New vehicle supply chain challenges set to impact the second half of 2021

The much-publicised semiconductor supply shortage to the auto sector, in addition to both rubber and aluminium supply chain issues, continue to add significant pressure on global new vehicle supply. While the full extent of the supply issues is expected to hit in the third and fourth quarters of 2021, the effects are already being felt, with lead times for new cars and LCVs increasing, some up to 5+ months and 12 months for certain commercial vehicles.

Meanwhile, new car registrations at the end of April 2021 are +16.2% (587,108) year-to-date, equating to a -28.9% drop against the 2000-2019 average for the quarter (825,707). In AutoFocus, Cox Automotive forecast a ‘most likely’ scenario of 520,835 new car registrations for Q2 – a -5.9% drop compared to the 2000-2019 pre-pandemic average. This remains achievable, albeit optimistic considering the headwinds facing supply.

Supply relationships will be vital for retailers in the coming months

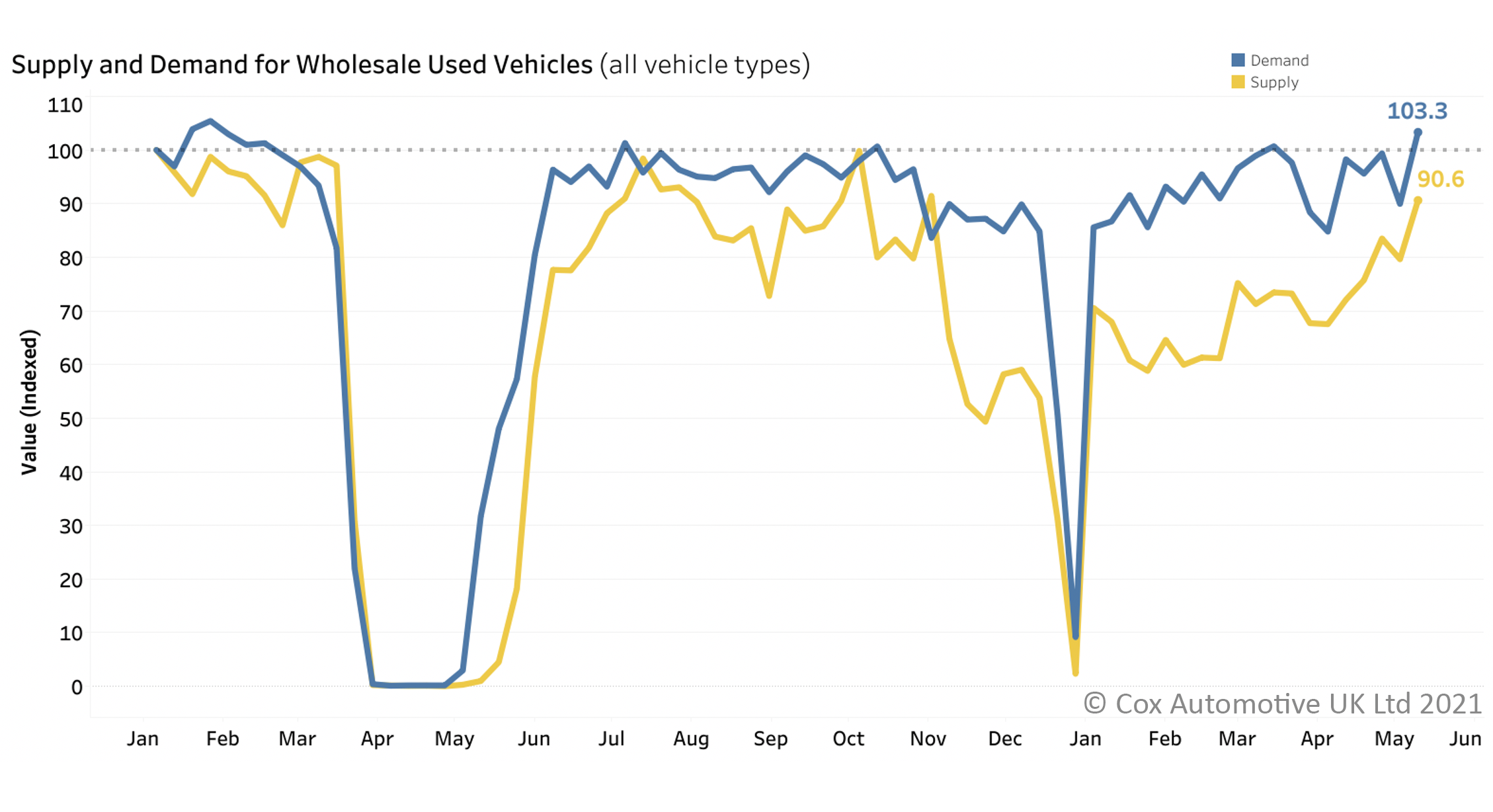

Supply volumes in the wholesale market remain under pressure following the effects of lockdowns in 2020 and 2021, and new vehicle registration losses. The shortage means dealers continue to hold onto the best part-exchange stock, causing a knock-on effect to the wholesale sector resulting in rising prices, healthy conversions and unseasonal demand.

However, margins and retail prices are under pressure, so the motor retail sector will need to focus on stock acquisition and maximising profitability rather than volume turnover in the short to medium term. Building strong supply relationships will be vital.

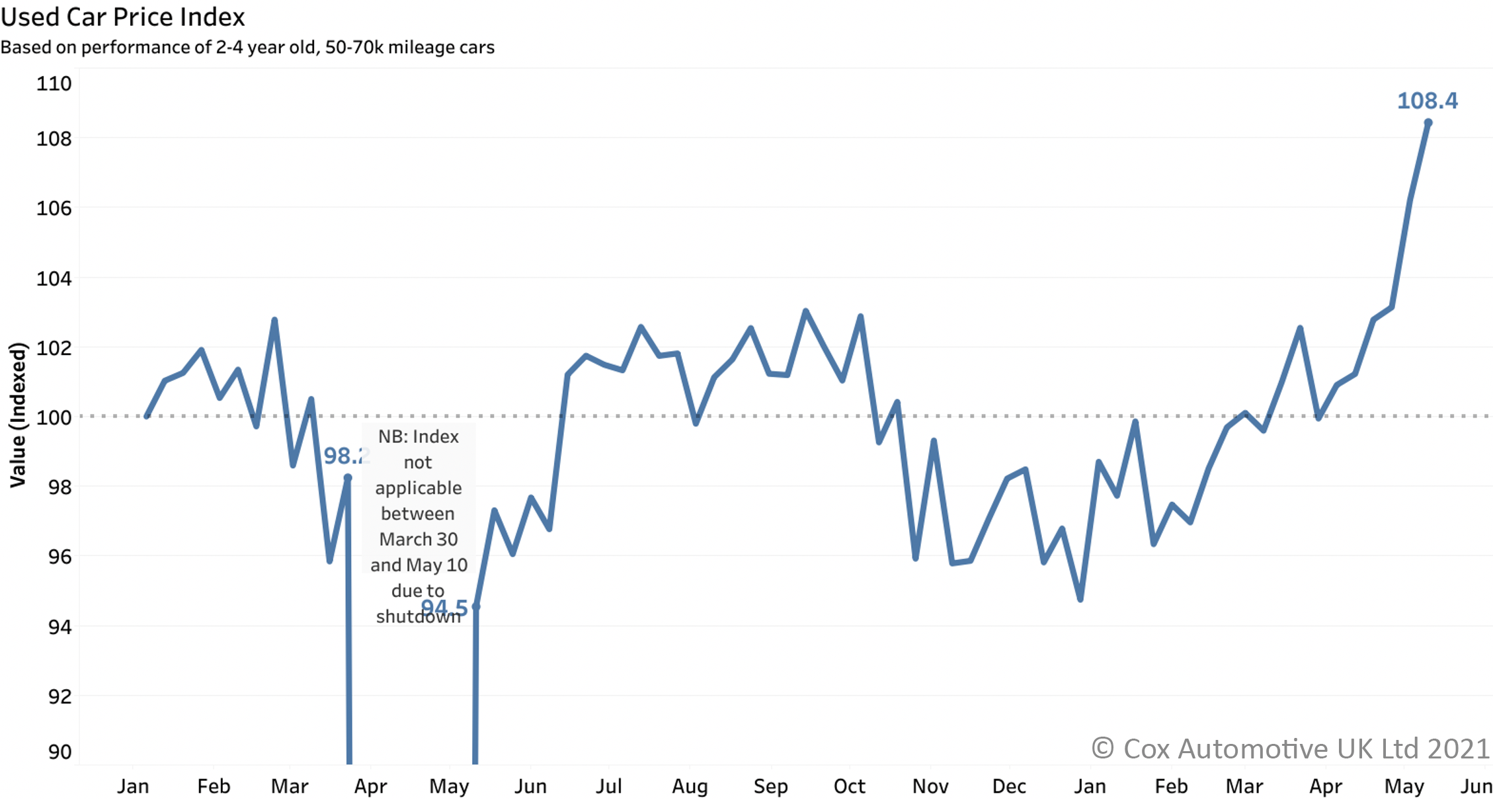

Used trade prices continue to rise as retailers chase ‘ready to retail’ stock

The headwinds faced throughout 2020 and 2021 in new vehicle supply, coupled with increased lead times, has caused prices for used vehicles to continue to rise following the reopening of physical showrooms from the 5th of April. Month-to-date, average wholesale sold prices sit at £5,770, a +£554 (+10.62%) increase on the same period in 2019.

First-time conversion rates are also up 6% compared to 2019. While these results are positive for the wholesale sector, it’s important to remember this comes as a consequence of challenges faced in the new vehicle market and the continuation of a limited supply of used retail vehicles entering the wholesale market. ‘Retail-ready’ stock is in the highest demand, but also seeing the biggest supply issues.