6 min read

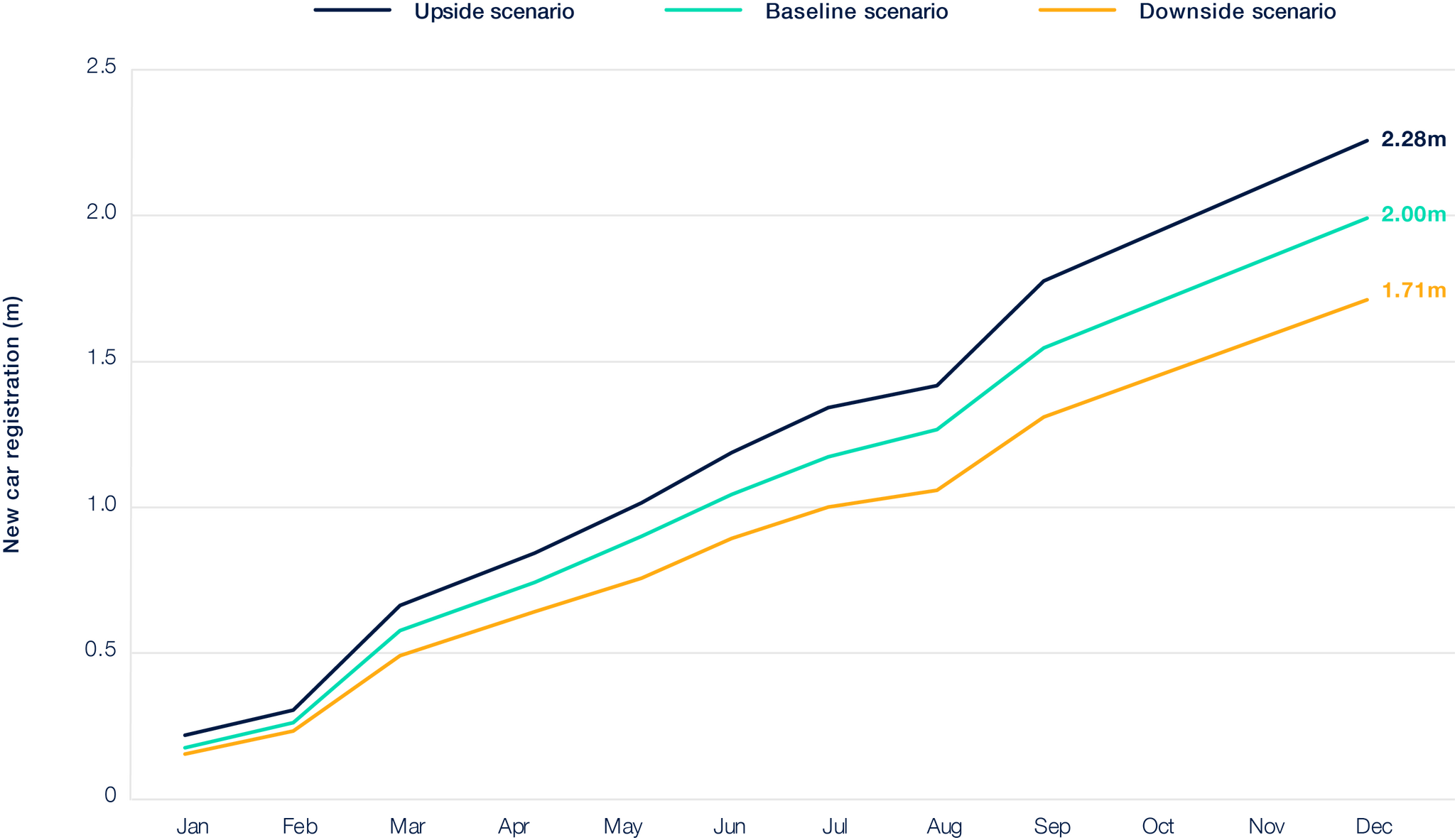

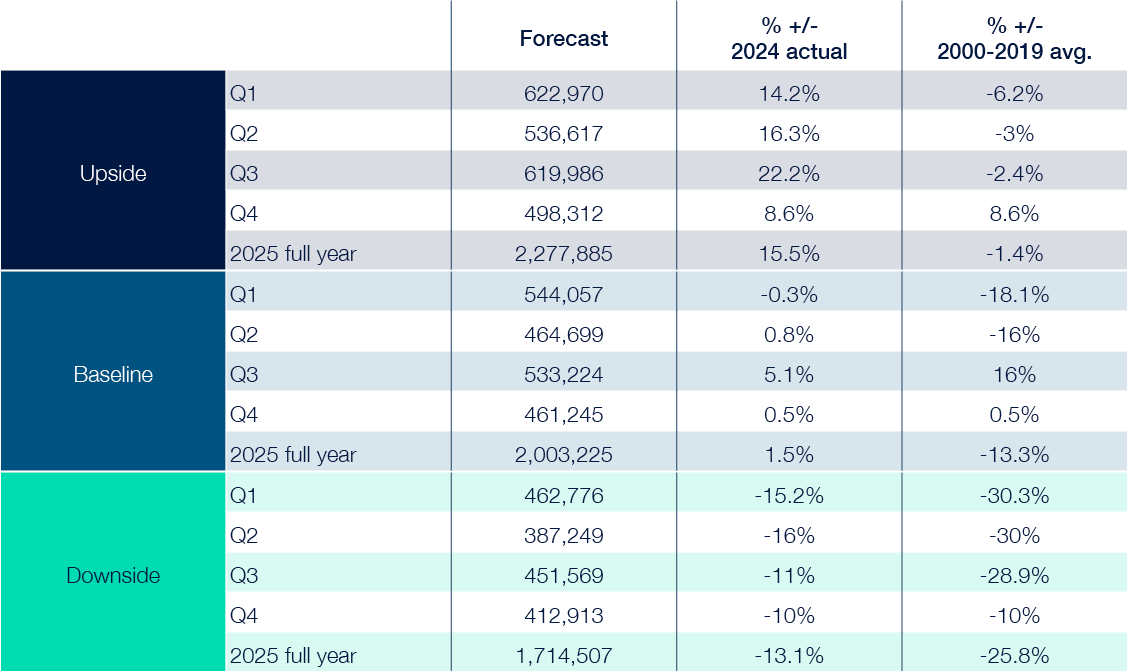

Combining the latest new car registration data with our proprietary insights and market intelligence, we have updated our new car forecasts for 2025. Our upside, baseline and downside scenarios provide an overview of the potential outlooks for the year ahead.

Our moderate baseline scenario predicts 2,003,225 new car registrations by the end of 2025, a modest 1.5% growth year on year. This scenario is characterised by ongoing economic volatility and uncertainty surrounding the governments ZEV mandate. However, a moderate sense of optimism helps to stabilise the market, although it continues to track far behind pre-pandemic levels, with registration levels 13.3% lower than the period between 2000-2019.

New car registrations (m)

Source: SMMT / Cox Automotive

Upside scenario

In this optimistic scenario, a swift reduction in the Bank of England’s base rate stimulates consumer and business confidence. Bolstered by government initiatives and stable competition in the market, EV sales enjoy a positive outlook.

- Accelerated interest rate cuts boost consumer confidence and spending, driving inflation down to below 3%. This further alleviates economic pressure on UK consumers, increasing optimism further and leading to a sharp recovery of new car registrations in H2 2025.

- New market entrants, especially Chinese brands, rapidly gain market share without displacing legacy brands, who retain competitiveness and avoid market exits.

- The government announces a revised ZEV mandate which drives higher EV adoption among private buyers.

Baseline scenario

In the baseline scenario, the sector experiences steady growth and moderate improvements. Challenges persist, but recovery remains on the horizon.

- Steady improvement is observed across the UK economy, supported by gradual base rate reductions and stabilised inflation. Moderate optimism stabilises the market trajectory, resulting in a rise in new car registrations.

- Industry challenges continue to disrupt the market, such as uncertainties surrounding the ZEV mandate and the management of commission disclosure.

- New entrant manufacturers grow incrementally, capturing ground from legacy manufacturers over time.

Downside scenario

Our latest downside scenario highlights the impact a lack of clear industrial strategy and slower-than-expected interest rate cuts would have on the market.

- Persistent inflation and cost-of-living pressures reduce discretionary spending as consumer confidence in the market weakens. As a result, the new market remains subdued throughout the year with limited recovery.

- Despite the government’s best efforts, the ZEV mandate fails to incentivise EV adoption. This brings the UK’s transition to electric travel to a halt.

- While Chinese manufacturers struggle to build the brand loyalty needed to cut through in the market, legacy manufacturers lose ground with no clear replacements.

Source: Cox Automotive