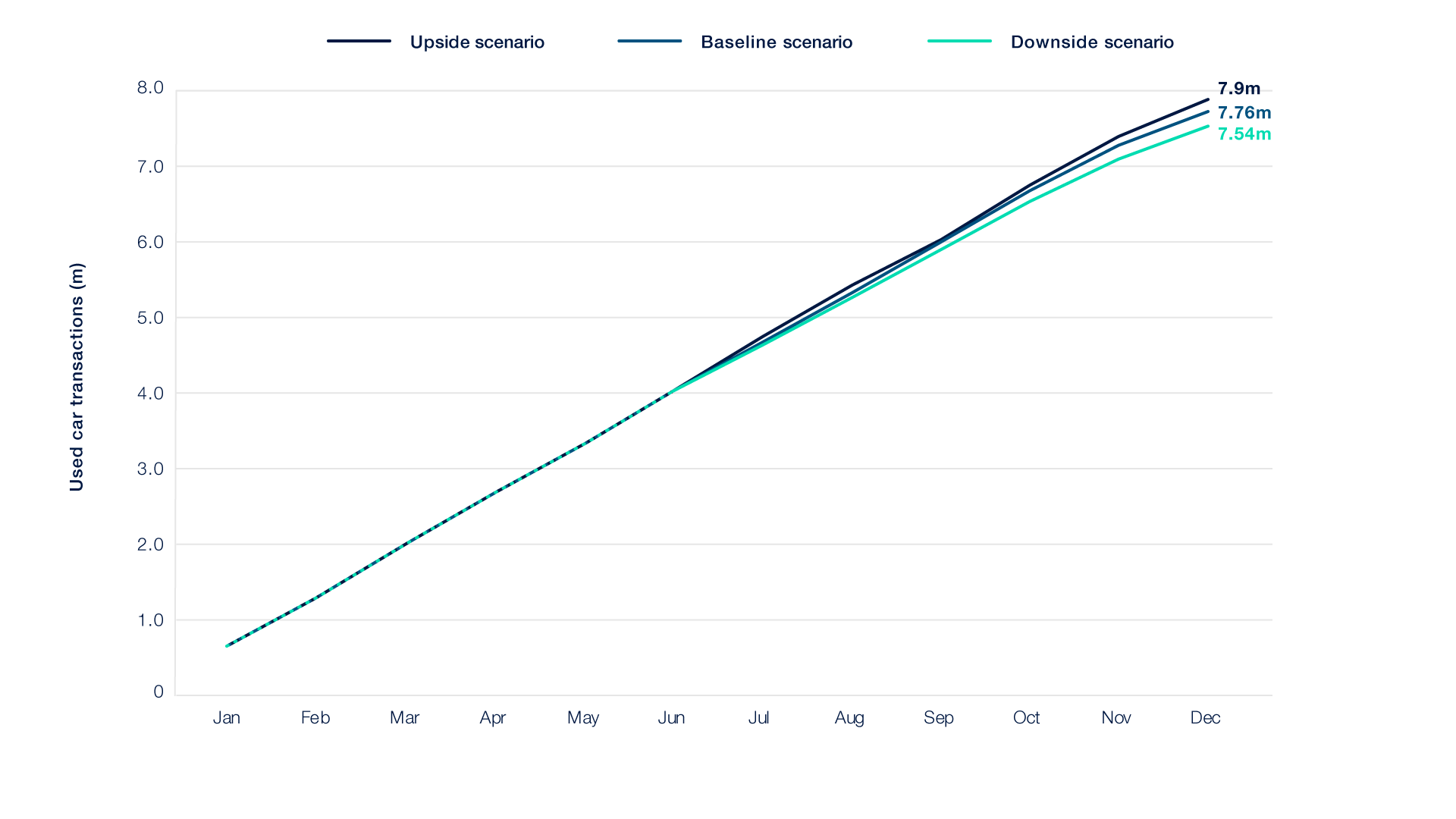

Cox Automotive Used Car Transactions Forecast vs Actuals

Source: Cox Automotive

How the used car industry can learn from experience

Looking back on the used car industry’s performance in 2024 can provide some valuable lessons for the market as we move into more uncertain times. Margin performance improved for many retailers, bolstered by stronger stock profiling, disciplined acquisition and a focus on retail-ready presentation. Those who invested in aligning their strategies with consumer preferences were able to protect their profitability despite market volatility, an approach that should continue to be leveraged for the foreseeable future.

Used car market forecast

Every quarter, we combine our proprietary market insights with the latest used vehicle data to create our used car market forecast: three scenarios which forecast the industry’s performance for the next 12 months. These include an upside, baseline and downside scenario, each reflecting different macroeconomic, policy and industry conditions that could shape the remainder of the year. Together, these scenarios provide a structured framework to help stakeholders plan for the possibilities that may unfold in the year ahead for the used car market.

Used Car Transaction Forecast

Source: Cox Automotive

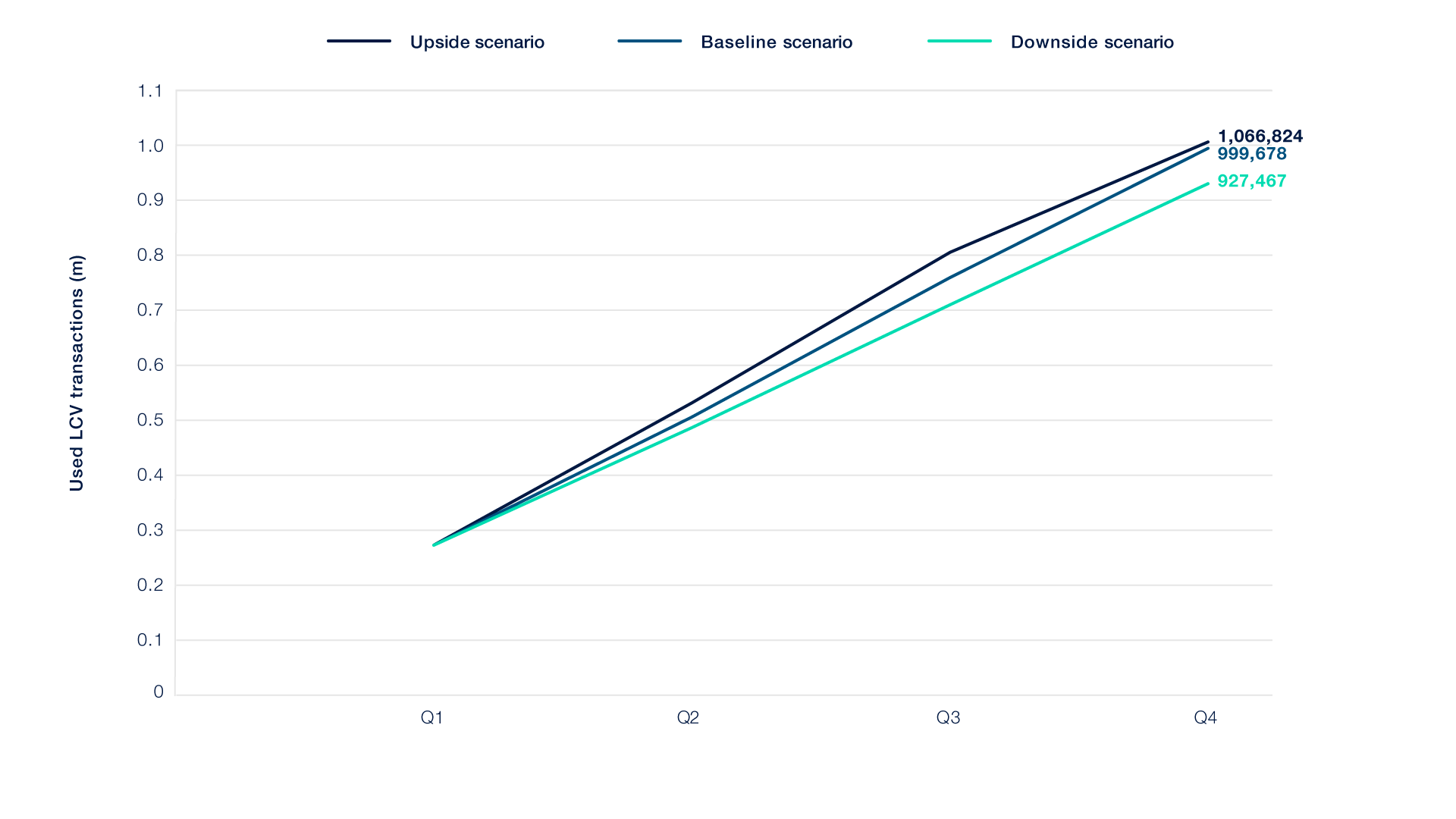

Used LCV Transaction Forecast

Source: Cox Automotive

Our baseline scenario forecasts a gradual return to a more typical rhythm for the used market in 2025. Used car transactions are expected to reach 7,717,595, representing a modest 1% year‑on‑year increase and sitting 4.6% above the 2001–2019 average.

In contrast, used LCV transactions are forecast to total 999,678, a 0.9% decline compared with 2024. However, this figure still reflects a significant 11.9% increase on 2019 levels, highlighting how the used van market has expanded compared with pre‑pandemic norms.

Used Car Transaction Forecast

Source: Cox Automotive

Used LCV Transaction Forecast

Source: Cox Automotive

Upside scenario

In this optimistic outlook, the UK economy performs better than expected through the remainder of 2025, with easing inflation, lower interest rates and more substantial consumer confidence supporting market growth. Improved economic stability, alongside a more predictable policy environment, helps boost both retail and fleet activity.

- Retailers adapt quickly to the changing mix of used stock, with part-exchange volumes and fleet returns increasing as new vehicle supply continues to normalise. A significant shift in buyer attitudes towards EVs emerges, driven by improving price points, greater availability of desirable models and the impact of the Electric Car Grant. Dealers respond by refining their inventory and sales strategies to meet rising EV demand.

- Depreciation rates stabilise across key segments, reinforcing price confidence and supporting stronger residual values. With supply chain pressures easing, wholesale and retail operations become smoother and more efficient, helping retailers to achieve stronger conversion rates and healthier margins.

- Together, these factors create a buoyant outlook for the used car and used van markets, offering greater opportunities for both franchised and independent retailers while accelerating the transition towards zero-emission vehicles.

Baseline scenario

In the most likely outcome, the used car and van markets follow a steady but cautious path to recovery through the second half of 2025. Transaction volumes rise modestly as supply continues to normalise, with part-exchange and fleet returns gradually increasing.

- The Electric Car Grant (ECG) delivers only a limited short-term boost to BEV demand, and while buyer attitudes towards electric vehicles are improving, affordability and charging infrastructure challenges continue to slow mass adoption. Retailers adapt incrementally to the growing mix of electric stock, but uptake remains behind government targets.

- Gradual reductions in the Bank of England’s base rate and stabilising inflation support modest improvements in consumer confidence, but high living costs and ongoing economic pressures prevent a stronger rebound in used vehicle demand.

- Depreciation rates remain broadly stable across most segments, with only limited improvements in residual values. While retailers continue to manage stock effectively, margins remain under pressure as the used vehicle market adjusts to structural and regulatory changes, including the impact of the new commission disclosure rules.

- Overall, the used vehicle market experiences moderate growth and stabilisation but continues to operate below pre-2020 activity levels.

Downside scenario

In this pessimistic outlook, conditions in the used car and van markets worsen as 2025 progresses into Q3 and Q4. Persistent inflation, high living costs and weak wage growth continue to erode household budgets, reducing discretionary spending and weakening both retail and fleet demand.

- The Electric Car Grant (ECG) fails to deliver meaningful growth in BEV uptake, and buyer confidence in electric vehicles remains subdued due to affordability concerns and slow progress on charging infrastructure. At the same time, the Supreme Court decision on commission disclosure further impacts dealer profitability and increases operational complexity, adding to market uncertainty.

- Supply begins to outpace demand in some segments as more stock returns to the used market, putting further downward pressure on values and margins. Depreciation rates rise in key areas, particularly for BEVs, where residual values remain volatile amid weak retail appetite.

- Regulatory pressures from the ZEV mandate continue to create uncertainty for manufacturers and retailers, delaying investment and slowing the rollout of the infrastructure needed to support electrification. New entrants struggle to build brand trust and achieve meaningful share, while some established brands lose ground due to limited innovation or competitive pricing.

- The combined effect is a stalled recovery, with transaction volumes remaining subdued, profitability under strain, and the transition to zero-emission vehicles progressing more slowly than planned.