IQ

Insight

Quarterly

Issue 6 | 2025

EV market report: The changing face of global production

In this edition of our EV market report, we take a deep dive into one of the biggest driving forces in the electric vehicle industry today: the impact of new brands founded in China on the direction of electrification in Europe.

China: How are domestic dynamics changing the shape of international EV production?

At home, China’s car market is booming. The country’s vehicle parc has now reached 353 million, with new car sales rising by 4.5% to 27.6 million in the latest full-year figures. Meanwhile, production has also grown by 3.7% to 31.3 million units, solidifying the region’s primacy as the world’s largest car manufacturer by volume.

The region also leads the globe in terms of electric vehicle (EV) adoption. EV sales reached 7.7 million in the last year, making up 27% of all new vehicles sold, meanwhile, new energy vehicles account for 41% of new car sales. This means that under a third of new vehicles sold are solely fuel-based.

While the domestic market has given new market entrants a solid foundation to establish themselves, international expansion is crucial to achieve their ambitious growth plans. At home, BYD, Geely, Chery, SAIC and Changan now lead the market, with BYD at the head of the pack, holding an 18% share. Their ability to successfully scale production and invest in proprietary EV technology has given them the capability to expand internationally with confidence, with car exports from China growing by 23% to 5 million units. It is worth noting, however, that EV exports declined by 10% which may reflect higher levels of domestic absorption as a result of international trade challenges.

International ambitions come to fruition thanks to ZEV mandate targets

The UK and Europe present the most lucrative opportunities for Chinese manufacturers when it comes to the EV market. American tariffs have made the region effectively off-limits for these brands, while other global markets haven’t achieved the appropriate level of electrification, revealing a golden opportunity in between.

The UK government’ ZEV mandate targets - achieving electrification by 2035 and phasing out petrol and diesel - demand for high-quality, affordable EVs is rising sharply. Brands such as BYD, MG and Nio are responding with models that meet evolving consumer expectations, offering long-range, fast charging, and advanced driver assistance features at prices that often undercut mainstream and premium competitors. Further, thanks to their domestic set-up, these brands can deliver high-spec vehicles at significantly lower costs than Western manufacturers.

Currently, these brands are moving into their localisation phase, investing in early-stage dealer networks, setting up European design and engineering centres and, in some cases, investing in local production to sidestep import tariffs. This phase is vital for these brands to build brand trust and familiarity with their target consumers, especially in markets with high levels of established brand loyalty.

How will this impact the used EV market?

Attempts to push new sales will inevitably impact prices in the used EV market, particularly for young used cars. There are clear indications that Chinese manufacturers are utilising this to their advantage with the levels of pre-registrations we have seen in the UK.

As it is very early for these Chinese brands in Europe, we are yet to see how their proposition will play out in the used EV market. However, remarketers and stakeholders have a crucial role to play in helping manage used inventory, given the importance of residual values in whole-life cost assessment.

Chinese manufacturers are no longer simply challenging legacy manufacturers; they are actively reshaping the competitive landscape and will shape all EV market reports in the future. Their ability to combine scale, innovation, speed, and cost-efficiency is driving a new era of automotive disruption. For UK and European stakeholders, this represents both a challenge and an opportunity: adapt to the pace of change, or risk falling behind in the global EV transition.

The used EV market and residual values

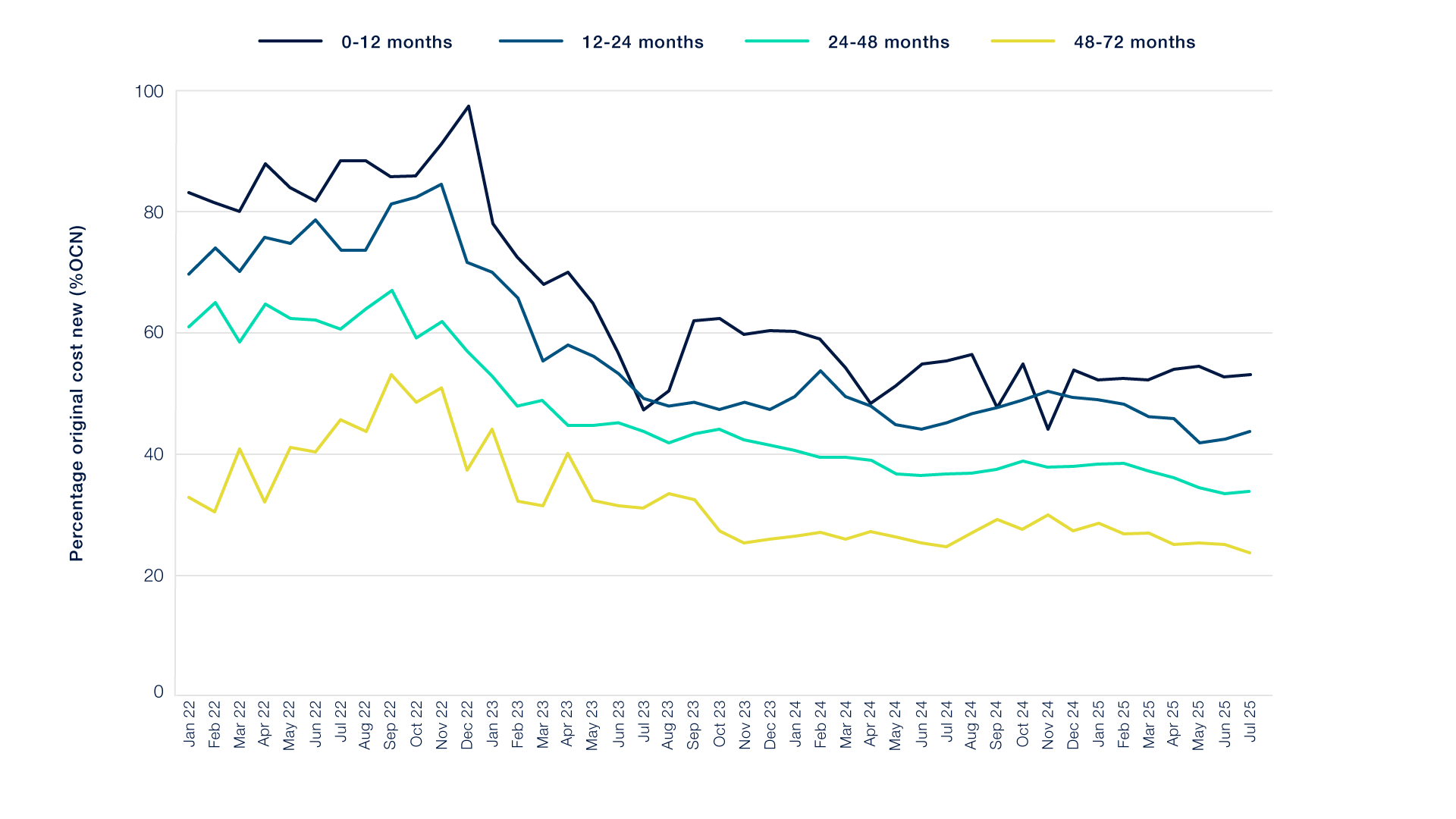

Looking at the performance of electric vehicle (EV) values compared with internal-combustion engines (ICE), there is still a significant gulf between the two. The widespread discounting of new EVs in the market has placed downward pressure on used values. Values for EVs remain close to 70% below their August 2022 peak, with particular pressure on EVs under 12 months old.

On average, we have only seen a slight decline in sold values for ICE vehicles under 12 months old (down 1%) and 1 to 2 years old (4%), whereas the story in the EV market is very different. EVs under 12 months old have dropped by 4% (£4,130) and a staggering 13% (£8,123) for 1 to 2-year-old EVs.

1%

The decline in sold values for ICE vehicles under 12 months old, compared to a 4% drop for EVs of the same age range.

4%

The decline in sold values for ICE vehicles between 1 and 2 years old, compared to a 13% drop for EVs of the same age range.

Values are expected to align more closely with seasonal patterns throughout the remainder of the year, with stability likely to continue into early 2026. However, we do anticipate some softening from late 2026 into 2027.

BEVs Trade Sale Value as a Percentage of Original Cost New (%OCN)

Source: Cox Automotive

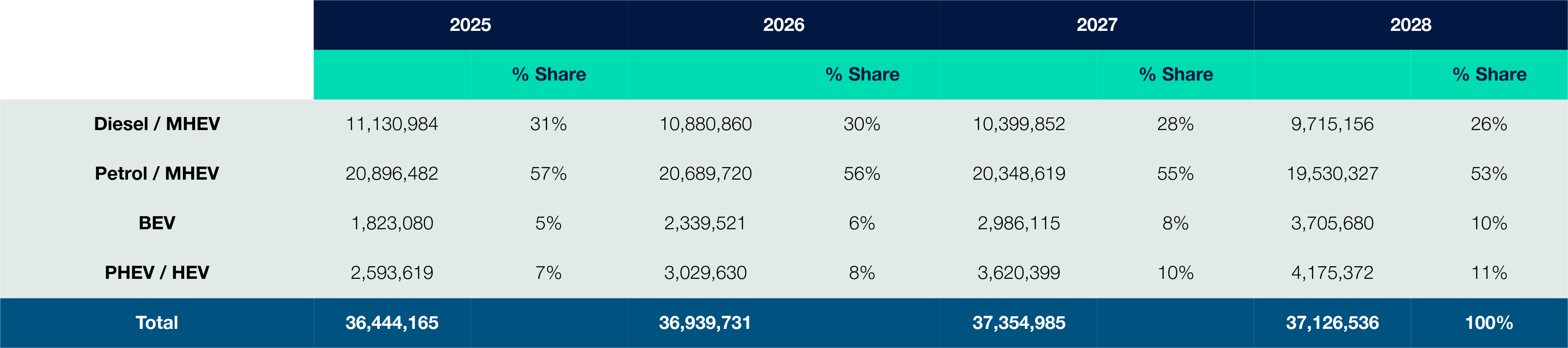

Used Vehicle Parc Forecast 2025 - 2028

Source: Cox Automotive