- Fuel duty cut welcome, but still ‘a flat balloon.’

- Pump prices reach the highest levels since records began

- Labour shortage continues to pose challenges

- The automotive industry braced for further pressures

- Consolidating logistics suppliers into one single provider can help automotive retailers navigate current headwinds

Cox Automotive is predicting severe disruption to the automotive retail supply chain caused by a combination of challenges affecting the vehicle logistics market. Referring to the recent fuel duty cut outlined in the Spring Budget as ‘welcome, but a flat balloon,’ Philip Nothard, Insight and Strategy Director at Cox Automotive, hinted several headwinds to come.

“The logistics market is facing a perfect storm of challenges,” he said. “Though welcome, the fuel duty cut is still something of a flat balloon and will do little to absorb some of the financial shocks affecting the sector. It simply did not go far enough. In addition, the much-publicised labour shortage in the sector is only marginally improving, and when you add to this the global trade issues that still exist surrounding Brexit, it’s a challenging time for the industry.”

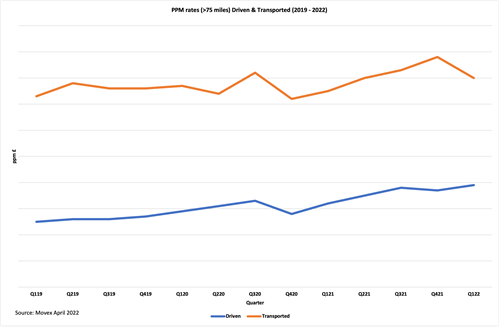

Movex data demonstrates price per mile increases

Nothard points to data from vehicle logistics specialist Movex to emphasise the strain high fuel prices are putting on the sector.

Movex data shows a direct correlation between rising fuel costs and price per mile (PPM) rates in the above graph. Without additional Government support to reduce fuel costs, Nothard believes this will translate into higher overall transport costs, which are inevitably passed on to customers. Automotive retailers will then be forced to pass these rising costs onto consumers who already face soaring new and used vehicle prices.

Despite temporary respite provided by the fuel duty cut, logistics businesses are still facing some of the highest fuel costs on record. Data from the Office for National Statistics show that unleaded petrol reached the cost of 145p a litre in January 2022 and has increased since. These prices are the highest recorded since records began in 1990. To put this into perspective, in the past month alone, the average cost of unleaded rose by 16p, while diesel has gone up by more than 24p during the same period.

Nothard commented: “The increased cost of fuel will force logistics companies to either raise prices across the board or suffer financial losses. This will also increase costs to dealerships wishing to transport vehicles too.

“More importantly, though, higher prices in logistics can create a ripple effect across the economy. When the cost of moving goods increases, this fuels an inflation cycle which can damage consumer confidence and stall vehicle purchases for automotive dealerships - the last thing retailers need!”

Driver shortages worsened by the geopolitical situation

Nothard believes that rising fuel prices and the sector’s ongoing challenge to attract and retain skilled drivers put the industry in a challenging position. While Logistics UK struck a confident tone in December 2021, declaring that driver shortages across the sector were due to show signs of easing following a concerted effort to bring more trainees through the training system, recent geopolitical events have hampered this progress.

“There are reports that many Ukrainian HGV drivers working in the UK and continental Europe are returning to their country due to the current conflict. While it is uncertain how many have left, between 30 per cent and 40 per cent of HGV drivers working on the Continent are from Ukraine, while a smaller proportion makes up part of the UK workforce. This will add further pressure to the driver shortages businesses already face.”

According to the Road Haulage Association, at the peak of the supply chain crisis last September, driver shortages reached 100,000. The figure has now fallen to 85,000 after the government relaxed visa rules. However, while progress is slow, logistics businesses remain vulnerable to further supply chain shocks while progress is being made.

Minimising economic exposure

Nothard claims that automotive businesses can begin to minimise balance sheet instability and reduce their exposure to economic risk by outsourcing vehicle movements to specialists that better overcome these obstacles. Accessing one supplier who handles multiple logistics businesses and can take care of entire journeys, rather than dealing with several individual transport providers, would reduce risks and keep costs down.

“Consolidating several suppliers into one single provider can help automotive retailers navigate these current headwinds. It’s more important than ever that automotive businesses review different providers and costs, but without spending too much time on organising deliveries themselves.”